If you’ve followed my writing for any period of time, you probably know that I’m a stickler for valuation. That isn’t to say that I only own contrarian, deep value names; actually, I oftentimes find those investments too risky for my liking.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

What it means is that fundamentals play a paramount role in my stock selection. I spend a lot of time looking at relative valuations, in terms of historical norms and industry/sector peers. I’m always on the look out for a bargain.

In the past I’ve covered high growth technology names here at Sure Dividend. Many of those names are expensive, especially if you ignore their growth potential. If those are the only pieces of mine that you’ve read you’re probably thinking to yourself, “This guy has got to be kidding, right?”

No, not at all. I have a small segment of my portfolio that I have earmarked for highly speculative and potentially disruptive investments like Amazon (AMZN) or NVIDIA (NVDA), but other than that, even if the high growth space, fundamental valuations are at the forefront of my mind when making capital allocation decisions. There is actually only one other set of stocks that I buy and sell based upon information other than the underlying fundamentals and that will be the topic of my article here this week.

The sub-group of stocks that I’m talking about are the high yield, interest rate sensitive names.

Click here to download your spreadsheet of all 397 high dividend stocks now.

After last Friday’s (2/2/18) massive sell-off sparked by fears of rising rates it seems like as good of a time as ever to talk about these names. We’re talking REITs, utilities, MLPs, BDCs, and to a certain, though lessor extent (in my opinion, anyway) telecom’s.

I view telecoms in a somewhat different light because of changes going on in that industry with regard to them looking for the same sort of content oriented growth as big tech. I like this move away from the traditional content/information distribution business. This industry trend has given me a more bullish long-term growth outlook for major telecom players and because of this I don’t necessarily look at them in a totally income oriented light.

While fundamentals remain important for stocks in these industries/sub-industries, I tend to use yields as non-negotiable thresholds when setting entry and exit targets.

Why? Because companies operating in these spaces aren’t known for their growth. I wouldn’t invest in any of these types of companies if I was looking for quick and/or outsized capital gains. Instead, companies in these areas of the market typically attract investors with their reliable cash flows and shareholder returns. In certain cases, they’re obligated due to tax structure to pay a certain percentage of their earnings out to shareholders as a cash dividend/distribution. In other words, they’re income oriented investments.

I like bolstering my income stream with the high yields offered by companies in these areas. But, because of their relative lack of growth prospects, I’m not willing to own these names unless the risk/reward scenario is tilted in my favorite with an acceptable yield.

What’s “acceptable” to me might not be acceptable to the next guy or gal. What’s more, “acceptable” yields remain on a fluctuating scale relative to the yields available in the fixed income space. Typically, I’m looking for yields in the equity space that are at least 200 basis points higher than the upper end of my near-term U.S. 10-year treasury note yield expectation.

This figure is admittedly arbitrary, but I feel comfortable with it and the defensible margin it gives me as a shareholder in the face of rising rates. Different investors will have different yield thresholds when it comes to rate sensitive companies like REITs. Really, it all comes down to understanding the relationship between the valuation premium that the market applies to equities based upon the perceived margin of safety between their current yields and the direction of U.S. treasuries.

The wider the margin the less volatile a stock will be as rates change because the risk/reward between the dividend/distribution and the bond yield won’t fluctuate as much. However, targeting wide yield margins also means that it is less likely that you will have opportunities to purchase high yielding equities. High quality names don’t often sell-off and other income oriented investors with lesser standards will be buyers, putting a floor on a stock before it hits your yield threshold. One’s need for income in the present should also be factored into this situation; sometimes it doesn’t make all that much sense to wait for higher yields if the dividend/distribution currently offered meets your lifestyle’s needs.

While I wholeheartedly expect to see interest rates increase in the short-medium term, I also believe that the FED will remain somewhat dovish and maintain its cautious stance to the normalization process. I wasn’t spooked by Friday’s sell-off because I believe that the FED will continue to be data driven even after Chairwoman Yellen’s departure and this should theoretically mean that the U.S. equity market remains in the short of Goldilocks zone when you’re looking at the balance of economic growth forces, inflation, and yields, all in a relative sense.

Sure, I lost a significant amount of money (on paper, at least) during Friday’s sell-off, but instead of crying over spilled milk, I was doing my due diligence on a handful of names that are hovering right around my buy targets. Many of those targets are in the high yield space; as the large chugs along higher and valuations increase across the board, I’ve become more and more attracted to high yielding investments. Why? Because I like the flexibility that comes with an augment passive income stream and the opportunity it gives me with selective re-investment every month.

I’ve written about this in more depth before, but due my confidence in my due diligence process surrounding dividend reliability, I feel comfortable substituting the yield that I receive for my cash position.

Let me explain: when I make moves in the market, I typically tread lightly, moving slow and steady, allowing time to smooth over any market timing mistakes that I might make. Historically, recessions/bear markets have lasted for approximately 18 months. I’ve always been a buyer on weakness and I suspect that I will be during the next major market meltdown as well. However, I know that I don’t have any hope of correctly calling the bottom, so instead of attempting to do so, I will slowly add high quality names over that time period.

Furthermore, even if I wanted to put a certain amount of cash to use during a bear market, I wouldn’t be doing it all at once. Because of this slow and steady approach, I’m able to be patient and wait on dividend income to supplement purchases over time. Dollar cost averaging is a proven way to build wealth over time, in both bull and bear market scenarios. It helps to remove emotions, namely fear and greed, from the equation.

Let’s say that my current macro view of the market has led me to believe a 7% cash position is appropriate. Well, I can hold 7% on my portfolio in cash, or I can substitute some of that cash exposure for names with reliable yields; i.e. AT&T (T) with its 5% dividend yield and 2% cash, which essentially gives me the same ability to capitalize on market weakness over an 18-month bear market period while also eliminating the opportunity cost of holding cash and contributing to the compounding on my income stream in the meantime.

Obviously this plan isn’t perfect. AT&T could cut its dividend and totally ruin my plan. However, I don’t think that is very likely; what is more likely, based upon historical data, is that the market continues to post gains (when you look at a very long-term graph of the U.S. stock market the trend is clearly from the bottom left side of the graph to the top right hand side) and the stock’s dividend continues to grow over time. The opportunity cost of holding cash is especially detrimental to a DGI portfolio build around the long-term compounding on passive income. I’ve never been fully invested because I like having a bit of rainy day money in my pocket for isolated incidences that bring quality names down, but in general, I’m happy maintaining a very high exposure to dividend growth stocks.

Something else that I’ve written about is the fact that there is no such thing as a bond equivalent equity. Sure, there are some stocks that seem like bonds with their low betas/reliable dividend yields, but at the end of the day, there are inherent risks in the equity market that fixed income investors simply don’t face.

I don’t want readers to become confused and think that my willingness to substitute what I deem to be reliable yield for cash holdings ignores this risk. I acknowledge that I’m putting my capital at risk when using this yield for cash strategy, but that’s a risk that I’m willing to take when weighing the long-term opportunity costs of sitting on the sidelines. I’m a young investor and this risk is a luxury of my long time horizon in the markets. If I were older/closer to retirement, I’m sure that I’d be singing a different, capital preservationist tune.

When it comes to the high yield space, my favorite type of company to buy/own are REITs. Ever since college, I’ve considered going the landlord route with an actual rental property. I’m still resentful about all of the money that I deposited in different property management company mail boxes at the end of those months and I’d love to be on the receiving end of those payments one day.

I still live in that college town where tenants are easy to come by. Buying a property near grounds essentially represents guaranteed income for life, but property values are high and I’ve heard my fair share of horror stories revolving around unruly tenants, damages, legal fees, and lost rent. Barring these types of issues, my ROI on a physical rental property would likely be higher than the dividend yields I can reliably receive from REITs in the stock market, but at the end of the day, I decided it is simply much easier buying high quality, triple net REITs instead of taking on the responsibility of being a landlord myself.

In the past I’ve been overweight REITs but over the last couple of years I haven’t allocated much cash towards this sector. I reduced my exposure towards interest rate sensitive stocks a couple years back when I thought the FED would begin the normalization process. I was a bit early in that trade, but lately names across this sector (and several others known for their yields) have suffered as the treasury yields rise. But now that they’re out of favor, I’m looking to jump back in.

I may end up being a bit early on this trade as well, but the contrarian in me sees best in breed companies down 20% or more and my ears perk up. And, most importantly, after years of waiting, I’m finally seeing yields that meet my minimum thresholds. For a couple of years now I thought the 10-year might move up towards the 3% range, meaning that I’ve been targeting 5% yields from several of the best in class REITs that I follow. Last year I used this same threshold to buy shares of STORE Capital (STOR) and National Retail Properties (NNN) and I’ve been waiting to fill out the trifecta of my favorite triple net retail plays, Realty Income (O).

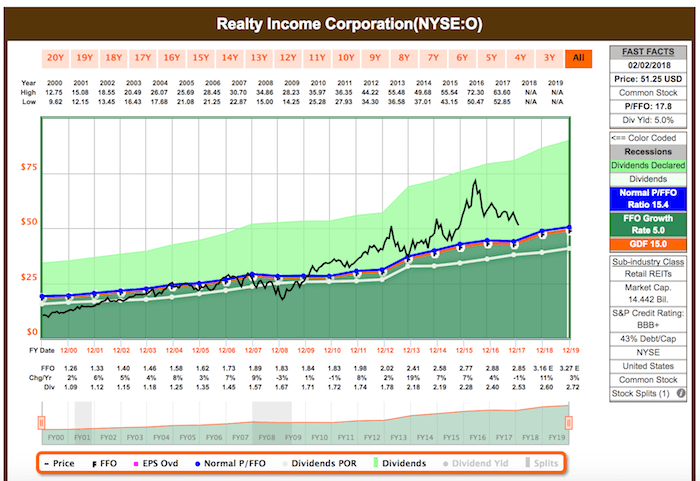

Realty Income has developed a bit of a cult following amongst income oriented investors. This company has trademarked the phrase, “The Monthly Dividend Company” and lives up to the name with 570 consecutive monthly dividends paid (and 81 consecutive quarterly dividend increases). What’s more, Realty Income’s dividend has posted a 4.7% CAGR since the stock listed on the NYSE in 1994. I won’t cover the company’s property portfolio in detail in this piece, but I think the dividend streak alone speaks wonders in terms of management’s ability to responsibly manage real estate (let’s be honest, Realty Income does a better job of playing landlord than I ever could).

As much as I love Realty Income, I haven’t owned the stock in some time. I sold my position back in 2016 when the yield was less than 3.5%. A 3.5% dividend, no matter how reliable, simply wasn’t worth the risk of holding a slow growth stock in an interest rate sensitive sector when I thought treasury yields were headed towards 3%. I took a lot of flack when I sold Reality Income at $69 back in July of 2016 because many DGI investors are of the buy and hold variety. However, my reliance on yield thresholds as a quasi-valuation method proved to be a prudent practice because since then Realty Income shares have fallen more than 25%. On Friday I bought Realty Income back at $51.09 and a 5.09% yield.

Source: F.A.S.T. Graphs

A similar situation played our recently for me when I trimmed my Digital Realty (DLR) position in half because its yield had fallen below the 3.5% range. I originally bought Digital Realty when its yield was in the 7% range. In hindsight it’s clear that that yield represented a strong value which lead to returns in excess of 100% when I sold for $119.90 last September. Due to its technology exposure in the data center sub-industry of the REIT space, Digital Realty has higher growth prospects than many of its overall industry peers. Because of this I set my yield threshold at 4%, or ~1% higher than my short-term interest rate estimate. I’ve been waiting for Digital Realty to trade down to that yield threshold ever since and its looking like I might have the opportunity to buy back in soon due to the ~15% sell-off that Digital Realty shares have experienced since I sold.

My point with these narratives isn’t to brag. No one gets them all right and believe me, I’ve made my fair shares of mistakes when buying and selling stocks. However, in the income oriented spaces I’ve been successful relying on yield thresholds. Like dollar cost averaging above, relying on these spreads relative to the treasury rates takes some of the guessing games out of the equation.

A stock either meets my non-negotiable yield threshold rules or it doesn’t. If it does, I’m a buyer/holder and if it doesn’t, I’m a seller. This relatively simple set of rules has lead to strong gains in the past, as well as protecting my capital from potential losses and I can’t ask for much more than that as a portfolio manager.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Sure Dividend

The world’s best investors have trounced the market decade-after-decade. The course Invest Like The Best uses actionable cases studies from investors like Warren Buffett, Peter Lynch, Seth Klarman (and more) to teach you the tools and techniques of super investors. Click here to enroll today and save $100.