CNBC Transcript: CNBC Transcript: Billionaire Investor Paul Tudor Jones II Speaks with CNBC’s “Squawk Box” Today

WHEN: Today, Thursday, March 26, 2020

WHERE: CNBC’s “Squawk Box”

Q4 2019 hedge fund letters, conferences and more

Paul Tudor Jones II On What Comes Next

All references must be sourced to CNBC.

ANDREW ROSS SORKIN: Paul Tudor Jones II is our guest this morning. He joins us now. He, of course, is the Founder, Chief Investment Officer of Tudor Investment Corporation. Jones is the Chairman of JUST Capital and the Founder of Robinhood. Paul, thank you for joining us this morning.

PAUL TUDOR JONES II: Thank you, Andrew. What a damn mess.

ANDREW ROSS SORKIN: You have -- what a mess. Tell us about it. You’ve been thinking about this, I think literally, since we spoke with you back in January. You also wrote a letter to your investors in February calling this right again. So, understanding where your head is at right now, where the market is at and where this is all headed is very important. How do you see it?

PAUL TUDOR JONES II: Well, I think COVID-19 is -- listen, it’s unlike anything we’ve obviously ever seen before. If we kind of think about where we are right now, we’re probably -- if you look at the Hubei experience and we extrapolate from that what is getting ready to happen in the United States, to New York in particular, we’re probably -- we’re probably going to hit our peak somewhere between April 4th and April 10th.

My guess is we can have somewhere between 3 and 400,000 cases in the United States. It’s going to be a -- that’s going to be a really challenging period, I think, for us as Americans. Because certainly in New York city our health care system is going to get overwhelmed. And it’s going to be something I think all of us have to steel ourselves for. There’s a really high probability it’s going to come. I don’t think we need to panic. I look at this like when I used to box.

And I remember, I never got knocked down in my life, but having seen many people get knocked down, you learn something from that in your next fight. And I think what we’re going to do is we’re going to see the worst of COVID-19. It’s going to throw its best punch over the course of the next -- say somewhere in the next two weeks. And then we’re going to be on the backside of that.

The good news, the great news is that in Hubei from the peak, it was 24 days, 24 days before they went back down to under 100 cases a day. We have to remember, there is light on the other side of this. We’re going to get through it. It’s going to be something that unfortunately, probably didn’t have to happen but has happened. Let’s not think about what could have been, let’s think about where we’re going to be, and what we’re going to do on the other side.

ANDREW ROSS SORKIN: So, Paul, explain this. You’re using Hubei numbers to extrapolate out and model out, and I would tell you, by the way, I love your optimism. I hope you’re right. One of the questions though is whether this starts to roll across the country. Meaning, you know, the measures that were taken in China really did quarantine the situation in Hubei for the most part. We have not had a national lockdown as we were just talking about with Zeke Emanuel in the last hour.

We’re starting to see hot spots emerge in other places like New Orleans and Atlanta, elsewhere. You know, New York may have its own curve, and hopefully, we will get to the other side of that in a couple of weeks, but there may be new curves that emerge. And so, how do you think about that as part of that timeline, or are you convinced that this is in lockdown now?

PAUL TUDOR JONES II: So, clearly everything that you say is 100% correct. I’m looking at Italy, because I think Italy is going to be the analog for us. Hubei they had, in Hubei, command and control. If you think about China, it’s a surveillance economy. Everyone has an I.D. Every phone can be tracked. If you think about the preventive measures they took, maybe on a scale of one to ten, they’re a ten.

And maybe where we’re going to go in a free society is going to be something like a five. So, whereas they had railroad tracks, if you look at their epidemic curve, they had vertical railroad tracks, we’re going to probably have more like a hill. And we’re going to have a fatter right tail. Again, I would look at Italy for us as the guide as to what we can expect. And then clearly, we’re learning as we go through this, right? Again, if we go back to China, people who were food preparers, I was in a McDonald’s yesterday, and they’re serving food without masks, without gloves.

In China, all food preparers at fast food were wearing masks, were wearing gloves, they were taking their temperature on the streets, they were taking your temperature in restaurants. It’s going to be interesting to see how our society responds to the pain and suffering that we’re going to witness over the course of the next two weeks, as we get to the peak of the epidemic curve. Having said all of that, and it is -- and listen, my heart goes out to the people that are going to be our first responders.

My heart goes out to the people that are going to be infected. My own daughter has CV-19 right now. She’s recovering from it. She had a mild case, gratefully. We’re so blessed. At 25-years-old, 26-years-old, she had nothing more than a mild case. She and her fiancé. So, I’ve seen firsthand what you have to do to self-quarantine.

I’ve seen firsthand the impacts I’ve had on them. I get nervous, I get nervous. And something as we go through these -- and, again, I think the next two weeks are going to be the most challenging for us from an emotional, psychological standpoint. Because we’re going to see this curve and new cases escalate every day. But we’ve also got to be careful not to mythologize this particular disease. Let’s assume a worst-case scenario. Let’s assume a million cases, which is 2.5 times what I think we’re going to have. And let’s assume a mortality rate, and again, forgive me for speaking with such morbidity. But let’s assume a fatality rate of 4%. Mortality rate of 4%, like what we’re seeing globally.

So, 40,000 Americans sadly and tragically will die. That still is the equivalent of what we see during the flu season. So, we’ve got to be careful not to mythologize this into the pandemic Godzilla. Because, we can beat this thing. America can beat this thing. Humanity can beat this thing. And we’re going to -- we actually will. We’re going to squash it and send it back to the oblivion that it crawled out of. I have zero doubt in my mind about that. We’ve just got to be calm. We’ve got to stay rational and not panic over the next two weeks.

BECKY QUICK: Hey, Paul, first of all, I’m so sorry to hear about your daughter. Although, relieved to hear it was a mild case.

PAUL TUDOR JONES II: She’s fine. She’s great. She’s working. She worked every single day remotely while she had it.

BECKY QUICK: Wow.

PAUL TUDOR JONES II: So, again, for the large portion of population, this is not going to be a life-threatening or -- it’s going to be life-changing but not life-threatening -- not a life-threatening thing, for a large portion of the population.

BECKY QUICK: I realize you’ve done the numbers and kind of worked this out, and that doesn’t sound like it’s unreasonable to think 4% mortality, that’s probably higher than a lot of people think we’re really going to see in terms of mortality cases –

PAUL TUDOR JONES: No, no, I think -- I think it will be much less. I’m saying in a worst-case basis.

BECKY QUICK: Yeah, I think it will be much less, too.

PAUL TUDOR JONES: I think on social media and the media we’ve got to realize we’re prone to hype things beyond what they are and we all have to remember --

BECKY QUICK: I -- I --

PAUL TUDOR JONES II: Yeah?

BECKY QUICK: I understand that entirely, and I just want to talk through a little bit what we hear from doctors pretty frequently, including Dr. Scott Gottleib who we’re going to talk with in a minute, is the concern that even though he thinks, too, you’ll come out the other side, you’re talking eight to ten weeks on something like this, the concern doctors have is trying to flatten the curve right now so it is less overwhelming on the health care systems like New York City. Do you go along with that? I understand everything you’re saying. But there are some people hear what you’re saying and as a result, say it should be business as usual and states should not do lockdowns. Is that what you’re saying?

PAUL TUDOR JONES II: No. I’m saying we have to be extraordinarily vigilant, and exercise, implement and practice extreme safety measures until we get on the other side of the epidemic curve and see it in a free fall. There’s no question that’s what we have to do. I think -- and my guess is that that’s going to be sometime in late April, early May. That would be optimistic.

That would be following the Hubei example. And again, if you just think about this, we’ve got these incredible experiments going on country-by-country. Some of it, China, command and control, Singapore, command and control, Hong Kong, command and control. They did a great job. We’ve got free societies in Europe, in the United States. They’re experiencing -- are going to experience much different outcomes. And then, tragically, we’ve got less developed countries like an Africa, who I worry about the most, with the most vulnerable populations who are not going to be able, I think, to get even as far as many free societies in Western Europe, as well as the United States. And those are the ones that I worry about the most.

But where we’ll end up say, three, four, five months from now is we’ll have these beta tests of various degrees of intervention by public authorities, various degrees of onboarding by private citizens of the protocols that it takes to actually stop this. And then we’ll also have a real-time GDP experiment to understand the impacts it has on the economies. And we’ll know so much more in three or four months. think we’ll be prepared.

You know, fool me once, shame on you. Fool me twice, shame on me. We’ll be so much better prepared this Fall to be able to deal with this, and I think to get back to business as usual and to resume the way our lives were but three months ago. And I think we’ll learn, again tragically, a lot about our immunity. Because we’re going to see that unfold and practiced real-time in some less developed countries.

ANDREW ROSS SORKIN: Hey, Paul, you know, you were right on the money on January 1st -- January 21st, rather, to tell us that if you were an investor, you would be nervous, you would be risk-off. Given where we are right now in terms of the curve that you’ve now talked about and where the stock market is right now. If you were an investor, what would you be doing?

PAUL TUDOR JONES II: Well, I think -- I think what’s -- I think what we’re going to see is -- first of all, let’s frame what’s happened from a monetary and fiscal stance. So, from a fiscal stance, we have a fiscal package of 10% of GDP. That’s double what we got in October of 2008. Double. Now, they came with another package in March of 2009 that got us up to 10%, and my guess is we’ll be back with a bigger fiscal package somewhere down the road. From a monetary standpoint, we’ve already -- and by the end of this week, we’ll have bought $1 trillion worth of Treasuries and mortgage-backs.

We did in two weeks what it took the Fed eight months to do in 2009. Remember, we didn’t even get quantitative easing until well after the great financial crisis had started, well into the recession. Here, we’ve got a trillion in two weeks. By May we will have already -- at this rate, already have purchased what took us six years to do in the great financial crisis.

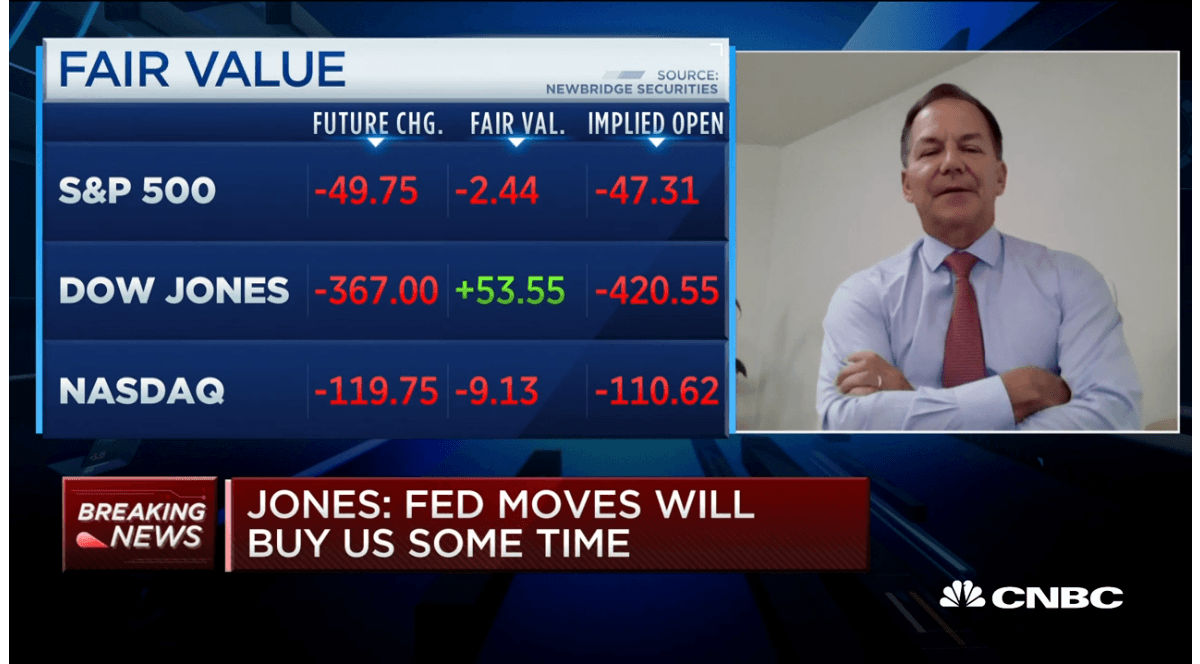

So, investors can take heart that we’ve counteracted this existential shock with the greatest fiscal monetary bazooka. It’s not even a bazooka. It’s more like a nuclear bomb. That’s literally the countermeasures that we brought in to sit there and to bring safety to our economic system. So, I think some combination of those two will buy us time. As Chairman Powell said this morning, it’s the bridge to the future. Now, what happened -- so my guess is -- my guess is one of the reasons the market is up right now is because of all of the month-end rebalancing, the market is front running, it sees the fact that there are going to be equities to buy.

That’s one reason why my guess is we’ll stay firm into month-end. We’ll be challenged into April. We’ll be challenged as we go through the epicenter – the peak of the epidemic curve. So, I think that could bring us to a retest. It might even bring us to a fractional new low. But I do think the stock market is going to find a bottom. Once we get the peak in the epidemic curve, no doubt in my mind the stock market will rally, and it should rally. And my guess is we’ll be higher three or four months from now, five months from now than lower where we are right now.

What happens after that is highly dependent upon our ability to get back to work, our ability to resume normal functioning. And it’s really interesting. You’ve got this dynamic tension. You’ve got people such as myself, in the economic field, thinking about getting back to work, thinking about resuming normal activity. And you’ve got people in the medical profession who can only see the problems that they’re dealing with and, my god, again, my heart goes out to them because they’re dealing with these huge problems.

But I can tell you from an economic standpoint, the risk that we have if we don’t -- each of us individually begin to think how we’re going to get back to work, how we’re going to deal with the new normal. If we don’t begin today, not get paralyzed by the next two weeks, and think about how we’re going to resume a normal life on the backend of this epidemic curve, we’re all making a big mistake.

So, we’ve got to look through these numbers, look through the tragedy of the next two weeks, think about how we’re going to restart our lives, think about how we’re going to deal with the new normal and think about how we’re going to restart America. The thing that I’m nervous about and one reason why I keep pushing this theme so much, is that I think people give our economy too much credit for its resilience.

If I just look at -- the biggest thing that I’m worried about for the long run is that we have a huge, enormous debt buildup of the last four decades, to levels we’ve never seen before in the history of this country. So, debt to GDP going into the 2000 Nasdaq top was 180% in 2007. It was 225%. And at the end of this year, we’re going to be 270%. So, it makes me really nervous, the resiliency, the possibility of a V-bottom. We have impediments to that. We have structural impediments to it. Which is the amount of debt we have.

So, I think we’re going to have to think smart and we’re going to have to begin now to think about: how are we going to restart our businesses? And do it living with CV-19 and we might have to live with something that’s going to be an impairment to our society, but it doesn’t have to be the end of our society.

So, I don’t know if we’ll eradicate it. I do know that if we have great testing--if we can have just in a few months’ time, three, four, five months’ time, if we have testing, so that we can identify and begin contact tracing individually, and as a society if we embrace that, then we can live with CV-19, we can live with people being out of work for a period of time, self-isolate, quarantine, and get back to things as normal. I think that’s what we’ve got to do. I’m most hopeful for the testing.

JOE KERNEN: Paul, you’re a trader obviously, but you’re also a human being and you talk about, you know, your family and things like that. When you were most -- I don’t know whether you would call it despair, but at your moment of peak worry about this, did you ever think in numbers of millions dying in the United States, was that a possibility at some point? And is it still a possibility that it could get to that point or did you –

PAUL TUDOR JONES II: Zero chance. Zero chance. Zero chance. Please, we are -- we are too smart. We are too smart. As a people, we’re too resilient. Again, I think when this is all over and said and done, we’re going to look at death rates very similar to the flu, because we’re going to take the precautions that are necessary to keep us from suffering from that type of mortality rate from CV-19.

What I’m worried about, and I’ll be really honest, what I’m worried about is, again, if our economy is -- oh, my lord, we had a 40, 50-year buildup of a globally interconnected, globally leveraged, highly sophisticated fine-tuned economy built on -- built on global trust, built on individual trust. Institutions with huge amounts of cross connectivity. So, now all of a sudden, we’ve got this -- again, this event that has stopped all of that.

We’re closing borders. We’re going insular. And so, I’m more nervous about what happens if we have something that’s between the Great Depression and the Great Financial Crisis. What are the human impacts of that? I’m much more nervous about the loss of life that could come with a 15 or 20% unemployment rate than I am about the loss of life that comes with CV-19. CV-19 may cost us -- let’s say CV-19, again -- I think we’re going to peak out somewhere in the 3 to 400,000 range.

Again, if I used a -- an overly pessimistic view of 4% mortality rate because our health care system will be overwhelmed in the next two weeks, we’re talking 16,000 people. In the Great Depression there was a study that was out, a ten-point rise in the unemployment rate could have as many as 200,000 fatalities, associated with it from health impairment, suicides, opioid use, drug use, et cetera. So, I’m thinking about -- and, again, as someone in the economic world, I understand the necessity and the need for us to deal with CV-19, but I don’t think that’s our biggest threat.

Our biggest threat is what happens to the economy on the other side. And that’s why I think each of us has to think: How are we going to restart our business? What do we need to do to make people say -- feel safe to interact again in business? And -- wearing masks -- wearing masks, wearing gloves, wiping down. And I think as American people we’re fastidious and we’ll do this. We’re going to kick this bug’s ass and we’ve got to think about how we’re going to resume our normal lives.

ANDREW ROSS SORKIN: Hey, Paul, we want to thank you for joining us, but before we let you go, I know you’re doing a lot of work with Robinhood in New York. which is going to be the epicenter of this, at least in the near term. What are you working on with the Robinhood program in New York right now?

PAUL TUDOR JONES II: Well, we had our benefit scheduled a year ago for May 11th at the Javits Center. The Javits Center is now a hospital. But we’re going to have our benefit. It’s going to be a virtual benefit. It’s going to be on May 11th. We’re going to broadcast from a variety of locations. We’re still going to -- instead of serving -- having 4,000 people, we’re going to hopefully have this televised and we’re going to have with us 400,000, 4 million.

New York City is the epicenter, and this bill that was just passed that -- you know, if you listen to Pelosi, Schumer, Trump: workers, workers, workers. And god forbid, we’re going to need help for American workers, they deserve it, but there’s -- again, there wasn’t that much in there for the most destitute and the most poor. And so, yes, we got relief for workers. But in New York, which is the most number of people in poverty, 1.8 million, there’s a lot of undocumented workers, there are people who have been out of work for more than a month that will not be eligible for checks. I can tell you food pan tris have already seen a 50% spike in people going.

We’ve lost our volunteers because people are afraid to go out in a variety of our organizations. This is the most important time for people to help the most poor because they’re the ones that are going to suffer the most. Imagine all the kids in shelter who don’t have the ability to get an education because they don’t have online access, they don’t have computers. There’s so much that we’ve got to do. And we’re going to do it on May 11th. So, tune in because it’s going to be a great night.

It’s going to be an uplifting night. It’s going to be like our 9/11 Relief Fund that we had back in 9/11. I’ll never forget. We were all so scared after the Twin Towers came down. Then we had the anthrax scare. We were scared to even put that event on. And I remember at that event we had our first responders. And introducing The Who, this fireman came up, he lost his brother in 9/11. He said, Osama Bin Laden, you can kiss my royal fat Irish ass. And the place went nuts. That moment, that was the moment that America began to fight back.

So, I’m hoping May 11th will be one of those beautiful moments where we’ll be on the backside of the epidemic curve. We’ll do it virtually. And we’ll show you can continue life but in a new way, and we’re going to continue business as usual and we’re going to help the people who need it the most. And it’s going to be a great night. So, more details on that. We’ll come back. And, again, I’m optimistic, this brings out the best in us, these crises do. In 2008 and the Great Financial Crisis, Robinhood raised more money than it ever has. I’m really optimistic about the future. I know we’ll beat this thing. And I’ll look forward to doing my small part in it, like each of us is going to.

ANDREW ROSS SORKIN: Paul Tudor Jones, it’s a privilege to spend time with you. Thank you for spending the last half hour with us and our viewers. I know we all appreciate it.