This is part three of a series on investing in a volatile market. Click here for part one on creating a financial roadmap and click here for part two on evaluating your risk tolerance.

Anyone who has spent any time planning their portfolio at all has heard the age-old advice: diversify! However, there are so many different ways to diversify a portfolio that it can be a bit overwhelming for the amateur investor at first, especially when you take into consideration the risk factor.

Q2 hedge fund letters, conference, scoops etc

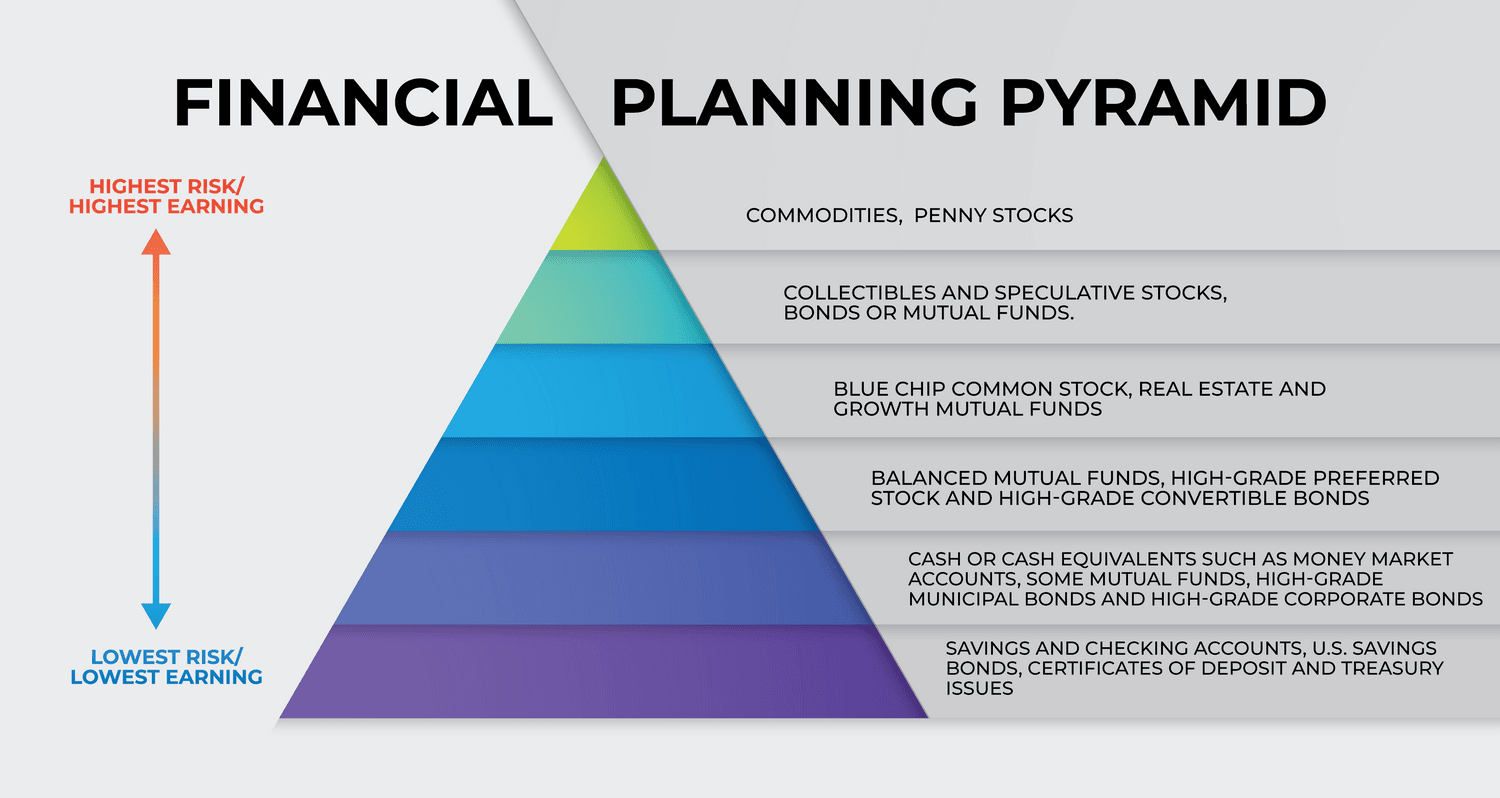

The idea behind diversification is to protect against major losses so that if or when one investment falls, another is rising. So how do you diversify adequately while keeping in mind your current risk tolerance level? One way is to use a financial planning pyramid or risk pyramid to help you strike the appropriate balance for your particular risk level.

Using a pyramid to allocate funds

A risk pyramid can help you understand which investments are the riskiest and which are the most conservative. By understanding where your risk tolerance stands, you'll be able to figure out which part of the pyramid you should focus on. The safest investments are toward the bottom and include savings and checking accounts, U.S. savings bonds, certificates of deposit and Treasury issues, according to the pyramid used by the New York Attorney-General's Office.

The next layer up is also fairly conservative and includes cash or cash equivalents such as money market accounts, some mutual funds, high-grade municipal bonds and high-grade corporate bonds. The next layer introduces a bit more risk in balanced mutual funds, high-grade preferred stock and high-grade convertible bonds. The next layer includes blue chip common stock, real estate and growth mutual funds. The next layer includes collectibles and speculative stocks, bonds or mutual funds. At the very top of the pyramid are commodities and penny stocks, although other pyramids sometimes include futures and options at the top as well.

The more risk tolerance you have, the more selections toward the top of the pyramid you will likely hold. The investments are grouped in a pyramid formation because the riskiest categories should generally take up the least amount of your portfolio. Allocations will shift over time based on the timing of your goals or whatever you are saving for, whether it's retirement, a house or some other goal. Your age is also a factor because younger investors have more time to recover potential losses from a market downturn.

The top sections of the pyramid are all focused on investing, but there is more to your financial picture than just your investments. Insurance makes up the base of the pyramid to protect against losses.

Lifecycle and index funds

For investors who want to simplify the allocation process, the Securities and Exchange Commission suggests lifecycle funds as an additional option. These mutual funds enable investors to save toward one particular goal which automatically shifts allocations as the years approach a particular goal. Investors can invest in different lifecycle funds for various goals like retirement or a home purchase by setting the year in which they expect to achieve that goal. Some financial advisors argue that lifecycle funds can be too conservative, which is why such a fund probably shouldn't be your only investment strategy.

Another way to simplify your portfolio diversification is by including one or more passive index funds in your portfolio. These funds enable you to invest in a portfolio of stocks that tracks a particular index like the S&P 500 or the Russell 2000 instead of requiring you to pick stocks. Hedge funds are another option for investors who want the risk of stock picking but lack the expertise to make the selections themselves. Hedge funds can help you avoid some of the market volatility, but the portfolio manager injects a certain amount of volatility through their selections.

Portfolio allocation tools like Morningstar's Portfolio Manager or Vanguard's investor questionnaire can provide additional guidance to figure out a good mix of investments for your situation.

For more information on managing your portfolio through times of volatility, watch for part 4 of this series on dollar cost averaging.

This article first appeared on ValueWalk Premium