Tesla Inc (NASDAQ:TSLA) stock surged on Thursday as investors shrugged off the latest delay in the Model 3 production ramp in favor of a bullish analyst report on the company’s electric semi. The analyst said after pitting the Tesla semi-truck versus diesel trucks that fleet owners may find it only takes about two years for the electric truck to pay for itself.

Tesla semi-truck versus diesel trucks

Piper Jaffray analyst Alexander Potter is one of the few analysts left with a bullish rating on Tesla stock, which he rates at Overweight. Thus, it should come as no surprise that he offered a rave review of the company’s upcoming electric truck. At least he brought some solid numbers to back up his view of the electric semi, unlike some other analysts who are bullish on Tesla stock and its semi. In fact, his model is one of the most thorough considerations for Tesla’s semi that I’ve seen since it was unveiled late last year.

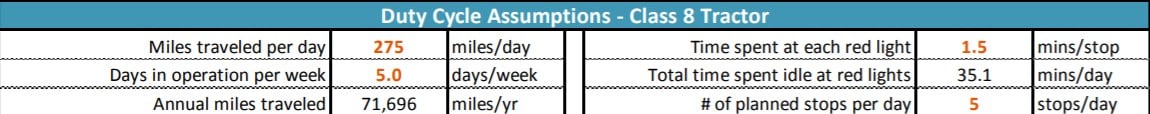

In his report on the Tesla semi-truck versus diesel trucks, he explained why he agrees with the EV maker in saying that electric trucks can indeed handle long-haul trucking. He noted that those who disagree simply say that electric batteries are too heavy or too expensive, but the debate goes deeper than that. To put together his comparison of the Tesla semi-truck versus diesel trucks, he spoke with industry contacts and studied “online physics tutorials” to determine about how long it might take for Tesla’s truck to pay for itself.

Tesla semi-truck could pay for itself in two years, but…

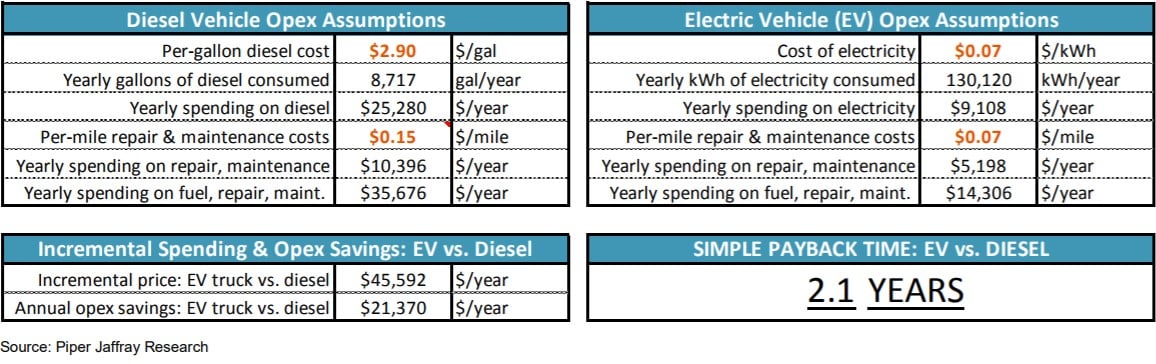

According to Potter, it’s possible for fleet owners to recoup the price of the Tesla truck in only two years, although he noted that many assumptions must be made in order to achieve such a fast payback. He noted that investors were understandably skeptical when Tesla management revealed their electric semi and the claims they made along with it.

However, Potter also said that the assumptions they factored into the claims they made are important and unclear, making it impossible to put their claims to the test. Further, he emphasized that each fleet is different from the next one, which means that what might be true for one fleet might not be true for another.

The biggest factor in the Tesla semi-truck versus diesel trucks comparison

The Piper Jaffray analyst said that he’s been hearing weight argued as the biggest factor when it comes to the debate over electric semi-trucks, but he argues that cost is actually the most important factor. He feels that investors are just too focused on weight, performance-related features and other physical limitations encountered by EVs.

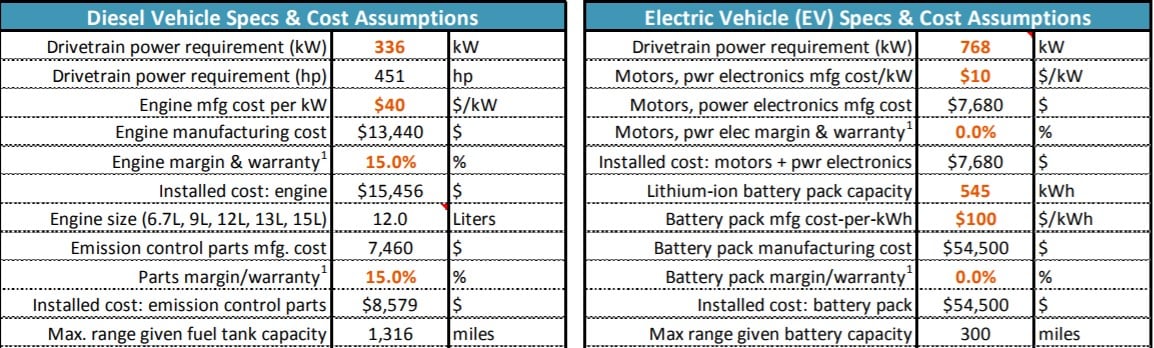

However, he’s not worried about any of these factors after looking at the impact weight has on energy efficiency. He also believes fleet owners will be able to minimize negative impacts by choosing the correct battery size and opting for lightweight parts. On the other hand, he said there are just too many question marks regarding costs for the parts, such as Tesla’s battery packs, motors and power electronics.

He described the price point of Tesla’s semi as “shockingly low” at $150,000 to $200,000 and said it appears the EV maker expects its costs to be low and believes it can scale its battery costs down to $100/kWh or less.

Many unknowns when comparing Tesla semi-truck versus diesel trucks

The analyst also said he would continue working on his model comparing the Tesla semi-truck versus diesel trucks. In the meantime, he explained the places where it’s lacking. For example, he noted that it’s unclear the extent to which battery range will degrade and whether older Tesla trucks could be reassigned to routes with lower mileages.

He also questioned “unforeseen maintenance costs” and the potential for downtime due to other reasons. Other big question marks when it comes to Tesla’s semi include the extent cold or hot weather will affect the battery efficiency, service costs, and residual value. Further, he wondered whether it would be possible for diesel truck manufacturers to “mimic Tesla’s impressive drag coefficient,” and if they do, whether Tesla’s truck will have a more difficult time delivering a payback versus diesel trucks.

Some of the key assumptions from Potter’s comparison of the Tesla semi-truck versus diesel trucks are below.

Tesla stock surged more than 2% in intraday trading on Thursday, climbing as high as $344.81.