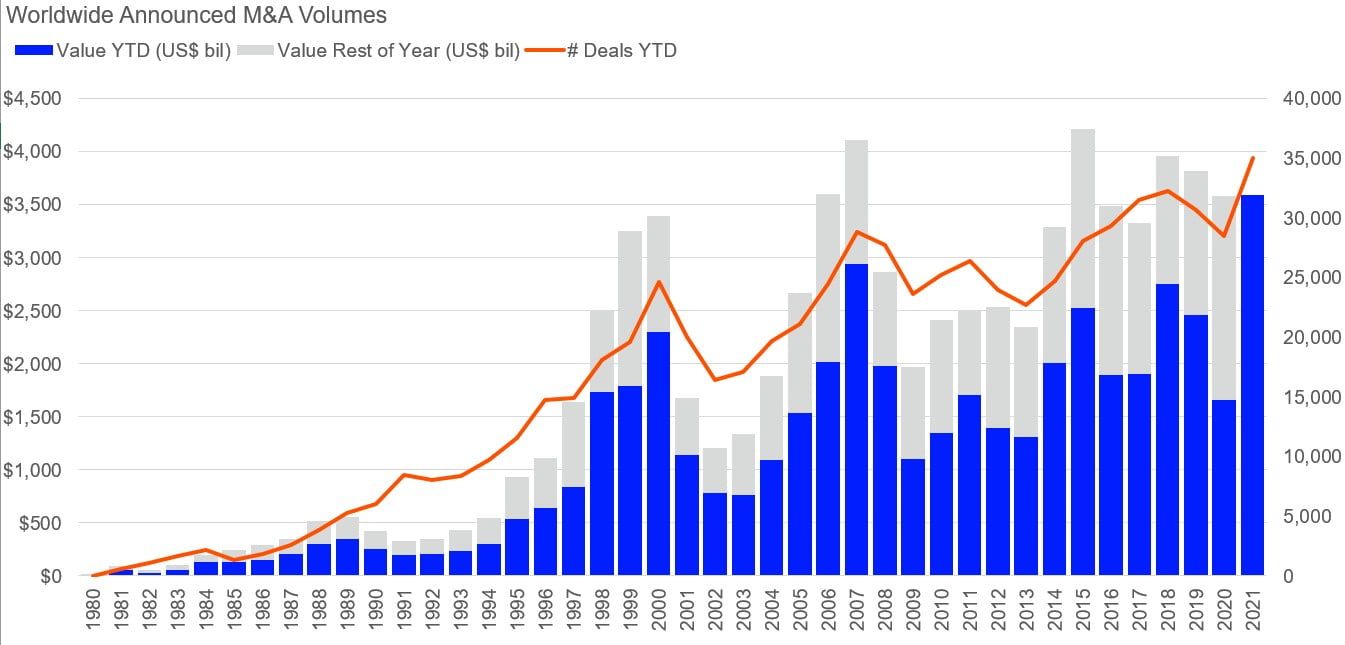

“Following 4 consecutive trillion dollar quarters, deal-making continues at pace in the third quarter with the US driving activity, and with tech leading the sectors as companies continue to embrace digital transformation. Less than 8 months into the year, we have already seen the value of global deal making smash 2020’s annual total and reach an all-time year-to-date high of US$3.6 trillion in an extraordinary rebound from the lows seen last spring in the early days of the pandemic,” says, Lucille Jones, Deals Intelligence Analyst, Refinitiv

Q2 2021 hedge fund letters, conferences and more

YTD Global M&A Hits $3.6 Trillion, Exceeding 2020’s Full Year Deal Making Total In Under 8 Months

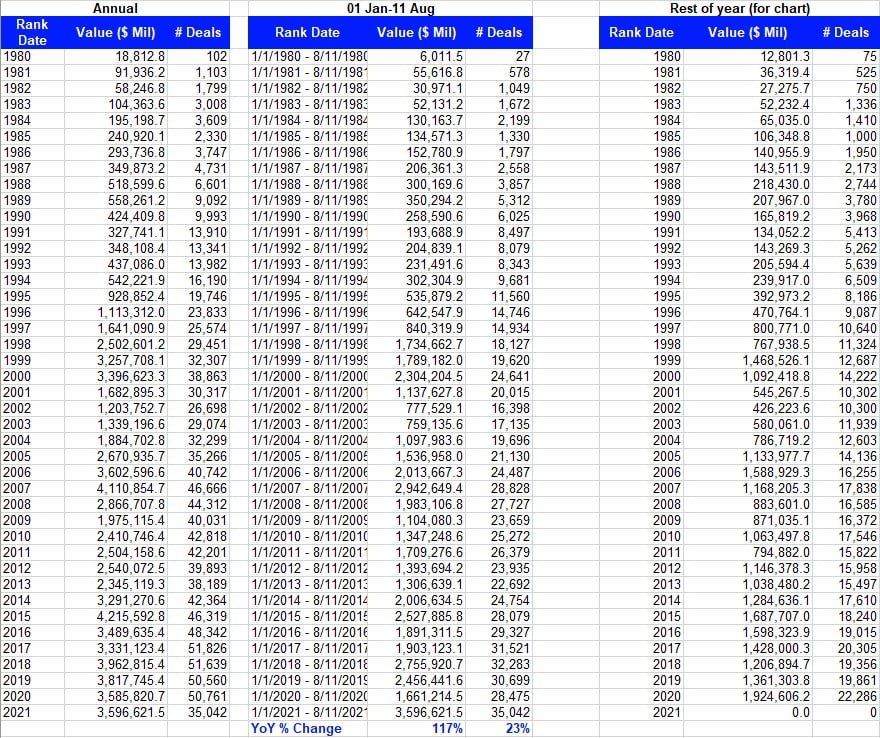

- US$3.6 trillion worth of M&A deals have been recorded so far during 2021, more than double (+117%) the value recorded during the same period last year and smashing the previous record of US$2.9 trillion, recorded in YTD 2007, by 22%

- In under 8 months the value of deals has already exceeded the full year total of US$3.59 trillion recorded last year

- Global M&A exceeded US$1 trillion during each of the last 4 consecutive quarters. US$730 billion worth of transactions have been announced so far during Q3 2021

- The number of deals announced so far this year is at an all-time record of more than 35k, 23% more than the 28k recorded during the same period in 2020

- The US dominates, with deals involving a US target accounting for almost half (48%) of global M&A activity so far this year. China and the United Kingdom follow accounting for 9% and 6%, respectively

- Technology is the leading sector for M&A investment globally, accounting for 22% of M&A activity. M&A involving a tech target totals US$800 billion so far during 2021, more than triple the value recorded last year and an all-time YTD high.

Sources: Data - “Refinitiv Deals Intelligence” | Commentary - “Lucille Jones, Deals Intelligence Analyst, Refinitiv”