What the activism world is talking about

Xerox has called off a merger with a Fujifilm subsidiary and fired its CEO for the second time, settling with activist investors Carl Icahn and Darwin Deason, who worked to upend the deal. The printer manufacturer also agreed to appoint five new board members from the activists’ slate, and replace CEO Jeff Jacobson with John Visentin, former CEO of Novitex Enterprise Solutions.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Icahn and Deason have suggested a sale of Xerox would deliver better value to shareholders than the merger with Fuji Xerox, with Icahn holding out hope of at least $40 per share. The printer manufacturer’s exit from the Fuji deal may pave the way for a new strategic review leading to a sale. On May 3, Apollo Global Management reportedly expressed interest in acquiring the company.

What we'll be watching for this week

- Will Moab Capital Management convince shareholders to vote against all six Macquarie Infrastructure directors at the group’s annual meeting Wednesday?

- Will investors of Whitestone REIT vote for the two board nominees advanced by activist investor KBS Strategic Opportunity REIT at the firm’s annual meeting Thursday?

Activist shorts update

Last week, the U.S. Department of Justice announced that three health care providers, including one Veterans Affairs (VA) employee, were indicted in South Carolina on charges of accepting money and gifts from medical equipment company MiMedx and causing "excessive use of MiMedx products on [veterans] in South Carolina." News of the indictments came about seven months after short sellers Aurelius Value, Viceroy Research, and Marc Cohodes alleged that MiMedx has defrauded the VA by increasing sales through channel stuffing.

In a statement Thursday, MiMedx emphasized that it was not indicted itself. The company also noted that it was cooperating with the VA’s Office of Inspector General. “The company maintains a robust compliance program that, among other processes and procedures, monitors the activities of our sales representatives,” MiMedx stated. “Those who do not comply with the company's policies and procedures are subject to disciplinary action.” The biopharmaceutical company also said it was "proactive" in informing the VA about employees it believed were not following VA rules and regulations.

Shares in MiMedx have traded down more than 42% since it was first targeted by short sellers in September.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

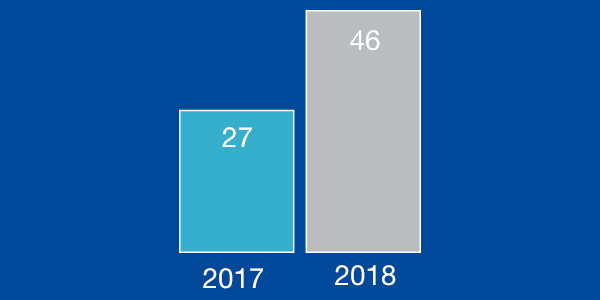

Chart of the week

The number of Canadian companies that have been publicly subjected to an activist demand, as of May 11.

For bespoke data requirements, contact our team at [email protected] or subscribers of Activist Insight Online can visit our interactive statistics page.

Article by Activist Insight