Whitney Tilson’s latest email to friends entitled : Our 3 programs in London July 7-11; 2 new free webinars on “How to Raise $1 Billion (or not)” & “Lessons from 15 Years of Short Selling”; The Harvard Undergrad Fixing Finance; stocks pitched at confs; Fear of Trade War; Bitcoin Drop; Toys “R” Us

VW readers should use “VW10″ for a big discount

Email below

1) We’re going on the road for the first time in two weeks and teaching our three programs in London on July 7-11 (our three-day Lessons from the Trenches investing bootcamp Sat.-Mon. July 7-9, a one-day seminar on How to Launch and Build an Investment Fund on Tuesday, and our new one-day program, an Advanced Seminar on Short Selling on Wednesday). We typically fill our last few seats at a steep discount for students and young/emerging investors, so if you’re available on short notice please email me and we’ll try to accommodate you.

2) Please join us for two more free webinars on Tuesday and Wednesday:

- A) How to Raise $1 Billion (or not)

Tuesday, June 26, 5:00-7:00pm EST

Rooted in their one-day seminar on How to Launch and Build an Investment Fund, Whitney Tilson and Glenn Tongue of Kase Learning will share the many things they did to grow Kase Capital from $1 million at inception in 1999 to over $200 million in assets under management at its peak in 2010 – and why they should have raised over $1 billion if they’d done a few things differently.

To register, go to: https://zoom.us/webinar/register/WN_99AojsWQQf2Fmsvz7xoqPg

- B) Lessons from 15 Years of Short Selling

Wednesday, June 27, 5:00-7:00pm EST

Rooted in their one-day Advanced Seminar on Short Selling, Whitney Tilson and Glenn Tongue of Kase Learning will share their experiences over 15 years of short selling: the highs, the lows, and the many lessons learned.

To register, go to: https://zoom.us/webinar/register/WN_88g6WT03Q-GVxTTqjx6FLw

Further information about Kase Learning and our programs is at www.kaselearning.com and posted at: www.tilsonfunds.com/KaseLearning.pdf.

3) I love this story about one of the students at our seminar a week ago, Angel Onuoha. He’s an extremely impressive young man and will go far. The Harvard Undergrad Fixing Finance, https://www.bloomberg.com/news/features/2018-05-03/harvard-student-starts-fund-to-lead-more-black-recruits-to-banks. Excerpt:

One morning last June, Angel Onuoha took a train from Connecticut, where he was staying with a friend, to New York City. His summer internship at C.L. King & Associates Inc., a small investment bank, was his first real taste of the finance world outside the student financial clubs he’d joined as a Harvard freshman. It was also a reality check. After a month on the job, he says, he had yet to meet another black employee.

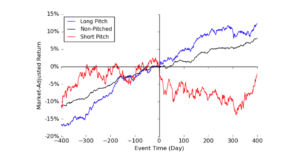

4) This is some shoddy journalism here. If you read the Bloomberg headline (Hedge Funds’ Best Ideas? Those Are Just Stocks They’re Dumping) or the Business Insider one (Here’s the real reason hedge funds give you ideas, according to Harvard), you would think that the Harvard report revealed that stocks investors pitched at conferences performed poorly, as scummy hedgies dumped their shares onto unsuspecting investors lured in by their pitches. But in reality, investors who bought the long ideas and shorted the bearish ideas that were pitched earned outsize returns! Excerpt:

He found that stocks pitched by hedge funds…outperform the benchmark by about 7% [after the pitch].

“Pitched stocks exhibit positive risk-adjusted returns both before and after the pitches,” writes Luo.

Here’s the chart that shows the data:

5) I think a global trade war is the greatest risk in the markets right now – not to say it’s likely, but the odds are going up. Just the Fear of a Trade War Is Straining the Global Economy, www.nytimes.com/2018/06/16/business/tariffs-trade-war.html. Excerpt:

Only a few months ago, the global economy appeared to be humming, with all major nations growing in unison. Now, the world’s fortunes are imperiled by an unfolding trade war.

As the Trump administration imposes tariffs on allies and rivals alike, provoking broad retaliation, global commerce is suffering disruption, flashing signs of strains that could hamper economic growth. The latest escalation came on Friday, when President Trump announced fresh tariffs on $50 billion in Chinese goods, prompting swift retribution from Beijing.

….

Even so, history has proved that trade wars are costly while escalating risks of broader hostilities. Fears are deepening that the current outbreak of antagonism could drag down the rest of the world.

6) Good to see this total scam dying: Bitcoin Drop Sparks Broad Cryptocurrency Selloff, www.wsj.com/articles/bitcoin-drop-sparks-broad-cryptocurrency-selloff-1529684764. Excerpt:

…….

7) An interesting, in-depth look at the demise of Toys “R” Us: Tears ‘R’ Us: The World’s Biggest Toy Store Didn’t Have to Die, www.bloomberg.com/news/features/2018-06-06/toys-r-us-the-world-s-biggest-toy-store-didn-t-have-to-die. Excerpt: