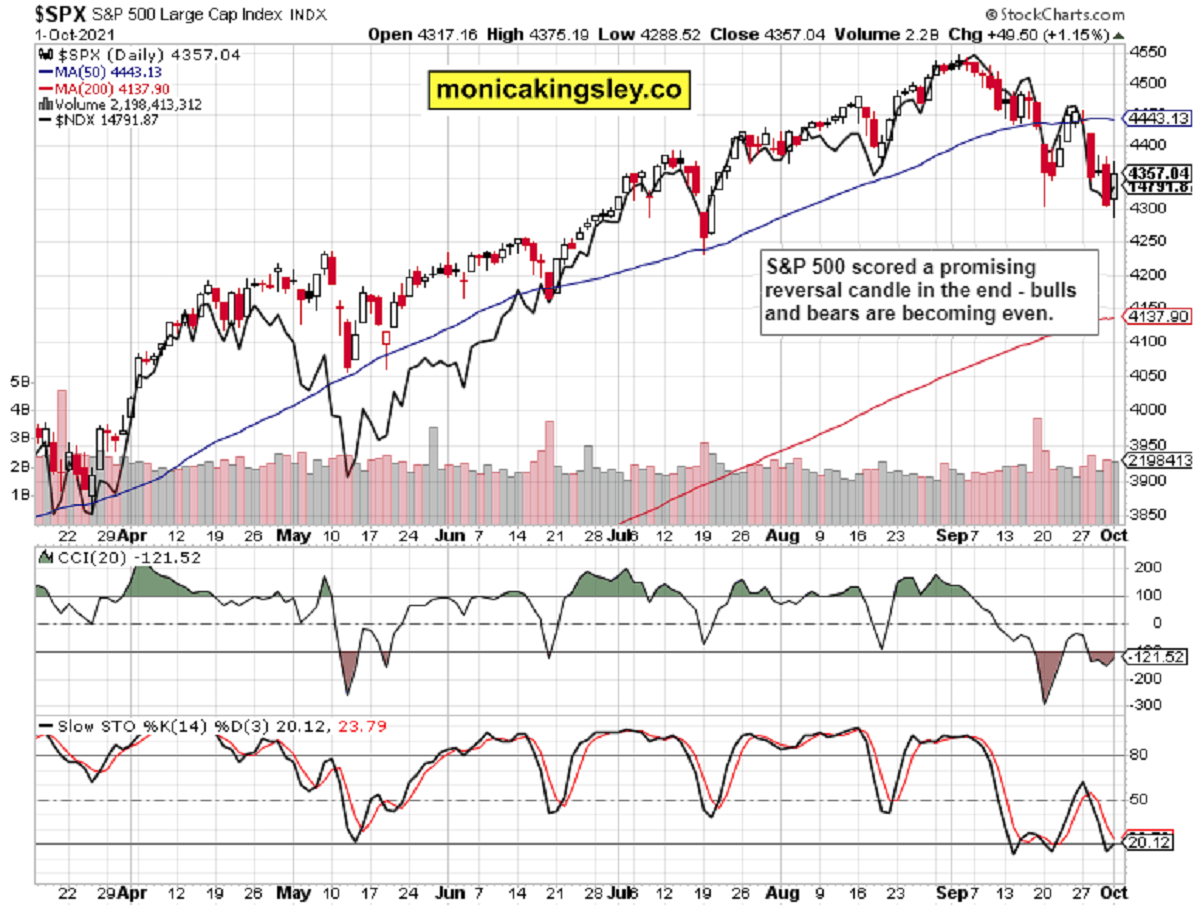

S&P 500 didn‘t make it to the overnight lows during the regular session, and almost fully reversed Thursday‘s slide. After an intraday tug of war, the credit markets leaned the bullish way, and VIX looks like it would try to move a little lower next. Coupled with the put/call ratio, that means a slight advantage for the bulls.

Q2 2021 hedge fund letters, conferences and more

The daily retreat in yields spurred a strong tech upswing – stronger one than in value. Given that yields are likely to keep rising due to the red hot inflation and in order to force Fed‘s hand on taper, that‘s a watchout for the bulls not to get carried away with Friday‘s upswing.

Forget for a moment about the debt ceiling drama or the postponed vote on the $3.5T infrastructure bill. As I wrote on Thursday regarding inflation, commodities and supply chains, add in the question marks over economic growth and job market strength, and you‘ll get the stagflationary picture. Should this theme gather steam, it would lit the fuse under precious metals and commodities – just as it did in the 1970s,, and that‘s why rising interest rates needn‘t be gold‘s death knell, and why silver would rise in price and popularity.

Such a time would correspond with a certain malaise in the stock market, to put it mildly. Real assets stand to gain much – and this time, cryptos as a then non-existent asset class, would benefit too. Earliest, I‘m looking for profits in energy, base metals, agrifoods and the other real assets – indeed, the open long oil and copper positions are solidly profitable again.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 rebound holds more than one day‘s promise, but a fair observation is that the bullish – bearish forces are roughly even early this week.

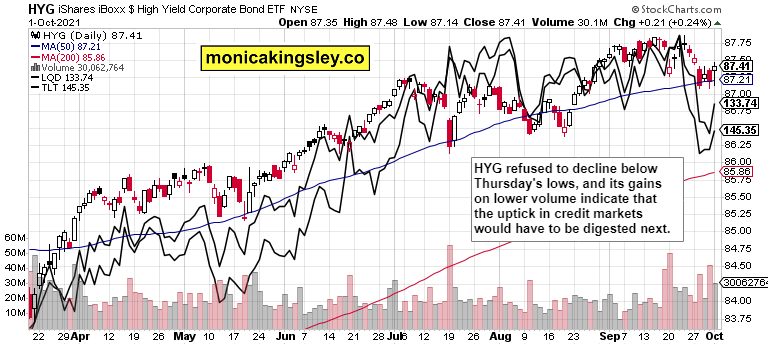

Credit Markets

Credit markets lack the strength of stock market conviction, and look to need a bit more time to confirm. If they don‘t, erasure of Friday‘s bullish uptick comes next – and as the bond guys usually get it right...

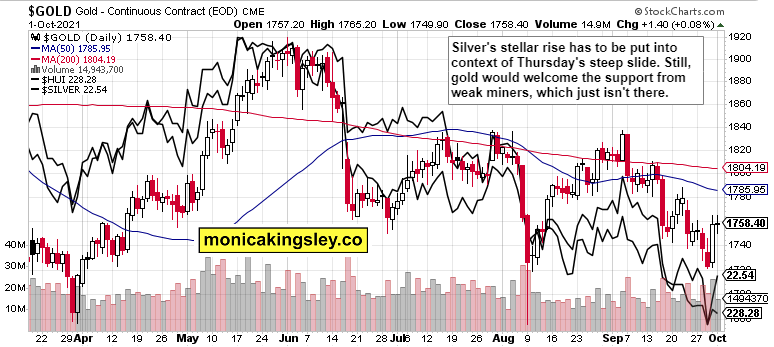

Gold, Silver and Miners

Gold consolidated while silver dealt with that daily slide. Gold volume could have been higher really, to lend more credibility to the nascent upswing. Once silver starts outperforming gold, we would know the focus is turning back to inflation consistently – we aren‘t there yet.

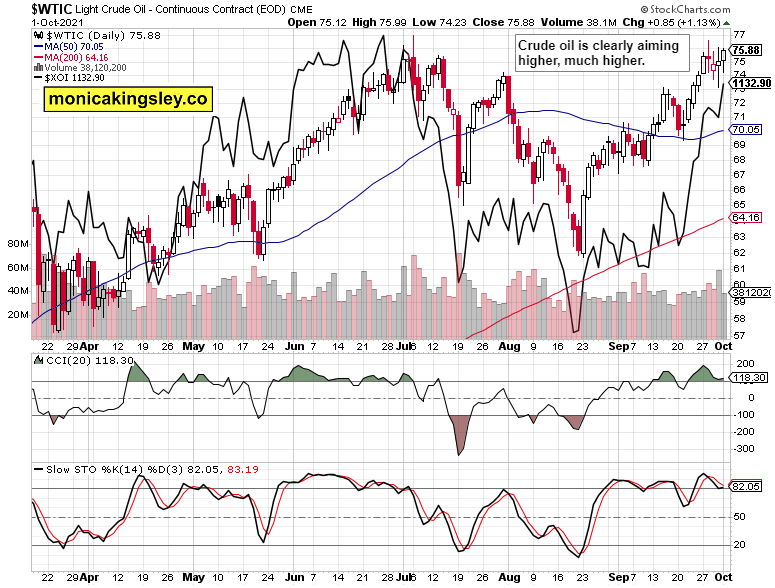

Crude Oil

There is no stopping crude oil, and oil stocks confirm – in spite of the lower volume on Friday, the path of least resistance is higher.

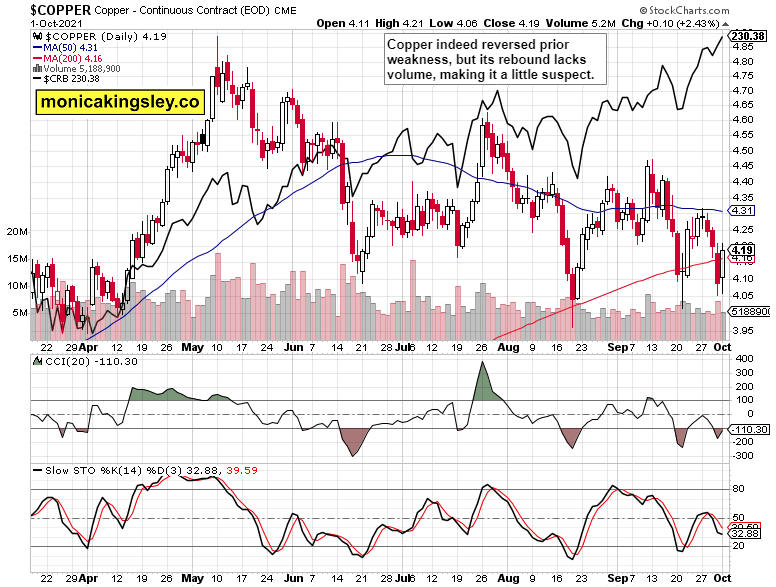

Copper

Copper recovered from that odd Thursday weakness, yet still continues woefully underperforming the CRB Index. I remain optimistic the red metal would rise next into the mid 4.20s at least.

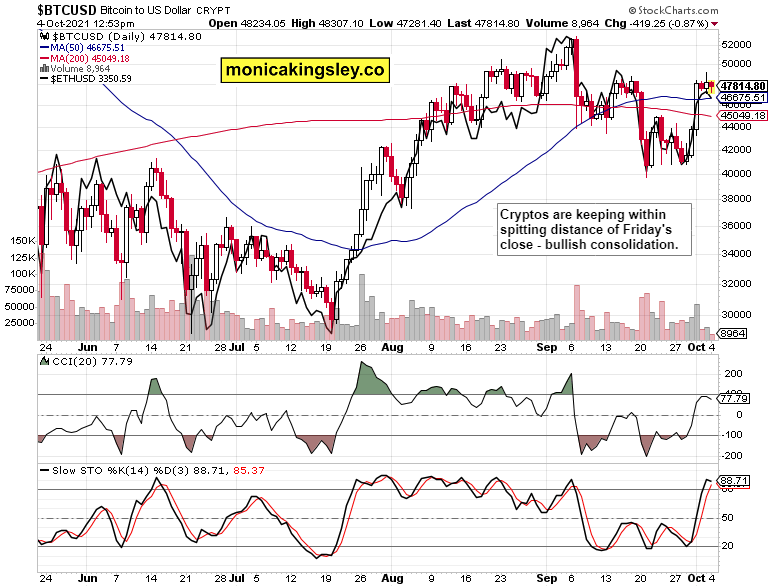

Bitcoin and Ethereum

Bitcoin and Ethereum confirmed the upswing by not retreating, and the early Sep highs are next in sight. The daily indicators have reached consolidation levels, which means the upswing may take a while to develop.

Summary

Stock market bears have taken a daily pause, and credit markets point to a tight range entry to the week. Rising yields is no fluke – inflation is coming back into focus, which would be a boon to precious metals and commodities well beyond energy. Cryptos stand to do great, too.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.