Vltava Fund commentary for the fourth quarter ended December 31, 2019, titled, “Price And Value (A User’s Manual).”

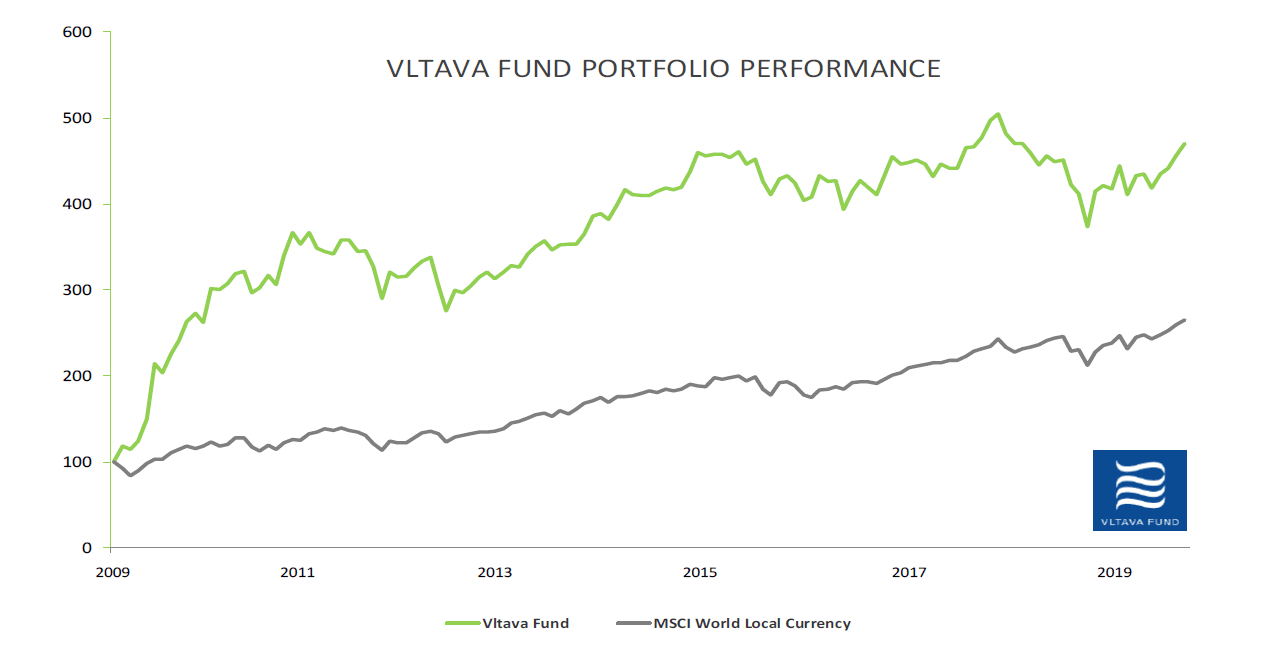

The year 2019 ended for us with a gain of + 25.4%. Our shares in the UK and Russia performed best, and our investments in South Korea, Canada, the USA and Japan also made a significant contribution. We will return to the investment returns later, but first I want to look at another topic.

Q4 2019 hedge fund letters, conferences and more

In October, we held our regular autumn seminar for shareholders. During the questions-and-answers part we touched upon the subject of price and value. After the close of the seminar, I continued this discussion with one of our shareholders. It was a very enlightening debate for both of us, and I think it is worthwhile to summarise it here for all the other shareholders.

Vltava Fund was established on 1 September 2004, and since that time we have published the NAV of the Fund at regular monthly intervals. The NAV is based on actual market prices of our shares, always at the end of a month. About a year and a half ago we took a step quite rarely seen, namely, we began to publish regularly also our estimate of the portfolio’s value together with the NAV. This value estimate is based not on current prices but on our current estimates as to the fundamental values of the shares held in our portfolio.

Our investment philosophy is, always has been, and in future will remain based on the simple idea that an intelligent investment is such investment the price for which we are paying is lower than the value that we are obtaining in return. Of course, this is no invention of ours. Rather, it is a common approach among value investors across the entire world. Not only investors but also analysts concern themselves with the intrinsic value of an investment. If you open any decent investment analysis, it will contain some reflection on intrinsic value of the investment and very frequently also will quantify that value.

When we are considering an investment, we always contemplate its possible value and we compare this value to the current market price. That is the way it always has been with our individual investments. Sometime in the spring of 2012, we began internally to put together from the individual positions in the Fund and their values also an estimate of the value for the portfolio as a whole. We have published this number regularly since 2018 on a monthly basis in the Fact Sheet.

We had been thinking for a long time whether or not we should publish the value estimate. We were aware that, if we were to start publishing it, we would regularly need to face questions like the following: How do you know that the value is exactly this? Why has the NAV been decreasing lately even though the value estimate is growing? When will the NAV catch up to the value? And so forth. The endeavour to provide more information to the shareholders would in all probability rather complicate our lives.

It is no accident that the majority of fund and investment managers do not mention information about a fund’s value. They would rather keep this to themselves (if they concern themselves with it at all), mainly perhaps because it makes life easier and also because they do not want from time to time to be caught with their pants down. Nevertheless, there exist rare exceptions of those who have their skin in the game and regularly publish information on their funds’ values. In Europe, for instance, there is the legendary investor Francisco García Paramés, who, both in his current company Cobas Asset Management and in his previous firm Bestinver Asset Management, has been publishing data on portfolio value for many years.

In the end, the following argument was what decided our internal debate: I consider the information on value to be very important and I also use it in portfolio management. How could I as a shareholder justify keeping that to myself and not provide it to the other shareholders? We did not find a satisfactory answer to that question, and therefore we began to publish data on the portfolio’s value.

What to do with it?

Each shareholder has essentially two possibilities as to what he or she can do with the information about value. One can ignore it completely or include it into the mosaic of information that one has about Vltava Fund and try to use it to one’s advantage. How can one make use of it? I will try to formulate a few basic rules and tools.

1) Is value truly a long-term indicator of price development? In other words, does price follow value in the long run?

I think that markets provide nearly boundless evidence confirming this. I do not want to burden you with this, however, so let us look instead at how it works within Vltava Fund. We began aggregating the value of the portfolio as a whole in June 2012, and since that time we have been showing its development together with that of the NAV at our seminars and annual meetings. You surely remember the graph. You also know from the Fact Sheet how much the Fund’s NAV has increased since then. Important is that the value during that period has grown by nearly the same amount as has the NAV. The difference between their increases is only 3% and actually in favour of the NAV. Even though this is a period of less than 7 years, it is possible to consider this as very clear confirmation of the thesis that price follows the development of value in the long run.

2) Will the NAV of the Fund someday catch up with the value of the portfolio as a whole? Will these two figures sometimes correspond to one another?

This is not very likely and, because that answer might surprise you, I will explain why. Our largest position is in the shares of Berkshire Hathaway. Their price at the end of the year was 340,000 USD and our estimate as to their value is around 420,000 USD. Thus, the value exceeds the price by 23%. This seems to us reason enough to continue holding those shares. Now imagine that the price of the shares would jump to 500,000 USD and thus that the shares would be trading at prices well above their value. This movement would shift the NAV of the Fund upwards, but the value of the portfolio would not change. Because the Berkshire stock would then be overvalued, we would sell it and buy some other stock instead. Ideally, we would buy some stock that is trading at prices considerably below its intrinsic value. This transaction would not influence the NAV of the Fund, but it would move the value of the portfolio upwards. The result would be that both the NAV and the value would have increased, but the difference between them would not have changed.

Therefore, the Fund’s NAV should never catch up with the value of the portfolio, because the stocks we hold in the portfolio should be trading at prices somewhat under their values. If it would happen sometime by accident that the NAV would rise to the level of the portfolio value, that would not be a good sign. In fact, it would mean that we were not able to find any undervalued stocks. To sum up, the NAV should always be somewhat lower than the value of the Fund’s portfolio.

3) How big a difference between NAV and the portfolio’s value is typical or average?

Looking back at the last nearly 7 years, the numbers show that the value of the portfolio has always been higher than the NAV. The greatest difference was 66% in December 2018 and the smallest was 7% in January 2015. On average, the difference is 25%. Also interesting is that the development in the value is far less volatile than is that of the NAV. One might have expected this, by the way. This is logical, and for those interested in this topic I can recommend an excellent study by Robert Schiller from 1980 entitled “Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?”

The change in the Fund’s portfolio value was positive in all years between 2012 and 2019. Its annual increase was in the range of 1–15%. By comparison, the Fund’s NAV is far more volatile. In individual years, it hits even higher upper values and deeper lower values than does the portfolio value.

4) How to take advantage of all this?

It follows from the aforementioned that in the long run the growth in value and NAV will be nearly the same. Furthermore, it follows that there is something like an average difference between NAV and value and that the NAV fluctuates a lot more than does the value. It is possible to make use of this information in two ways. First, the value development is a good indicator of future returns. In our work, we concentrate more on building value than on price movements and NAV. This is because value creation is something we can influence, and it also is decisive for the development of NAV in the long run.

Second, if you see that the difference between value and NAV becomes extreme, you can use is to plan your own investments. If the difference between value and NAV is unusually small, then it is better to be cautious about further investments. On the contrary, if the difference between value and NAV is too great, that can be a sign of better than average future returns and these are the times to consider further investments.

It is exactly this type of thinking we use when choosing individual investments for the Fund’s portfolio. Correspondingly, for the Fund’s shareholders this is applicable on the level of the whole Fund. The numbers at present are as follow: As at the end of 2019, the value of the portfolio exceeded the NAV by 30%, and we anticipate that it will grow faster this year than it did last year.

Changes in the portfolio

There were no major changes in the Fund’s portfolio. Our portfolio shows very little turnover and it does not change much over time. I think this is good. Nor was there reason in the past year to interfere much in the portfolio. Recently, however, there has been one substantial change, and that relates to the costs of currency hedging. We hedge currency risk (except for in the cases of Sberbank and Samsung shares). That means one whole important risk component, the foreign exchange risk, is nearly eliminated. In the long run, it is a good decision. When we launched the Fund on 1 September 2004, the Czech crown’s exchange rates vis-à-vis the two main currencies were as follow: 31.85 CZK per 1 EUR and 26.15 CZK per 1 USD. Today, the crown is stronger against the euro by 20% and against the dollar by 13% (even after its substantial weakening in recent years). If we had not been hedging currency risk, the NAV growth in crown terms would have been significantly less.

There are some costs, though, in relation to hedging currency risk. These ensue from the difference between interest rates in crown terms and in terms of the other currencies against which we hedge. For most of the time, these costs were negative. This means that we even earned a little on currency hedging. The situation changed at the end of 2013 when the Czech National Bank began currency interventions. Until these ended in April 2017, we effectively had substantially negative interest rates here. This had an impact on the price of currency hedging. This cost even exceeded the level of 2% annually during this period. Due to the rise in domestic interest rates after interventions ceased, the costs of currency hedging are this year again negative. For a couple of years, we spent a lot of money on currency hedging, but now we are again earning on it a few tenths of 1 per cent per year.

A look back and ahead

It has been 11 years now since we switched to our present investment strategy. The end of a year presents a good opportunity to take stock. I would happily take last year’s result (+25.4%) in any year. It is the 2018 result (−24.9%) I feel badly about. A single year (indeed, even its very end) was able to devalue several years of good results. It was terribly frustrating for me that after several years of maximum effort I could not demonstrate any solid and tangible result. I think you had the same feelings a year ago. It would be probably naïve to think that we could avoid such a bleak period, because even the greatest investment legends did not avoid it, but this was no consolation for me. In fact, though, the 5 previous years were not bad (+55.2%) and neither had been the 4 years immediately prior (+220.5%). Total returns for those 11 years came to 368.4%, which is more than I ever could have dreamt. (Global stock markets rose by 165.5% over the same period.)

History always leaves room for interpretation, and everybody can interpret these results in his or her own way. One thing is certain, however, and that is that they say nothing about the Fund’s future returns. We are quite often asked the question as to what development we expect in the future. The inquirer usually anticipates a clear and simple answer based on a consideration as to whether we are in a recession already or we will be in a year or how deep the recession will be and that sort of thing. These things may be subject to quite interesting debates, but long-term returns to the portfolio do not depend upon them. Those returns depend primarily on the kinds of stocks in our portfolio.

So, if we should debate about prospects for future development, we had best conduct a debate about our individual positions. Imagine, for instance, that our largest position would be not Berkshire Hathaway but perhaps Uber. Instead of a company tested by time and recessions that is literally drowning in cash and producing strong cash flow, we would own a company that has never been –and may never be – profitable and burns through billions of dollars a year in its business. Are the prospects for these companies the same? What would be their chances of surviving a recession? Surely not the same.

Or imagine that we would own Nokia instead of Samsung, Deutsche Bank instead of Sberbank, and Tesla instead of BMW. There may be investors who would say that this would be better, but we would absolutely agree even with them that the prospects for these two groups of stocks are not the same. Neither would the risk be the same in relation to holding these. There is just no doubt about it.

In considering the prospects of any investment fund, one must begin from an analysis of the current portfolio holdings. That is why we devote a lot of time at our annual meetings and seminars to the individual stocks we own together. I am aware that for some of you this is a level of detail beyond what you want to concern yourself with. For us, though, this is our daily bread. Is there not some simplification that would enable you to assess the Fund’s prospects? This in fact brings me back to the point from which I started. The information about the fundamental value of the portfolio, its development over time, and most especially the difference between this value and the NAV is for you simple, aggregated information that somehow sums it all up. Therefore, we will continue to publish data about value even knowing that it will sometimes show our estimates of value to have been mistaken.

Daniel Gladiš, January 2020

For more information

Visit www.vltavafund.com

Write us [email protected]

Follow www.facebook.com/vltavafund