Article by RCM Alternatives

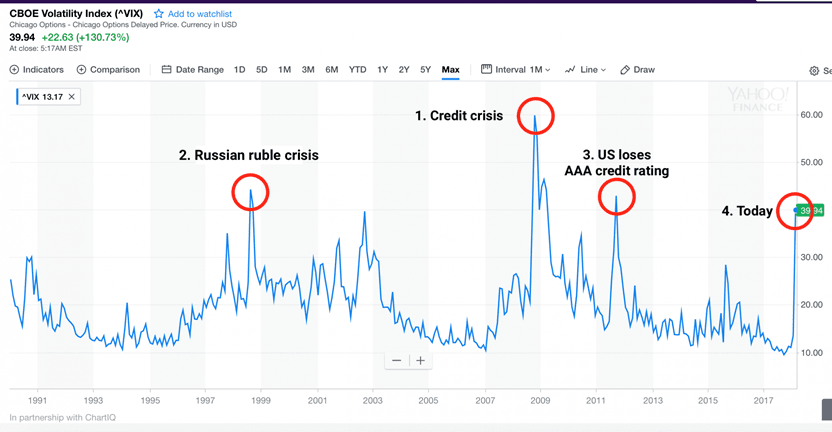

With our whitepaper covering the various ways investors invest in the VIX, how to trade the vix infographic, and various VIX posts – we should have expected our inboxes to be filling up with people asking how the various VIX and volatility traders in the managed futures space performed this week with the VIXmageddon on Monday. And have they ever, with investors curious as to how these firms managed the first real VIX spike since maybe 2008 (with honorable mention to 2011).

(Disclaimer: Past performance is not necessarily indicative of future results)

And it wasn’t just the spike and resulting with the VIX futures move, there was pain in stock index options as well, with one trader mentioning in his letter to investors that the option pricing was even more extreme than in 2008, with a much, much lower S&P 500 index move. When the dust settled on Tuesday, there were a few clear winners (Pearl Capital Advisors – Hedged VIX (QEP)) and some large losers; with a bunch of firms there in the middle, either losing material (but not firm ending) amounts or deftly avoiding the mess and finding themselves about even for the month.

Here is our completely unofficial listing of several volatility trading firms, via both VIX and index options, and how they have fared thus far in February – with the very big disclaimer that these aren’t official numbers from the managers, include just Monday’s results in some cases, include all of Feb in other cases, and have been gleaned from our own estimates, client accounts, manager reports, conversations, observations, and more.

Schedule a call with us for more color on each of these managers, why they performed as they did, and what the coming weeks and months look like for their programs.

Past Performance is Not Necessarily Indicative of Future Results

- Pearl Capital Advisors – Hedge VIX (QEP) +32%

- Aleph Strategies – Aleph Options +1%

- Carbide – Absolute Return 0%

- Double Helix Capital 0%

- HiProb Capital Management – HiProb-I (QEP) 0%

- Warrington Asset Management – Strategic (QEP) 0%

- Certeza Asset Management – Macro Vega 1%

- Global Sigma Group – Global Sigma Plus (QEP) -3%

- Esulep Management -Permo Fund (QEP) -4%

- Diamond – Enhanced S&P -6%

- Orion Asset Management – Beta Opportunity (QEP) -7%

- Cauldron – Stock Index Plus (QEP) -9%

- BlueNose – BNC BI -10%

- Goldenwise Capital Management – Quantitative Multi Strategy (QEP) -25%

- Marmon – VIX Program 1 (QEP) -35%

- GNE Management – S&P Futues & Options Strategies -38%

- LJM Partners – Preservation Growth Fund (QEP) -82%

- Intex – Covered Program -95%