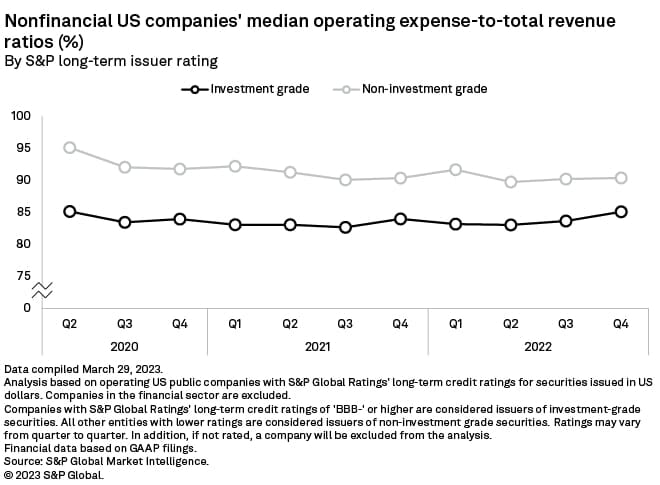

The day-to-day costs of running a business are rising relative to US companies’ revenues. The median ratio of operating expenses to total revenue for investment-grade-rated companies climbed to 85% in the fourth quarter of 2022, up from 83.6% in the third quarter of 2022, according to the latest data and analysis from S&P Global Market Intelligence.

Q1 2023 hedge fund letters, conferences and more

Key highlights from the analysis include:

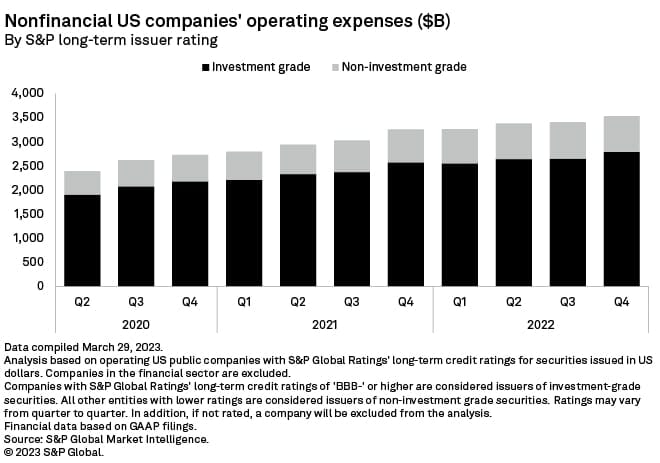

- The 10-quarter high came as operating expenses, such as rent and payroll, increased 5.3% in the quarter to $2.791 trillion.

- The median operating expense ratio also increased for companies rated non-investment grade by S&P Global Ratings, rising to 90.3% in the fourth quarter of 2022 from 90.2% in the third quarter of 2022. That rise was despite total operating expenses in the quarter declining 1.7% to $742.92 billion.

- The investment-grade communication services sector recorded the biggest jump in median ratio to 85.8% from 78% in the third quarter of 2022. The utilities sector also experienced a sharp increase, with the median ratio for the noninvestment grade component rising to 90.7% from 84.5%.

- The energy sector lowered the ratio by slashing day-to-day costs. Among investment-grade companies, total expenses fell 9.5% to $333.91 billion, helping the median ratio fall to 78.9% from 81.4%. Energy companies rated lower than BBB- cut operating expenses 23.1% to $64.20 billion in the fourth quarter of 2022, contributing to the median ratio declining to 74.7% from 81.2%.