The United States borrowed $488 billion in the first quarter of 2018 – a record high for this period.

That’s only from January through March. . .

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

At this rate – over a full year – that’s $2 trillion in more debt.

As I wrote a couple months ago, the rising debt is making the economy very fragile. Especially since all this borrowing is happening during non-recessionary times.

Making matters worse, the United States’ spending increased 300% more than the growth in revenue.

And don’t forget that interest payments due to service the U.S. National Debt is hitting new record highs. . .

One thing is for certain – borrowing is going to keep increasing.

“Tax and spending measures approved by Congress and President Donald Trump are expected to push the budget gap to $804 billion in the current fiscal year, from $665 billion in fiscal 2017, and then surpass $1 trillion by 2020, according to the Congressional Budget Office.”

You might be asking yourself – like any sane individual – that this huge amount of borrowing is becoming unsustainable.

And you’d be right to do so.

But how does U.S. Treasury Secretary Steve Mnuchin – the man who’s in-charge of the United States bank account – feel about this?

Well, he’s not concerned at all about the rising debt or about the bond markets ability to absorb it all without sending interest rates soaring

“It’s a very large, robust market — it’s the most liquid market in the world [U.S. bond market], and there is a lot of supply,” he said in a Bloomberg TV interview on Monday. “But I think the market can easily handle it… I’m not concerned about that. I think that there are still a lot of buyers for U.S. Treasuries,” he said when asked about the risks of reduced demand for Treasuries and increased supply.”

So, is his unconcern of all this increasing debt – and his assumptions that others will eagerly keep funding U.S. – correct?

No – and he’s dead wrong.

Here’s why. . .

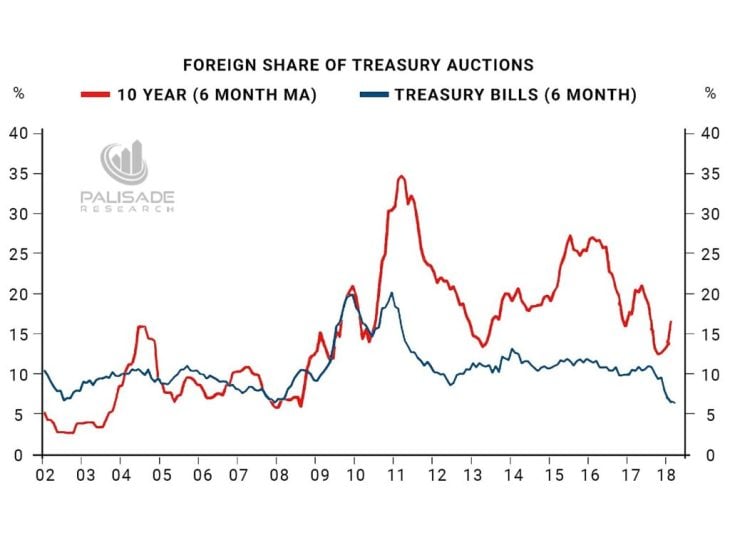

Foreign Central Bank demand for U.S. government debt is declining.

Right now, foreign investors hold roughly 40% of U.S. government debt – the lowest since November 2016.

This trend has continued downwards since its peak at 55% during 2008. . .

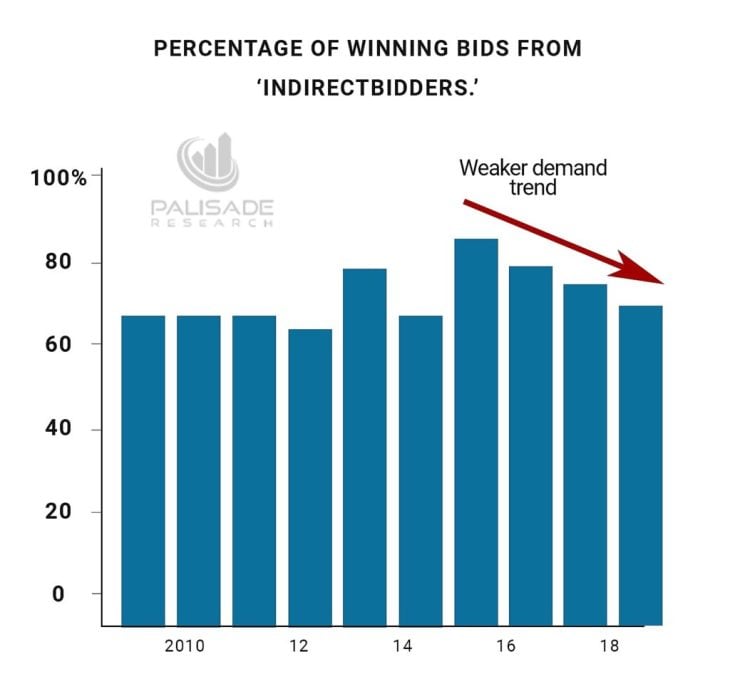

Not to mention, The ‘indirect bidders’ of U.S. debt (these are mutual funds and foreign investors) are becoming less interested at the treasury auctions. . .

This is a recipe for disaster: declining foreign demand of U.S. debt at a time when the U.S. needs significantly more funding is worrisome.

But – there’s something else making the situation extremely fragile. . .

The Federal Reserve is no longer monetizing the Treasury, which they did between 2008 – 2014 with their aggressive bond buying programs; known as Quantitative Easing.

Instead, the Fed is now actually selling bonds – Quantitative Tightening – which is sucking money out of the system.

This is the worst possible time for the Fed to be selling bonds – because as foreign demand for debt is declining, the Treasury will depend on the Fed to monetize the deficits eventually.

That’s why I expect the Fed to reverse their tightening and restart their printing press – sooner than many expect.

Think of it this way – if you live in your lavish apartment but can’t afford to pay rent with your own income alone, you will need to borrow the difference. But what if friends and family become less interested in lending you money?

You can see how that situation becomes hopeless – but thankfully for the U.S., they have a printing press at the Fed.

And without a doubt they will need them to help cover the growing difference. . .

Once the market starts opening their eyes and realizing this is the only option for the U.S. to keep borrowing vast amounts over the long-term, the Dollar will suffer.

So, does U.S. Treasury Secretary Steve Mnuchin really believe that nothing is wrong?

How can he be so unconcerned about the United States’ soaring borrowing – at a time when foreign lending is fading – all while the Federal Reserve is tightening credit?

I’m sure he must be worried deep down – very worried – but won’t ever admit it publicly.

Because it’s all about upholding confidence in the ‘full faith and credit’ of the U.S.

Even though in reality – things are becoming much more fragile than the market realizes. . .

Previously Published HERE https://palisade-research.com/where-are-the-borrowers/

Author Bio:

Adem Tumerkan

Editor-in-Chief of Palisade Research

Before joining Palisade Global Investments, Adem was a Research Analyst at Stansberry Research – under Agora Financial. Adem is a born contrarian and has extensive knowledge of markets, financial history, and economics. He is a value investor and fascinated with cycle theory. But his focus on ‘black swans’ and how to position oneself to make huge returns during volatile times is what really separates him from the rest.