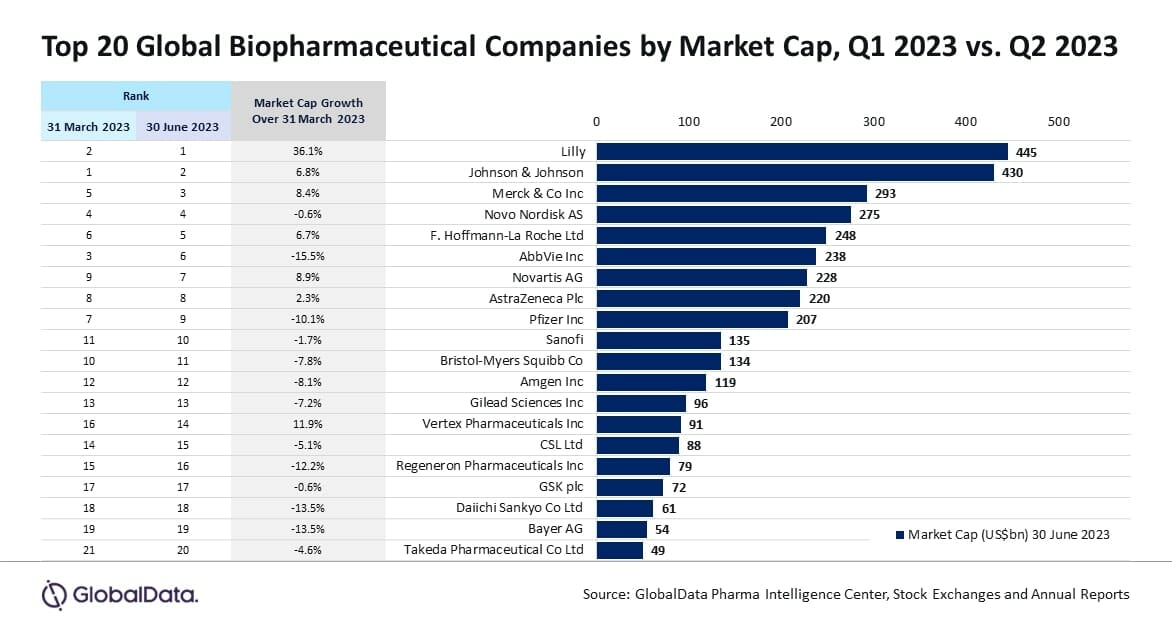

Despite the continued inflationary pressures, the second quarter (Q2) of 2023 yielded promising outcomes for the top 20 global biopharmaceutical companies. The aggregate market capitalization demonstrated a resilient upswing of 2.3%, surging from $3.49 trillion during the first quarter (Q1) of 2023 to an impressive $3.56 trillion in Q2 2023, reveals GlobalData, a leading data and analytics company.

The Top 20 Global Biopharmaceutical Companies

Alison Labya, MSc, Business Fundamentals Analyst at GlobalData, comments: “Lilly witnessed the largest market capitalization growth of 36.1% over Q2 2023, moving up to first position in the list and displacing Johnson & Johnson from its top spot for the first time even though it reported a 6.8% increase in market capitalization.”

Eli Lilly

Eli Lilly And Co’s (NYSE:LLY) strong market capitalization growth over Q2 was attributed to its diabetes drug Mounjaro, a synthetic peptide that reported $980 million in global sales, according to GlobalData’s Pharmaceutical Intelligence Center Drugs Database. In addition, Lilly is anticipating Mounjaro’s approval for the treatment of obesity based on the release in Q2 of two positive pivotal phase III trial results; SURMOUNT-3 and SURMOUNT-4.

Furthermore, the favorable outcomes of the phase III trial in the TRAILBLAZER-ALZ 2 investigation, evaluating donanemab as a monoclonal antibody therapy for early symptomatic Alzheimer’s disease, played a pivotal role in Lilly’s market capitalization surge last quarter. The subsequent submission for regulatory approval to the US FDA, anticipated to be received by year-end, further fueled this advancement.

Vertex Pharmaceuticals

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) moved up by two places with a 11.9% market capitalization growth over Q2 following the submission of CRISPR-based ex vivo cell therapy exagamglogene autotemcel (exa-cel) for US FDA approval with its partner CRISPR Therapeutics.

Merck & Co

Merck & Co Inc (NYSE:MRK) moved up to the third position with an 8.4% market capitalization increase due to its $10.8 billion acquisition of Prometheus Biosciences. This strengthens Merck & Co’s immunology pipeline with the addition of PRA023 – a monoclonal antibody drug currently being evaluated in ulcerative colitis, Crohn’s disease and systemic sclerosis – which is forecasted to achieve global sales of $2.1 billion by 2029, according to GlobalData’s Drugs Database. This may likely offset blockbuster drug Keytruda’s expected sales decline following its loss of exclusivity in 2028.

More than half of the top 20 global biopharmaceutical companies reported a decline in their market capitalization over Q2 2023, with AbbVie (-15.5%), Daiichi Sankyo (-13.5%), Bayer (-13.5%), Regeneron Pharmaceuticals (-12.2%) and Pfizer (-10.1%) recording negative growth exceeding 10% in Q2 2023.

AbbVie

AbbVie Inc (NYSE:ABBV) reported the largest market capitalization decline in Q2 2023, largely due to the reported decline in sales of its blockbuster drug Humira resulting from biosimilar competition. Concerns regarding the efficacy and safety of Daiichi Sankyo’s partnered monoclonal antibody conjugated lung cancer drug with AstraZeneca, datopotamab deruxteca, triggered its market capitalization decline in Q2.

Labya concludes: “Biopharmaceutical companies such as AbbVie are starting to experience the consequences of biosimilar competition. To mitigate the impacts of inevitable patent cliffs, top players in the industry are forced to shift their focus to new blockbuster drugs and continue to invest in the research and development (R&D) of innovative therapies.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.