The yield curve is an important way to predict if a recession is approaching.

And right now, it’s signaling that our economy is dangerously close to one. . .

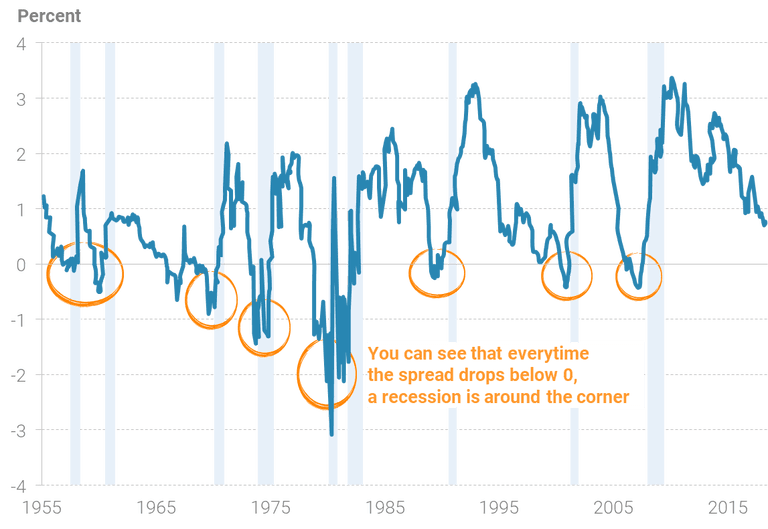

You just need to look at the spread between the 2 and 10-year bond yields.

A couple economists and fund managers I know call this The 2 n’ 10 Rule.

It’s really simple:

If the 2-year interest rate is less than the 10 year, it’s a normal curve.

This is what the yield curve looks like 99% of the time – when an economy is growing. . .

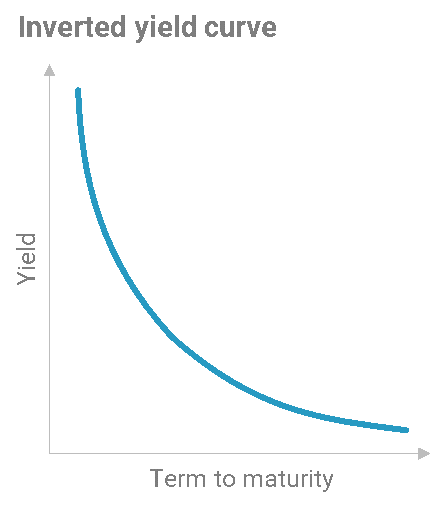

But, if the 2-year interest rate is higher than the 10 year, it’s an inverted yield curve.

This occurs when there is low growth in the economy – or when a recession is about to happen. . .

An inverted yield curve has correctly signaled the last nine recessions since World War 2 – except 1 in the 1960’s.

That’s 9/10 times in 60 years . . .

And right now, the yield curve is getting close to inverting again. . .

Its ability to predict a recession is so important that the San Francisco Federal Reserve recently published research about it – finally acknowledging it’s powerful accuracy.

“Every U.S. recession in the past 60 years was preceded by a negative term spread, that is, an inverted yield curve. Furthermore, a negative term spread was always followed by an economic slowdown and, except for one time, by a recession. . . “

Just look at the predictive power of the 2 n’ 10 Rule yourself. . .

So why do Inverting Yields precede a recession?

There are a couple reasons. . .

First: A flatter and inverted yield curve make it less profitable for banks to borrow short term and lend out long term – the entire business model of banking. This lessens the supply of loans available and tightens credit markets.

Second: When investors think a recession is likely to happen, they buy longer term bonds. That’s because in a recession there is low growth and deflation, so they try to lock in yields before they drop lower.

The inversion happens when the Fed starts forcing short term interest rates higher through rate hikes.

So, on one end of the yield curve, you have the bond market predicting lower growth and deflation, and on the other end is the Fed predicting inflation and growth.

They’re basically playing tug-of-war.

And historically, the last 9 out of 10 times, the bond market was right. . .

Another key takeaway here is that the bond market is doubting the Fed’s agenda – this shows us that there is weakening confidence in the Fed and their abilities to get growth going. . .

My analysts and I have been using The 2 n’ 10 Rule for a while now – among many others.

This tool is critical for us when we are planning macro-situation trades.

Unlike other mainstream analysts and investors, we aren’t claiming to know the ‘what’ or ‘when’ of a recession in the U.S.

We just look at the probabilities of one happening.

“With all the current information and data available, what are the chances of a recession going forward?”

With the U.S. budget deficit soaring, GDP and growth forecasts declining, and the Fed’s rate hikes helping cause the very recession the Fed is so worried about – known as the Fed’s Paradox – we view the economy as highly fragile.

Imagine a house of cards on a kitchen table. Each new card added to an already delicate tower could knock everything over. Or even the slightest nudge of the table or gust of wind could do it.

This is being fragile – when something is very sensitive to any disturbances.

And the point is, there are a lot of catalysts and external issues pointing towards huge downside – not upside.

Before financial markets imploded in 2008, Greenspan was raising rates because his models told him “everything looked good.”

But the bond market wasn’t as optimistic. . .

Investors who actually looked at the fragility of the U.S economy and used The 2 n’ 10 Rule positioned themselves properly.

And this time is no different.

You’ve been warned. . .

Article by Adem Tumerkan, Palisade Research

About The Author

Adem Tumerkan - Editor-in-Chief of Palisade Research

Before joining Palisade Global Investments, Adem was a Research Analyst at Stansberry Research – under Agora Financial. Adem is a born contrarian and has extensive knowledge of markets, financial history, and economics. He is a value investor and fascinated with cycle theory. But his focus on ‘black swans’ and how to position oneself to make huge returns during volatile times is what really separates him from the rest.