FORECASTS & TRENDS E-LETTER

by Gary D. Halbert

April 3, 2018

1. Barron’s: “The Great Labor Crunch” by Avi Salzman

2. When Labor Shortages Hit, They Can Last For Years

3. Labor Force Participation Rate Lowest in 40 Years

4. Demographics Make Labor Shortage a Near Certainty

Overview

Debi and I have been out of town the last several days helping our son and daughter-in-law move into their first house. As a result, I have reprinted an excellent but very concerning article which appeared in Barron’s last month. We have a growing labor shortage in the US, and it will get worse before it gets better. You need to be aware of this problem as it will significantly affect the economy and the markets. Please read on.

Barron’s: The Great Labor Crunch

By Avi Salzman, March 9, 2018

[Emphasis is mine, GDH.]

It took mere months for the Great Recession to claim millions of American jobs. Now, as employers scramble to rebuild the workforce, they’re facing a dilemma: The labor pool is shrinking, and it could be decades before it comes back.

Across the nation, in industries as varied as trucking, construction, retailing, fast food, oil drilling, technology, and manufacturing, it’s becoming increasingly difficult to find good help. And with the economy in its ninth year of growth and another baby boomer retiring every nine seconds, the labor crunch is about to get much worse.

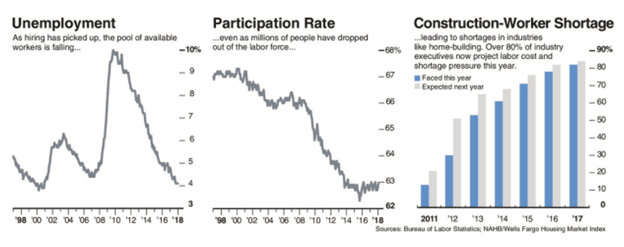

In the near term, this shortage is undoubtedly good news for workers. Unemployment, at 4.1%, is at a 17-year-low, and wages are rising in a more robust pattern, despite Friday’s employment report showing a deceleration in wage growth in February. More Americans say jobs are plentiful than at any time since 2001. This, of course, is how a labor market works: Production rises, workers get scarce, and employers raise wages to attract employees.

It won’t be so simple this time. A long-awaited demographic shift, and a protracted slowdown in productivity improvement, has stiffened the economy’s joints. Business growth should be sprinting, but it’s stuck at a trot, and most economists don’t see it speeding up over the longer term, even with the recent tax cuts.

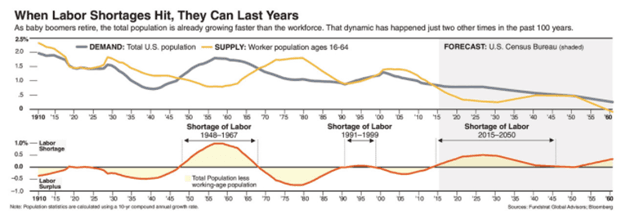

Census Bureau projections show the overall U.S. population, a rough proxy for the country’s demand for goods and services, growing faster than the workforce— which supplies those goods and services— through 2030 and probably beyond. From 2017 to 2027, the nation faces a shortage of 8.2 million workers, according to Thomas Lee, head of research at Fundstrat Global Advisors. It’s the most substantial shortfall in at least 50 years, on a percentage basis, according to his calculations.

The crunch threatens to stall America’s economic engine: Oil and gas stay in the ground because there aren’t enough workers to extract it; homes aren’t built because builders can’t find enough laborers. In Maine this winter, the state couldn’t find enough people to drive snowplows.

A labor shortage has hit the nation’s most productive oilfield, the Permian Basin in Texas and New Mexico. “It’s an emergency, a crisis actually. It’s causing major delays,” says Clint Concord, senior operations manager at Byrd Oilfield Services in Odessa, Texas.

Concord adds that he has been through several boom and bust cycles, but has never had such trouble finding and retaining good employees. For the first time, his company has been giving bonuses to workers willing to sign contracts. The key: They must sign noncompete clauses, to discourage them from jumping ship.

The problem is even hitting the local doughnut shop. Last month, Dunkin’ Brands Group CEO Nigel Travis called the labor squeeze his biggest strategic challenge. It’s not just going to make it harder for Dunkin’ franchisees to staff the 1,000 net new locations the company plans to open over the next three years. “It’s going to affect GDP growth, if it’s not fixed,” Travis said.

Gad Levanon, chief economist for North America at The Conference Board, a nonprofit research organization, says that most economists are projecting gross-domestic-product growth of 2% or less, on average, over the next decade, versus the 3% long-term average. Much of that gap is caused by the labor pinch, he argues.

Two other pressure points add to the pain. Millions of people have dropped out of the workforce, owing to factors such as disability, opioid addiction, and prison records that make it hard to snare jobs. The labor force participation rate, which measures the percentage of the adult population that’s working or actively seeking employment, has dropped to 63% from 67% in 2000.

Those who are working are sometimes pulling double duty, but it’s not showing up in the economic numbers. Since the recession, productivity has risen “more slowly than at any other period in U.S. history,” Levanon says. And the Trump administration’s plans to reduce immigration—both legal and illegal—could hamper another source of labor force growth.

Levanon has been waving red flags about the labor problem for years. The message, he says, has been overshadowed by another source of anxiety: robots. The assumption is that automation is about to replace millions of workers. But the robots probably won’t get here in time.

“A lot of the low-hanging fruit of replacing workers with tech already took place 10 to 20 years ago,” Levanon maintains. “Production workers were replaced by robots, and secretaries were replaced by personal computers. It turns out that to replace the next worker with technology is not as easy.”

The shortage raises two substantial concerns for investors. If employers are forced to boost wages more dramatically in a bidding war for staff, it could spark faster inflation and thus interest-rate hikes by the Federal Reserve—the fear that sparked last month’s stock market correction.

On a longer-term basis, slower economic growth will hit asset prices. Although stocks can climb during periods of tepid economic growth—see, for example, the past nine years—that effect eventually diminishes. Today’s high valuations are largely a bet on growth eventually breaking higher.

The labor shortage is a unique sort of problem—easily predictable years ago but still a surprise. That’s largely because of the 2007-09 recession, which sparked a longer-than-usual employment slump. The jobless rate was above 5% for more than seven years, during which labor was cheap and abundant. Employers had little incentive to prepare for tighter labor markets by upgrading their machinery or processes, which might have boosted productivity.

“Normally in recessions, even a deep recession like 1980 to ’82, the economy snaps back quickly enough that businesses don’t settle into that pattern,” says J.D. Foster, the chief economist at the U.S. Chamber of Commerce.

The recession also caused many workers to delay retirement because their savings had evaporated in the stock downturn. That might have masked the shortage, but now retirements are picking up again.

Labor, of course, is still cheap by many measures—average hourly earnings have risen at an annual pace below 3% for more than eight years, lagging behind the gains in other recoveries. In addition, few people are quitting their jobs to take better-paying gigs.

That supports a counterargument: “The biggest evidence that there aren’t labor shortages is that you’re not seeing it in the wage growth,” says Elise Gould, senior economist at the Economic Policy Institute, a left-leaning nonprofit research organization. She says there may be shortages in some industries, but not on a widespread basis. “If they’re getting by without having to [raise wages], then there is no shortage.”

However, some big companies are starting to take action, announcing pay hikes—some in the form of one-time bonuses—since the tax cuts went into effect. Last week, Target (ticker: TGT) said that it would boost its minimum hourly wage to $12, a 9% increase from its prior minimum of $11, established by an earlier hike just last fall. In areas with particular shortages, pay boosts have been more generous; average compensation for carpenters in Houston jumped 57% in only three years, according to one wage survey.

New laws boosting minimum wages to $15—more than twice the federal minimum of $7.25—are starting to take effect in several cities and states.

Friday’s employment report showed annual wage growth slowing to 2.6% in February from 2.8% the month before, but those numbers don’t tell the whole story. Supervisors saw their pay growth slip, but nonsupervisory and production employees— who make up 80% of the workforce—saw wage gains accelerate. “Do not buy into the view that wages were tame” because the overall number looked weak, said David Rosenberg, chief economist at money manager Gluskin Sheff.

Higher pay will solve only part of this problem. In the longer term, demographics make a labor shortage a near certainty. The working-age population is set to grow just 3% by 2030, even as the total population expands by 9%, the Census Bureau projects.

Manufacturing has about 12.5 million workers today. By 2025, about 2.5 million will have retired in the preceding decade, says Carolyn Lee, executive director of the Manufacturing Institute, an arm of the National Association of Manufacturers. All told, the industry is looking at a two million-worker shortage by 2025.

Bayard Winthrop founded his apparel company American Giant on the premise that he could create high-quality clothes in the U.S., while offering workers competitive salaries. Some good early press led to a surge of orders, allowing Winthrop to open two factories in North Carolina. But he and his U.S. suppliers ran into problems staffing their factories, leading to backlogs that caused customers to wait as long as six months for their sweatshirts.

“I never imagined that we were going to have a hard time spinning up our labor force,” he said. “A big component of that is just a lack of available labor—skilled labor and unskilled labor.” Winthrop says the company now starts its Christmas-time production in April to ensure that labor shortages don’t set it back again.

The trucking industry already faces a shortage of 51,000 drivers, and that’s expected to more than triple by 2026, according to the American Trucking Associations. The shortage, and a spike in demand, is causing freight costs to surge around the country. A key gauge of spot trucking prices was up 31% in February, year over year, and those costs have become a frequent cause for griping by retailers and manufacturers on earnings calls. Truckers’ wages are rising, but are unlikely to draw enough recruits. “If it was just a pay issue, I think solving this would be a lot easier,” said Bob Costello, the association’s chief economist.

Tesla and others are building prototype trucks designed to drive themselves around the country. But anyone expecting robots to take over soon probably will be disappointed. “A robot will not replace a driver for a very long time,” says Costello. “We think it’s decades.” Indeed, there are worries that talk of self-driving trucks is sabotaging efforts to sign up new drivers. “The last thing we can afford is for our rhetoric on driver assist or autonomous to get out in front of reality and start seeing enrollments and interest in the field drop before the technology is ready to really engage,” Derek Leathers, CEO of trucking company Werner Enterprises (WERN), said at an investor conference last fall.

The National Association of Homebuilders found last year that 82% of builders saw labor cost and availability as a major problem in 2017, up from 13% in 2011. Nine years after the recession, the pace of home construction remains more than 10% below normal rates, and there was just 3.4 months-worth of inventory on the market in January, just above December’s record low of 3.2 months. Builders want to boost those numbers but can’t find the workers, observes Instinet analyst Michael Wood… END QUOTE

Gary here: The article goes on with examples, but the point is clear. The US economy has a growing labor shortage, and it’s going to get worse before it gets better with the increasing retirement of Baby Boomers. I’ll have much more to say about this problem in the weeks and months ahead.

Webinar: Why You Need Real Estate in Your Portfolio

More and more investors understand the importance of diversifying their portfolios with assets like real estate that are not highly correlated with the stock markets and have the potential to produce income while those assets grow in value. The problem is that most people are not experts in real estate.

On Wednesday April 11th at 3:00 PM Eastern Time, we will host a live webinar featuring Allan Swaringen, President and CEO of JLL Income Property Trust. Allan has over 25 years of experience in the real estate industry, and you’ll be able to ask Allan your questions at the end of the presentation.

JLL Income Property Trust invests in a portfolio of office buildings, apartments, retail-anchored shopping centers and industrial properties. Their investment objectives are to:

- Generate attractive income for distributions

- Preserve and protect capital

- Achieve NAV appreciation over time

- Provide portfolio diversification

Register today for our webinar.

You don’t want to miss this opportunity. I highly recommend you join us for our webinar on April 11th at 3:00 PM Eastern Time. Even if you are unable to watch the webinar live, be sure to sign up. We’ll send you a recorded version of the webinar that you can watch at your convenience.

You can also call Phil Denney or Spencer Wright at 800-348-3601 to learn more about JLL Income Property Trust. They’ll be happy to answer any questions you have.

All the best,

Gary D. Halbert

Gary's Between the Lines Blog: China Seeks to Avoid Trade War With US... Maybe