GlobalData has announced the latest Legal and Financial Adviser League Tables, based on the total value and volume of merger and acquisition (M&A) deals they advised on in metals & mining sector in H1 2023.

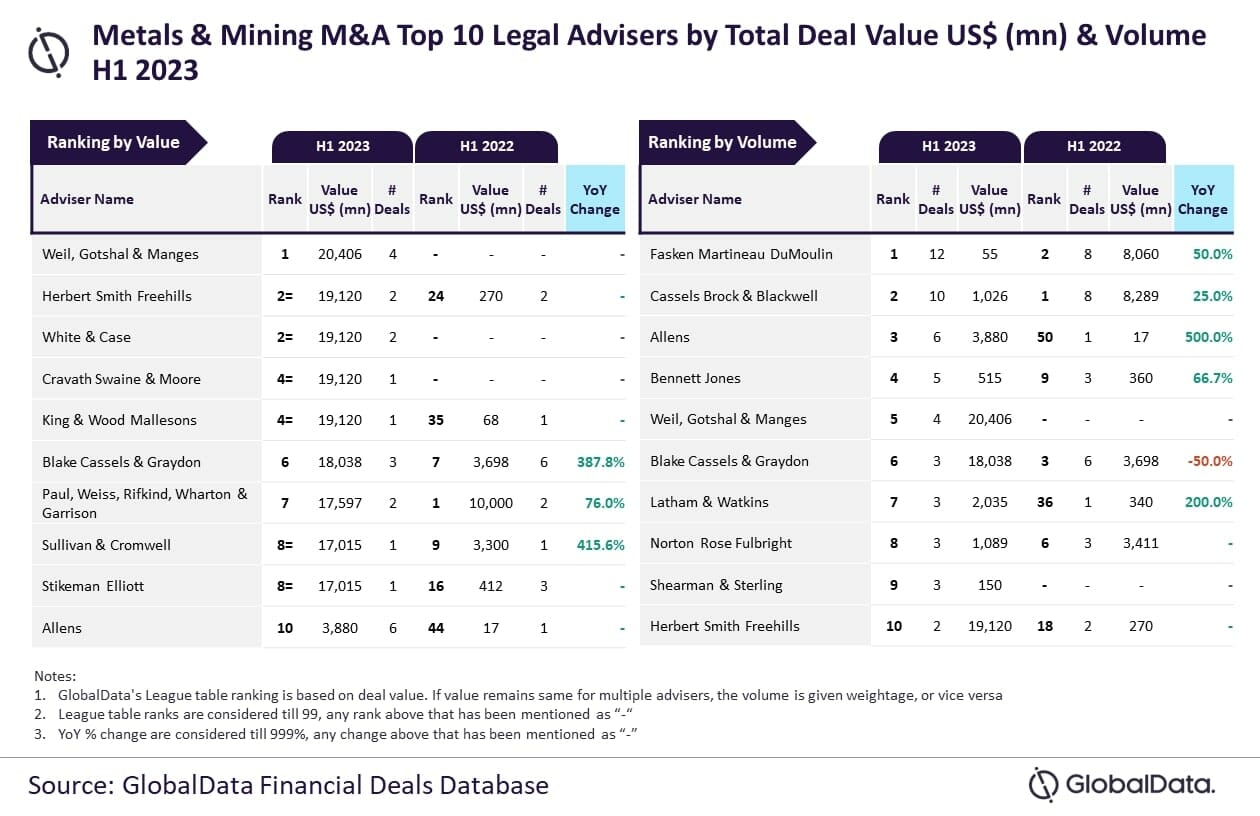

Weil, Gotshal & Manges, Fasken Martineau DuMoulin top M&A legal advisers by value, volume in metals & mining sector in H1 2023

Weil, Gotshal & Manges and Fasken Martineau DuMoulin were the top mergers and acquisitions (M&A) legal advisers in the metals & mining sector during the first half (H1) of 2023 by value and volume, respectively, according to the latest Legal Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that Weil, Gotshal & Manges achieved its leading position in terms of value by advising on $20.4 billion worth of deals. Meanwhile, Fasken Martineau DuMoulin led in terms of volume by advising on a total of 12 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Fasken Martineau DuMoulin was among the only two firms with double-digit deal volume in H1 2023. However, despite leading by volume, it lagged in terms of value and did not feature among the top 10 by value.”

“Meanwhile, Weil, Gotshal & Manges, despite advising on less than half the number of deals advised by Fasken Martineau DuMoulin, managed to top the chart by value due to involvement in big-tickets. Weil, Gotshal & Manges advised on a $19 billion deal, which helped it lead by value.”

Herbert Smith Freehills and White & Case jointly occupied the second position in terms of value, by advising on $19.1 billion worth of deals each.

Meanwhile, Cassels Brock & Blackwell occupied the second position in terms of volume with 10 deals, followed by Allens with six deals, Bennett Jones with five deals, and Weil, Gotshal & Manges with four deals.

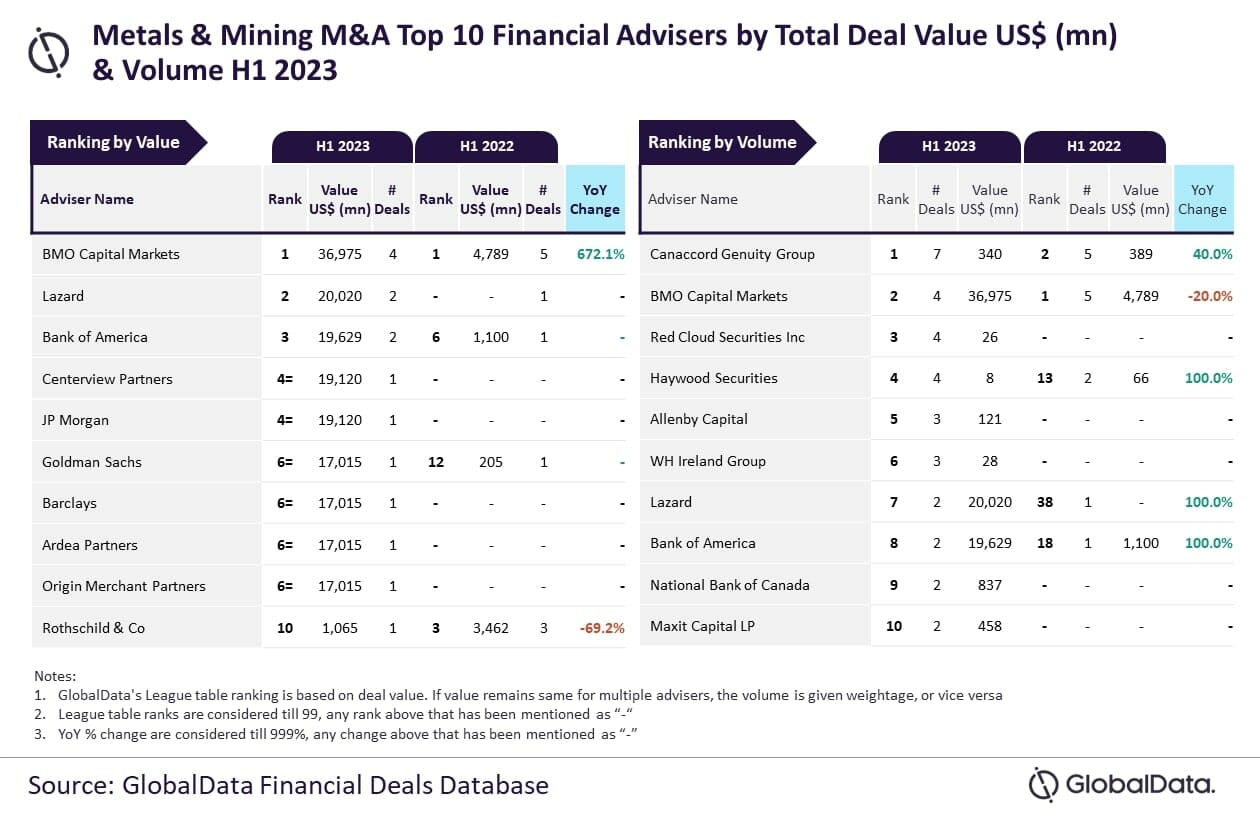

BMO Capital Markets, Canaccord Genuity Group top M&A financial advisers by value, volume in metals & mining sector in H1 2023

BMO Capital Markets and Canaccord Genuity Group were the top mergers and acquisitions (M&A) financial advisers in the metals & mining sector during the first half (H1) of 2023 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that BMO Capital Markets achieved its leading position in terms of value by advising on $37 billion worth of deals. Meanwhile, Canaccord Genuity Group led in terms of volume by advising on a total of seven deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “BMO Capital Markets advised on four deals out of which two deals were valued more than $15 billion. The involvement in these mega deals helped it top the chart by value in H1 2023. Interestingly, BMO Capital Markets occupied the top position by volume as well in H1 2022 but lost it to Canaccord Genuity Group in H1 2023.”

BMO Capital Markets occupied the second position in terms of volume with four deals, followed by Red Cloud Securities Inc with four deals, Haywood Securities with four deals and Allenby Capital with three deals.

Meanwhile, Lazard occupied the second position in terms of value, by advising on $20 billion worth of deals, followed by Bank of America with $19.6 billion while Centerview Partners and JP Morgan jointly occupied the fourth position with $19.1 billion each.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.