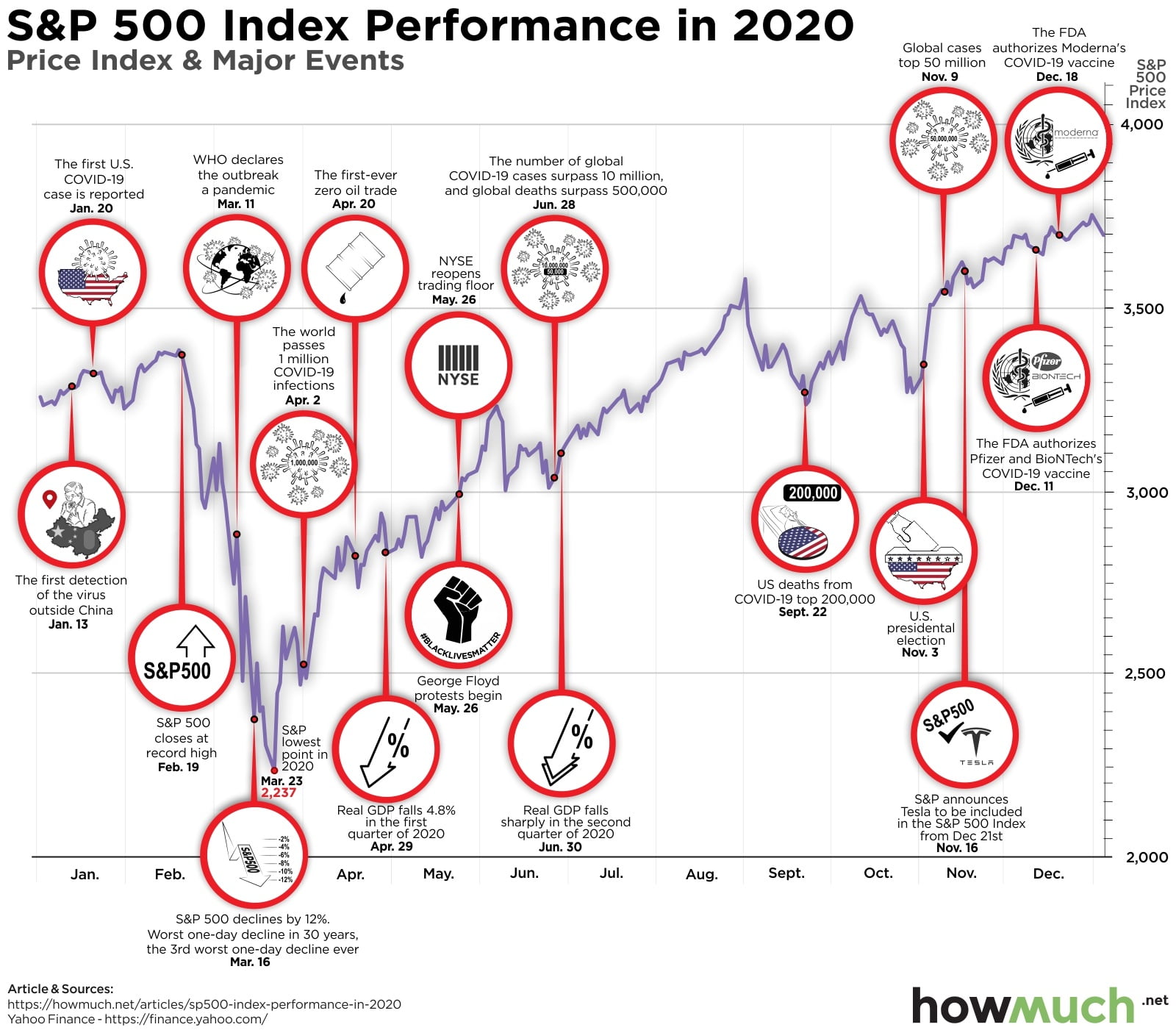

2020 was a bad year, but not for the stock market. In fact, the S&P 500 index ended the year at an all-time record high. But that doesn’t mean there weren’t challenges along the way, as our latest visualization shows.

Q3 2020 hedge fund letters, conferences and more

- The S&P 500 index provided a V-shaped performance throughout 2020, opening the year at 3,258 before collapsing to 2,237 on March 23 and then rising to an all-time record of 3,756 on December 31.

- 2020 also saw the S&P 500 set a record for the fastest bear market, including the third worst one-day decline ever on March 16.

- April 2020 was one of the best months in 80 years of stock market history, with the S&P 500 growing over 12%.

- The S&P 500 index’s rapid recovery in the midst of the coronavirus pandemic highlights how the stock market is very different from how regular people experience the economy.

The S&P 500 Index Performance

We created our visual by first grabbing daily S&P 500 performance data from Yahoo Finance. We then plotted the most important news events of the year, demonstrating how the markets first plunged when COVID-19 hit, then continued to relentlessly climb despite serious headwinds.

The stock market almost collapsed during March 2020 as COVID-19 forced widespread closures both in the U.S. and around the world. After starting the year off on a good note and climbing to a record on February 19 of 3,386, the S&P 500 index fell all the way to 2,237 on March 23. Over the course of just 23 trading days, the index lost more than a thousand points, including the third single worst trading day ever on March 16. On multiple occasions, stocks were plunging so fast that exchanges had to automatically break their circuits to pause trading and prevent a total crash.

But then S&P 500 started to climb and never looked back. April was the best month in some 82 years, turning in a 12.7% return. Lots of things were still broken in the global economy, like how the price of oil dropped to minus $40.32 on April 20. But even as the coronavirus infected millions of people and unemployment exploded to record levels, the stock market continued its upward trajectory throughout the summer. When racial unrest erupted in the aftermath of George Floyd’s murder, igniting perhaps the largest social movement in American history, the stock market still climbed higher. And even after a second and then a third wave of the virus washed over the U.S., the markets still went up.

There are a few reasons why the stock market climbed throughout 2020 even though lots of people experienced a terrible year. The economic stimulus packages in the U.S. and around the world no doubt reassured markets. More importantly, the stock market is always future-oriented. Stock traders usually value the future earning and profit potential of companies, not the hardship people are facing right now. This means that even with a dark winter ahead of the country with COVID-19, the vaccine promises a brighter future with a healthier U.S. economy.

Want to help fight the coronavirus right now? Donate to the WHO’s COVID-19 Response Fund.

Article by HowMuch