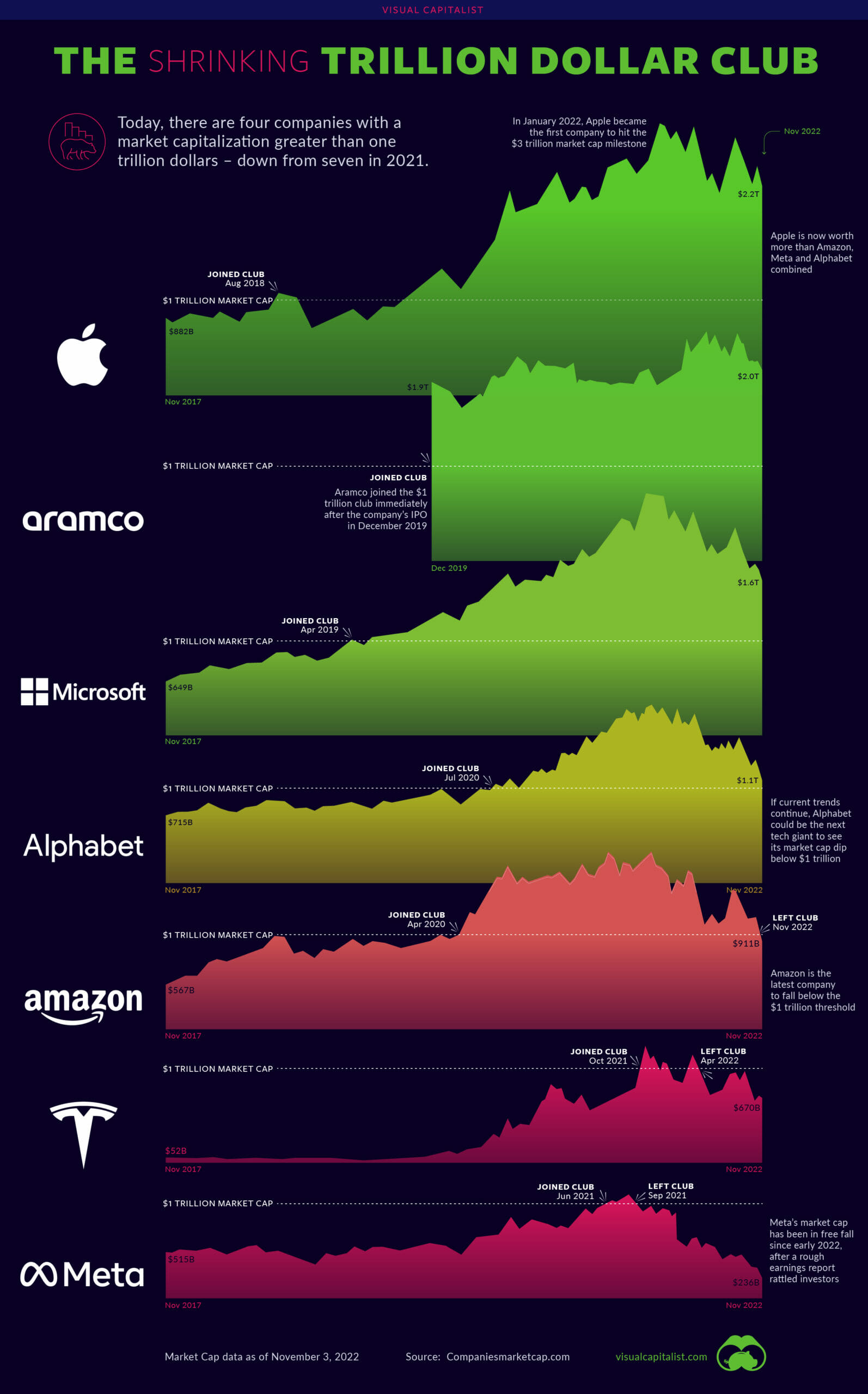

Aggressive tightening from the Federal Reserve has caused tech stocks to plummet back to Earth in 2022, and this has shaken up the membership of the trillion dollar market cap club.

Here are the four current members of this exclusive club:

| Company | Sector | Date Market Cap Hit $1T | Market Cap (Nov 3, 2022) |

| Apple (AAPL) | Tech | Aug 2, 2018 | $2.21 trillion |

| Aramco (2222) | Energy | Dec 11, 2019 | $2.01 trillion |

| Microsoft (MSFT) | Tech | Apr 25, 2019 | $1.60 trillion |

| Alphabet (GOOGL) | Tech | Jan 16, 2020 | $1.08 trillion |

Apple (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT), and Saudi Arabian Oil Co (TADAWUL:2222) are all still well above the $1 trillion mark for now, but Alphabet’s trajectory could take it out of this list if circumstances don’t change soon.

Google has indicated that the decrease in crypto advertising has had a big impact on revenue, and ad budgets continue to be slashed as economic uncertainty continues.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Here are the three former members who have seen their market cap dip back below $1 trillion:

| Company | Sector | Date Market Cap Hit $1T | Market Cap (Nov 3, 2022) |

| Amazon (AMZN) | Tech/Retail | Sep 4, 2018 | $911 billion |

| Tesla (TSLA) | Automotive | Oct 25, 2021 | $675 billion |

| Meta (META) | Tech | Jun 28, 2021 | $236 billion |

Amazon.com, Inc. (NASDAQ:AMZN) recently became the latest company to fall below the 10-digit threshold. In response to a poorly received earnings report and forecasts for lighter spending this upcoming holiday season, the ecommerce giant has paused corporate hiring for the foreseeable future.

Though Tesla Inc (NASDAQ:TSLA’)s valuation has dipped in recent months, Elon Musk remains bullish on Tesla’s prospects, stating the company could eventually be “worth more than Apple and Saudi Aramco combined”. To his credit, Tesla reported record revenues last month.

Diverging Fortunes

Though Apple is down nearly 20% from its peak, the company has faired better than its tech giant peers. In fact, Apple is now worth as much as Amazon, Meta, and Alphabet combined.

Meta Platforms Inc (NASDAQ:META), on the other hand, isn’t just going through tough times, it’s the worst performer in the entire S&P 500 this year so far.

Investors are bearish on Mark Zuckerberg’s expensive leap of faith that is the “metaverse” – a virtual reality world that people access via headsets (e.g. Meta Quest). It’s too early to tell whether Meta is on the forefront of the next digital revolution, or embarking on one of the most expensive tech flops in history.

Article by Nick Routley, Visual Capitalist