I recently read Michael Lewis’ Moneyball and although I’m not a big baseball fan, I thoroughly enjoyed the book. The book basically describes how the Oakland A’s a team with one of the smallest budgets in major league baseball were able to put together winning teams by purchasing players that were systematically undervalued. The goal was to win games as cheaply as possible. Michael Lewis explains that the Oakland A’s strategy was essentially value investing applied to baseball. “And to win games cheaply is to buy the qualities in a baseball player that the market undervalues, and sell the ones that the market overvalues.” Your goal as an investor should also be to own the highest quality stocks, with the greatest earnings and sales growth, for the lowest possible cost. If you invest in individual stocks this process is relatively straightforward. However, if you invest in index funds it’s virtually impossible to buy stocks when they’re undervalued and sell them when they’re overvalued. As an indexer you’re systematically purchasing the most expensive stocks as the vast majority of indices are market cap weighted. Index funds facilitate the ability of the average American investor to own a slice of American businesses at exceptionally cheap prices. For the average investor they make a lot of sense. Even Warren Buffett has advised that 90% of his estate be invested in index funds on behalf of his wife when he passes away. However, he still continues to invest in individual equities. Similarly, as a high net worth investor you have more sophisticated investment options available to you. The purpose of this article is to highlight some of the fundamental weaknesses of index investing.

Q1 2021 hedge fund letters, conferences and more

Index Funds Are Market Cap Weighted

The vast majority of indices are market cap weighted. This means that that the value of any particular stock in the index is determined by how much the market currently values it. Market cap is calculated by taking total shares outstanding and multiplying by the current share price. Thus, companies that are currently performing well in terms of price will become a bigger part of the index over time. As a fundamental investor, I firmly believe that the stock market is not always efficient. There are times that stocks can become both overvalued and undervalued. The problem with market cap weighted indices is that as a stock becomes more overvalued it takes up a larger position in the index. You actually want to be reducing exposure to the overvalued stocks and increasing your exposure to the undervalued less expensive stocks.

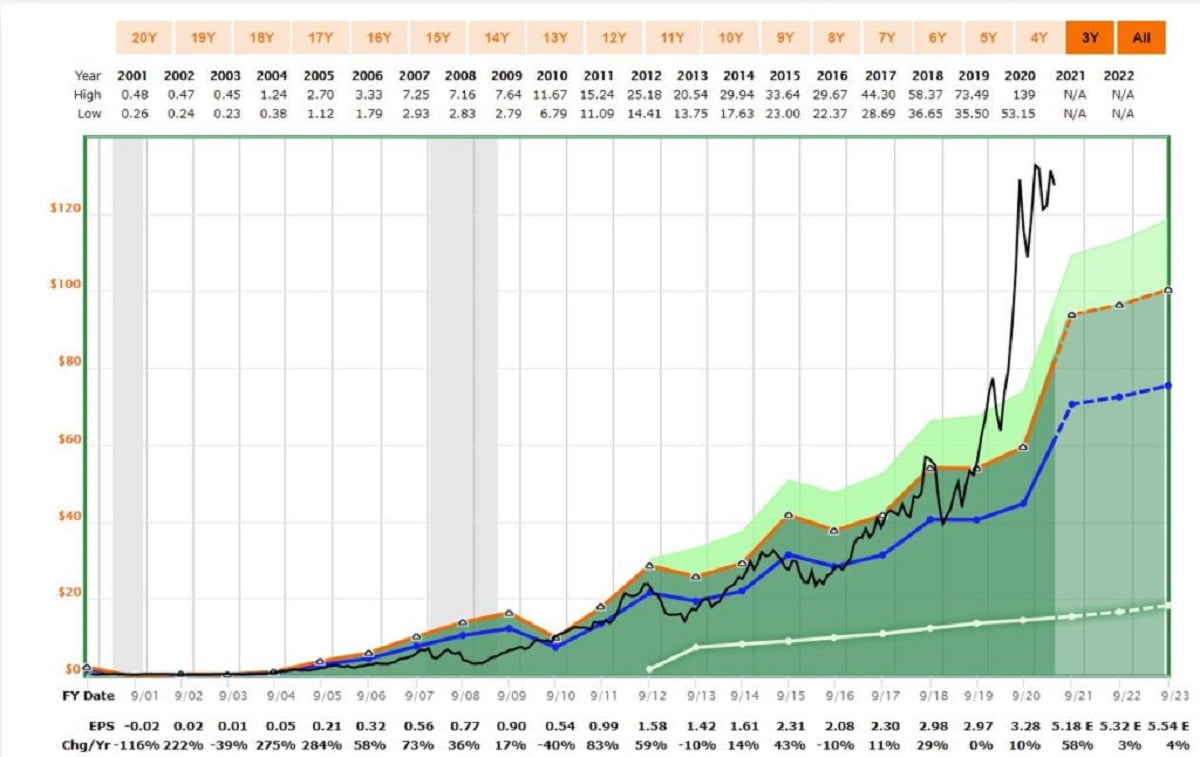

The five largest components of the S&P 500 are Apple, Microsoft, Amazon, Facebook and Alphabet (Google). Apple alone accounts for 5.7% of the total S&P500 index. Apple is a great company. It’s a company that I would love to own but at the right price. The chart below plots the price of Apple (black line) against its “earnings line” (dark blue line). The earnings line represents the price that the stock should theoretically trade at based on its 20 year average P/E. AAPL is currently trading at a 28.6x blended P/E which is significantly higher that its historical trading P/E of 13.63x. Thus, AAPL is a great business but it’s currently not a great investment due to its premium valuation.

Apple Share Price and Earnings Line

Thus, by buying the S&P index your actually buying AAPL at a peak valuation. Over time you will end up being overexposed to expensive stocks and underexposed to cheaper stocks. Essentially, you will be following a strategy that is the opposite of the one described in Moneyball.

Indexes Don’t Always Go up - the Lost Decade

Dave Portnoy, the founder of Barstool sports and famous day trader, has popularized the belief that stocks can only go up. For the Robinhood crowd that comprise most of his core fan base it’s easy to see why you would believe him. Most of these young traders came of age in one of the longest bull markets in US history. Essentially, from the great bottom in 2009 it was a one way trip to the recent all-time highs on the S&P500. Obviously, we had the Covid-19 bear market in 2020 but it proved to be short lived. As a Gen-Xer, the beginning of my investing career coincided with the lost decade (the 2000s) for investment returns. From January 2000 to December 2009 the S&P500 produced an annual return of (0.95%). The decade contained both the Tech Bubble of 2000 and the Great Financial Crisis. My point in rehashing this history is that I’ve experienced real bear markets and fully understand that stocks don’t always go up and to right.

The poor performance of the markets in the 2000s, led to the strong performance in the 2010s as the market became significantly undervalued during the great financial crisis. Unfortunately, the situation has now revered with the S&P500 trading at a significantly overvalued blended P/E ratio. I’m not saying that we’re headed for a bear market but it’s highly unlikely that the market will repeat the 13.56% annualized returns achieved from January 2010 to December 2019. The 2020s will unfortunately not be so kind to index investors.

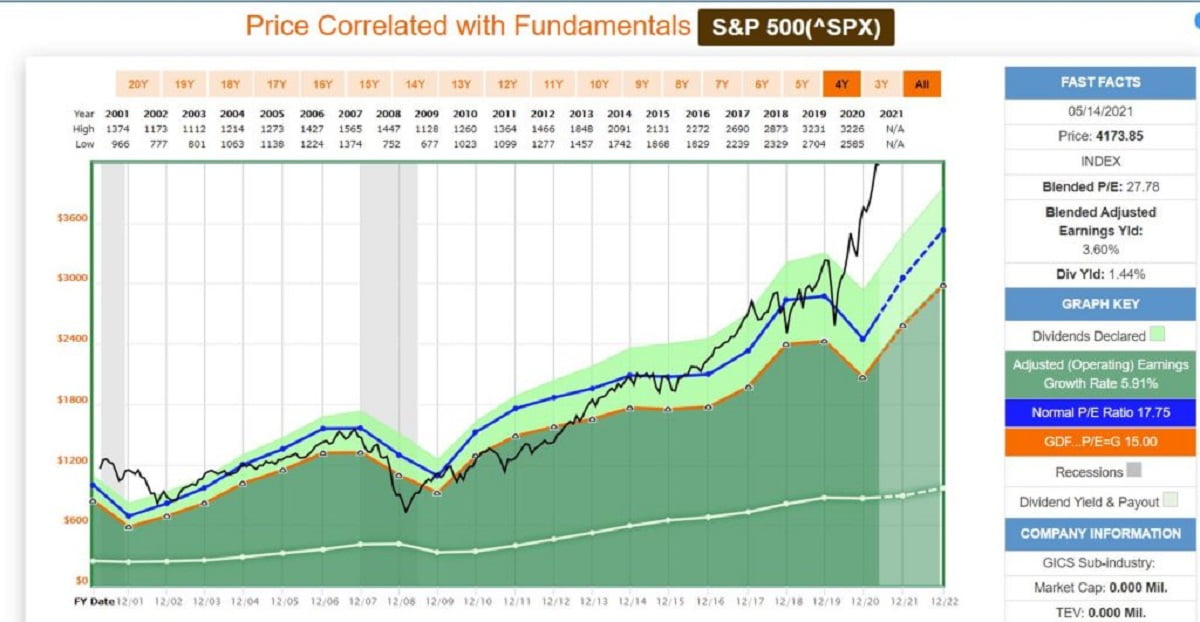

Thus, success in index investing is also highly dependent upon purchasing the index when it’s undervalued and selling when its overvalued. The same principles that applied to individual baseball players or individual stocks also applies to the market overall. The chart below show s that the S&P500 is currently trading at a blended P/E of 27.8x this is significantly above the earnings line (blue line). We can see that back in March 2009 at the beginning of the bull market the S&P500 was trading well below the earnings line signifying that it was exceptionally cheap relative to its history.

S&P 500 Price and Earnings Line

The key to success of the Oakland A’s was to systematically purchase baseball players that had the qualities they found valuable for the lowest cost possible. The Oakland Athletics were able to put together a playoff worthy baseball team with a minor league budget. Similarly, as an investor your goal is to put together a portfolio with the highest expected return for as low a cost as possible. If you manage an individual portfolio, this process is relatively straightforward. However, if you’re primarily investing via index funds you’re systematically buying the most expensive stocks for your portfolio. Finally, the S&P500 has periods of underperformance based on its starting valuation. While it’s impossible to time the market, I highly doubt we’ll get a repeat of the S&P500’s performance over the past 11 years over the next decade. Indexing is a great tool for the average investor but it definitely has drawbacks. If you’re interested in learning more about how we create a portfolio of winning investments at Ashva Capital, sign up for our email distribution list by using the optin form at the top of the screen. Not only will you receive our email course on how to outperform the market but also gain access to all our past investor letters. I encourage you to take some time to learn about our investing process and to read our investor letters. Ultimately, you’ll be able to determine if an investment in the Ashva Capital LP fund makes sense given your financial goals and current portfolio allocation.

Article by Ankur Shah, Ashva Capital