The global personal finance software market is predicted to reach $1.8 billion by 2030 — an increase of nearly one billion dollars since 2019.

Q4 2021 hedge fund letters, conferences and more

And for good reason.

Financial services have shifted from being mostly dominated by Wall Street to being an industry where anyone can control their finances.

From budgeting apps to family banking solutions, the personal finance sector has opened its doors to the everyday consumer.

This revolutionary open-door approach has led to an influx of creative changes in the market - and more opportunities for businesses alike.

Let’s explore seven recent changes in personal finance management and what they mean for businesses today.

What's Personal Finance Management?

Personal financial management (PFM) refers to the software powering various personal finance and mobile banking tools.

While PFM once primarily focused on decluttering and simplifying bill-paying, today, it prioritizes creative personal finance solutions.

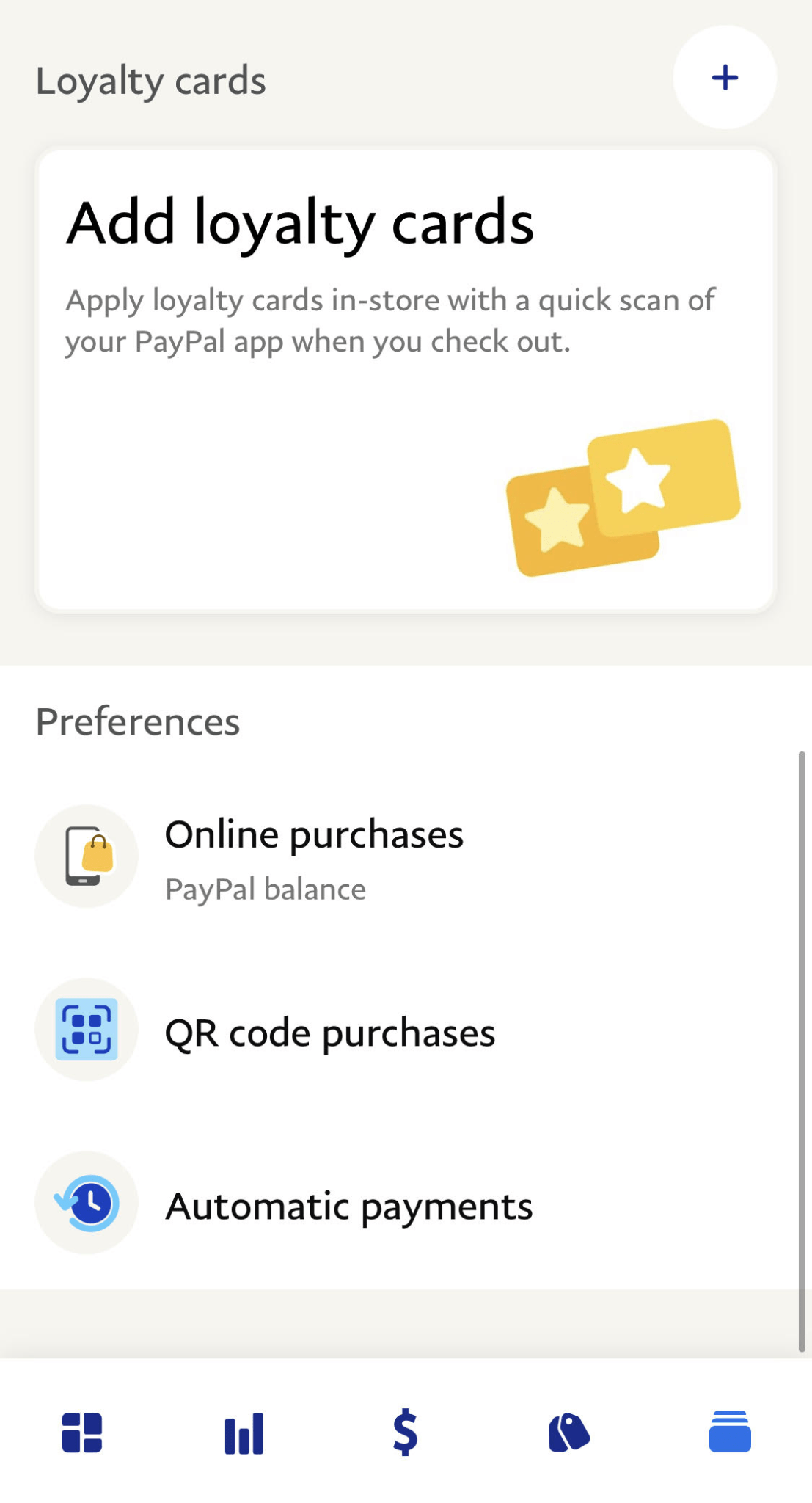

Take Paypal Holdings Inc (NASDAQ:PYPL), for example.

PayPal was founded on the premise of fast and easy digital payments for consumers and businesses. But the company has evolved into much more than a digital payment platform.

Today, PayPal offers a full host of creative solutions, including cryptocurrency trading, international cash pick-up, loyalty cards, and more.

Let’s look at some other evolutions in the personal finance management sector.

What’s new in personal finance management?

The following seven changes will continue to make waves in personal finance management.

Family banking solutions

Family banking emerged after customers asked for solutions that allow kids to take initiative over their money — with the help of their parents.

With more apps, kid-friendly banking options, and budgeting tools than ever before, families interested in teaching their kids how to manage money can do so in a few clicks.

As a result, solutions like debit cards for kids, virtual kid banking, and digital savings goals have taken shape.

Parents and kids can use family banking solutions to:

- Allocate virtual allowances

- Allocate funds toward savings goals

- Set savings goals

- Monitor past transactions

- Automate future deposits

- Attend virtual budgeting and money management classes

Financial education services

Financial education services have emerged to help consumers struggling with debt management, budgeting challenges, and investment questions.

Popular solutions include online courses, monthly subscriptions to stock advisors, and one-on-one sessions with virtual financial advisors.

Take The Motley Fool, for example.

It offers a monthly stock advisor subscription program on the premise of making stock investing more accessible. Customers who sign up for the subscription service get access to a monthly stock picking service, robust educational resources, webinars, and fresh content.

From improving their math skills via in-app lessons to learning all things micro-investing through online courses, people can take advantage of financial education services to improve their financial health.

Cost savings solutions

Millennials have become more financially aware and digitally savvy, with 95% confirming they search the internet for coupons before making a transaction online.

To satisfy high demands for cost savings options, businesses are creating more ways to help customers save money when they shop.

Here are some examples of popular cost savings solutions on the market today:

- Coupon directories: A robust list of current deals, coupons, and discount codes

- VIP programs: Programs that provide bonus features and monthly savings for loyal customers

- Rewards programs: Programs that allow customers to earn rewards, gifts, and discounts after hitting specific spending milestones

- Cashback programs: Programs that reward customers with a certain percentage of cash back with every purchase they make

- Points, miles, and account credits: Solutions that help customers earn points, miles, and credits based on specific spending habits

Wearable spending technology

It’s no secret that wearables have soared in the health and fitness space, but did you know banks have also adopted the technology?

After searching for unique ways to adopt the technology for their customers, banks landed on a revolutionary concept. Enter wearable spending.

Wearable spending means using physical devices with embedded payment sensors to make purchases.

Banks have embedded sensors into several devices, including keychain tags, smartwatches, fitness trackers, and even smart jewelry.

Virtual banking

Virtual banking, not to be confused with online banking, refers to accessing banks and their functions online — without ever stepping foot in a physical office.

While virtual and online banking appear to be the same thing, the difference lies in the banks operating the two processes. Virtual banks operate fully online, and traditional banks have both physical banking locations and online access.

Take banking options for students, for example. Banks that specialize in family and young adult products tend to house their institutions online. International banks created for nomads, expats, and travelers also tend to host their institutions online.

Virtual banks will continue to remain popular as consumers look for more cost-effective banking solutions. With products like no-fee checking accounts, higher interest-bearing savings accounts, and mobile payment platforms, the world will continue to see an influx of virtual banking.

Budgeting apps

Budgeting apps have surfaced to help the millions of Americans who are living paycheck-to-paycheck take control of their finances.

While traditional budgeting has a bad rap for being boring or restrictive, apps have stepped up to help make budgeting fun and efficient.

From developing an automated household spending plan to using AI to track spending, budgeting apps are more user-friendly than ever. In fact, a study found that budgeting app users typically reduce spending in the “dining and drinking” categories by 31% in their first seven months.

More accessible investment options

Piggybacking on our Wall Street comment, investing is no longer reserved for VIPs. These days, anyone can invest in the stock market or the cryptocurrency sector without having to drop bags of cash.

The key to this breakthrough is something called micro-investing or fractional shares — sometimes also called stock slices or bite-sized investing.

Micro-investing means buying bite-sized pieces of a stock or cryptocurrency rather than buying the stock or currency in full. So, instead of buying one share of Netflix stock, you might buy a quarter of a share. Instead of buying one Bitcoin, you might buy ten fractions of a Bitcoin.

While tech companies have ushered in the micro-investing trend, big players like Charles Schwab and Fidelity are adopting the practice, too.

What do changes in personal finance management mean for businesses?

Changes in personal finance management mean that businesses must look for creative ways to satisfy customers' evolving financial demands.

For instance, accepting traditional payment methods like cash, credit, and debit may have worked in the past. But now, customers are demanding a wider array of payment methods.

To satisfy customer demands, businesses will need to first examine which financial products and methods their customers value most — and then look for ways to integrate those products and methods into their business models.

For instance, if your customers value the changes we listed today, then you may consider:

- Accepting a wider variety of payment methods to appeal to customers with mobile wallets, cryptocurrencies, wearable spending, and family payments

- Creating rewards programs that help build loyalty with repeat customers

- Collaborating with virtual banks or budgeting apps to offer services, products, or pay for in-app ads

- Offering deals, coupons, points, or cash-back to satisfy customers that value cost savings

Wrap up

With the global personal finance software market predicted to reach $1.8 billion by 2030, anyone looking to jump on the bandwagon should start considering it now.

Consumers looking to take control of their financial health can do so using the seven changes we’ve covered today.

Businesses interested in taking advantage of these changes should keep an eye on the industry and look for creative ways to adopt the technologies customers crave most.