- McCormick reported a solid quarter and gave favorable guidance that has shares higher.

- The valuation is high for this 2.1% yield.

- General Mills and Kraft Heinz offer better value and yield in the same sector.

- 5 stocks we like better than McCormick & Company, Incorporated

If you have doubts about the meaning of McCormick’s (NYSE:MKC) Q1 results, look no further than the price action chart. The stock price is up more than 10% on the news and indicating a bottom for this market.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Sluggishness in consumer staples, slowing and post-COVID blues are fading away in favor of a greener outlook. The company is engaged in 2 programs to help drive margin and cost recovery, and they appear to be working.

The gross margin contracted compared to last year, and the operating margin was flat, leaving adjusted earnings well above forecast. The takeaway is this blue chip dividend payer is in a solid position for 2023, and its shares could see double-digit gains by the end of the year.

McCormick: Pricing And Efforts Drive Results

McCormick had an excellent quarter due primarily to cost-recovery efforts that included higher consumer prices. The company reported $1.56 billion in net revenue for a gain of 2.6% despite significant headwinds from FX conversion, exiting Russia and divestiture.

The company reports organic strength in all segments and reaffirms the guidance. Regarding margin, gross margin contracted by 80 points, far less than expected, driving earnings of $0.59. This is down from last year but beat the Marketbeat.com consensus by 1800 basis points.

The guidance is favorable. McCormick expects top-line growth of 5% to 7% compared to the consensus of 5.30%. The company also expects margin improvement throughout the year and adjusted earnings of $2.56 to $2.61.

The earnings forecast brackets the consensus with the consensus at the low end of the range leaving ample room for outperformance. Assuming the company can build momentum, it may even outpace its forecast. The risk is pricing actions will drive the improvement, and the company is already reporting a decline in volume. At some point, higher prices are not going to work anymore.

McCormick Has An Attractive Yield, But It’s Expensive

McCormick has an attractive dividend with a yield near 2.1%. The company has a long track record of increases and a reasonably low payout ratio, so there is an element of safety as well. The caveat is that McCormick stock trades 28X its earnings while others working hard on cost savings and fueling growth offer better value and yields.

General Mills (NYSE:GIS) recently reported strength, and its shares are moving. It trades about 19X earnings and yields 2.5%. Kraft Heinz (NASDAQ:KHC), now exiting a turn-around on track for growth, trades at 15X earnings and pays more than 4.0%.

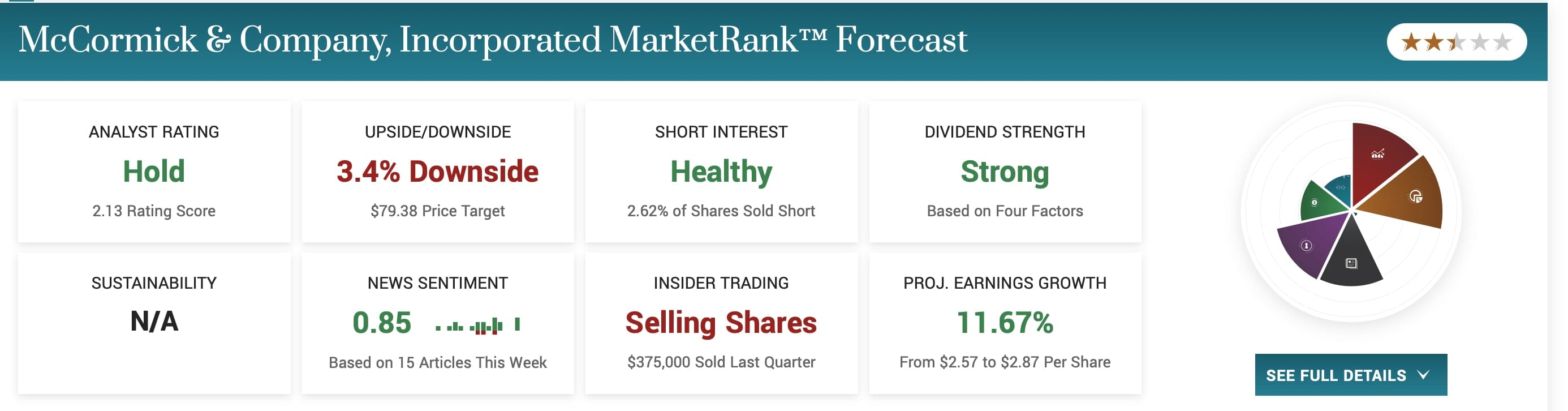

That may be why the analysts do not seem impressed with the results. The results did not spark any commentary, and the trend in sentiment going into the report is unfavorable for higher stock prices. The analysts' sentiment slipped to a weaker Hold from verging on Moderate Buy with a price target trending lower and assuming the stock is fairly valued at the post-release highs. The stock price will likely be capped if this trend continues.

The Technical Outlook: MKC Popped, And It Looks Done

The price action in MKC popped on the news, but the move looks played. The action hit resistance near $82.50, and that is capping gains.

This level is consistent with a significant support/resistance line that has been in play since before the pandemic and has a good chance of keeping the action from moving higher. In this scenario, shares of MKC should remain range bound at current levels until there is a more compelling reason to buy.

Should you invest $1,000 in McCormick & Company, Incorporated right now?

Before you consider McCormick & Company, Incorporated, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McCormick & Company, Incorporated wasn't on the list.

While McCormick & Company, Incorporated currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

Article by Thomas Hughes, MarketBeat