At a very first glance, Tekmar Group PLC (LON:TGP), a AIM listed UK company looks like a very interesting “hidden Champion”:

Q1 2021 hedge fund letters, conferences and more

The company is active in a very attractive market: their main business is to provide sub sea protection systems for cables with its biggest entity providing this service to the fast growing off-shore wind farm market.

In addition, Tekmar claims to have 75% market share. the combination of a company providing an essential, relatively small ticket item to a large installation with a dominating market share makes many investors water their mouths I guess.

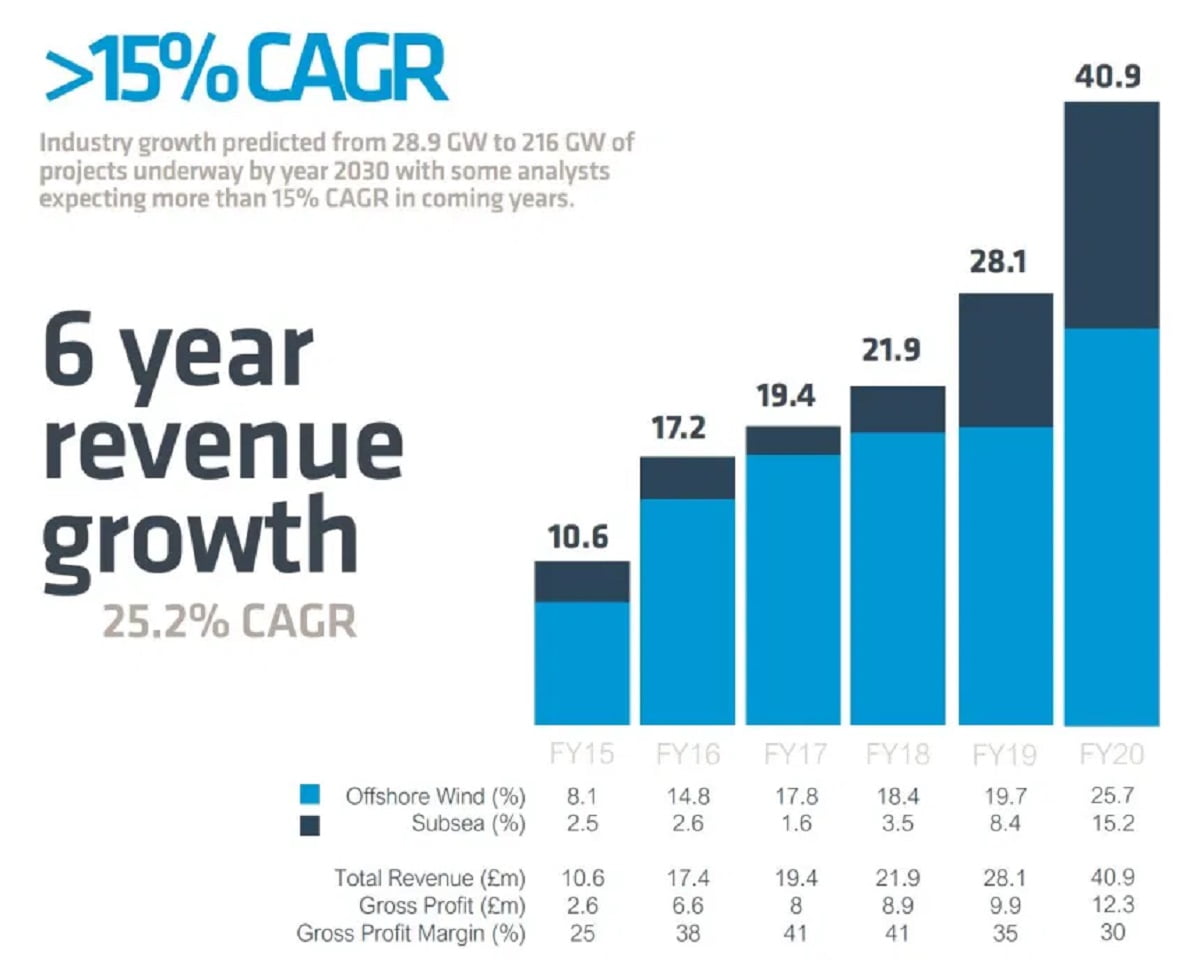

Even more mouthwatering looks their chart from the 2020 annual report (from August 2020):

A 25,2% CAGR in top line is really attractive. And it gets even better:

At a current market cap of around 26 mn GPB, the trailing P/E is ~13 and the company has no debt. On top, the stock trades significantly below book value. What is not to like ?

Reasons why the stock is cheap:

As always, I try to find reasons why the stock is cheap and if I might have a different view.

A first warning sign is the stock chart:

Since its IPO in 2018, Tekmar has lost around 2/3 of its value. This could be either a total misunderstanding from investors or things are not as great as they look like.

Gross margins /EBITDA/EBIT margins:

What we can see from the growth chart is that gross margins are relatively slim and have been declining significantly since 2018 when they IPOed in 2018. Especially all the growth in the FY 2020 (which ends on March 31, so little Covid Impact) has not translated into higher profits. Even Adjusted EBITDA fell. The high point of absolute adjusted EBitda had been reached shortly before the IPO at around half the sales they are doing now. The problem seems to be mainly the “non wind farm” business which grew quickly (supported by acquisitions) but is not profitable. The segment reporting is not easy to read because group eliminations are ~80% of net profit. This kind of intransparency is always a topic.

Overall the profit margin were never that great but have been significantly eroding even in the core wind farm business.

One of the big factors depressing net margins seem to have been salaries which increased by more than 50% from 2019 to 2020.

Order book / work in progress assets

Tekmar shows a quite innovative order book reporting. Their headline number is what they call an “Enquiry book”. the actual order book at the end of the FY was only 10 mn GBP. This is a number I do not understand. Especially wind parks are long term projects with long lead times. I would have expected a much larger order book. Vestas for instance has an order book of 150% of 2020 sales on their turbines alone compared to only 25% of annual sales for Tekmar.

What I also don’t understand how 225 mn in enquiries translate into 40 mn sales and 10 mn order book and they still claim to have a 74% market share. Even if they see all the enquiries, the majority of the business seems to go elsewhere.

Another topic which makes the numbers hard to read is the fact that the company books significant “Work in progress” assets, which amounted to ~15 mn GBP at the end of FY 2020 or ~40% of sales.

The missing CEO

Finally, this smart looking guy, James Ritchie has been a “founder” of the company and CEO since the IPO:

However a few months ago in October, Tekmar announced that the Chairman of the board will take over the CEO role.

According to an article, they seem to be looking for a new CEO since then and following his Linkedin profile Mr. Ritchie is now rich enough to do investments with his own money.

He seems to be quite young, when the company Ipoed in 2018 he was called “Baby Boss” by the British press. According to the IPO prospectus at the tender age of 19 as a director. Digging a little bit deeper, it seems that his father seem to have run Tekmar in the early days, then split up but sold a company back to his son James.:

Tekmar’s CEO is 28-year-old James Ritchie, who led the management buyout of the company in 2011 when he was just 21.

Now Tekmar Group – which floated on AIM in June – has announced its intention to acquire Subsea Innovation Ltd for £4m from its founder Gary Ritchie-Bland, subject to shareholder approval, in a move to trigger growth as the firm’s capitalise on their complementary client bases and expertise.

Why he left is anyone’s guess. Maybe it has to do with the fact that Tekmar’s earnings didn’t hit the performance hurdle for the options granted to him during the IPO which were tied to the 2020 result.

Covid-19 impact

Although top-line “only” shrank by around -15% (due to an acquisition), profits more or less disappeared and the company showed a loss. Again a hint that the business model is not super solid.

18 months financial year

Another “Nice one” seems that for some reason they decided to extend the current business year to 18 months. This is from the half year report:

Outlook for the remainder of FY 2021

The Group’s full year results for the 18 months ending 30 September 2021 (“FY 2021”) will be dependent on the speed at which the markets in which we operate recover from the pandemic. As delays to contract timings have had, and continue to have, a significant impact on the Group’s financial performance, we do not intend to reinstate guidance on financial performance until visibility on the timing of contract awards returns

My guess is that the maybe want to show another FY with growth even if it takes them 18 months to achieve it.

Orsted problems

The recent drop in the share price seems to have been triggered by Orsted announcing that they had issues with their subsea cable protection systems in 10 wind parks, costing around 400 mn EUR. Tekmar thinks that they don’t have any issues with this, but shareholders seem to have some doubts.

Business model

The company presents itself as a “tech company”. This is the slogan from the web site:

“Working together to provide leading technology and services to the global offshore energy markets.”

However R&D is only 0,3 mn, both in 2019 and 2020. My suspicion is that Tekmar in the end is “only” a plastics maker with very little pricing power if the prices of their inputs go up.

Summary:

At this stage I have identified already a couple of significant factors that explain why the stock is “cheap”. My main issues are a not so attractive business model, growth that did not turn into profits (bad capital allocation) and the exit of the long time CEO. Therefore I’ll stay at the sidelines and “pass” on this stock.

Article by memyselfandi007, Value And Opportunity