- 53% of advisors think tech stocks will outperform in 2021

- 94% say their clients have exposure to US tech shares

- 34% think there is a tech stock bubble

- 18% say tech shares will follow the same trajectory as the dot-com bubble

- 26% have recommended clients sell tech stocks

Q4 2020 hedge fund letters, conferences and more

Tech Stocks Set To Outperform In 2021

(London, March 2021) The majority of US advisors say tech stocks will outperform in 2021 and just one-third think the sector is in bubble territory, recent research shows.

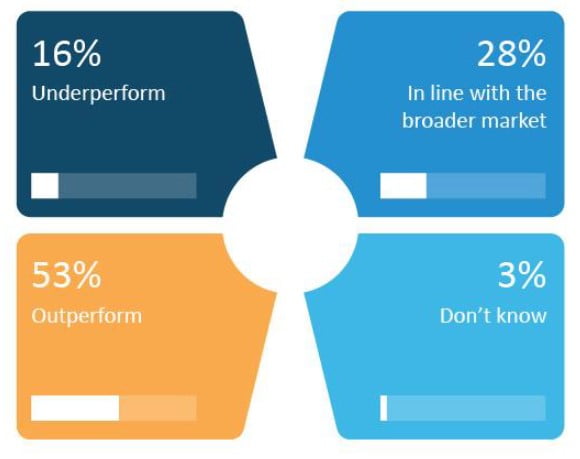

A CoreData Research study of 400 US financial advisors conducted in December found more than half (53%) think US tech stocks will outperform over the next 12 months. About a quarter (28%) think tech shares will perform in line with the broader market, while just 16% think they will underperform.

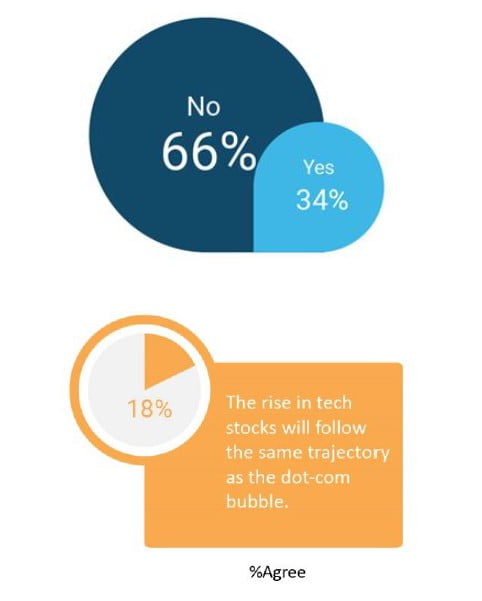

This bullish view has led advisors to downplay the existence of a bubble. Only one-third (34%) think there is a US tech stock bubble brewing. And an even smaller proportion (18%) say the growth in technology shares will follow the same trajectory as the dot-com bubble.

Meanwhile, almost all advisors (94%) say their clients have exposure to large cap US tech stocks. While 60% of advisor clients gain exposure through individual tech shares themselves, the most popular investment vehicles used to access the sector are actively managed US large cap/growth funds (68%) and thematic/sector ETFs (63%). More than half (52%) also invest via index funds tracking the broader US stock market such as the S&P 500.

Portfolios Exposed To Major Correction

“These findings show that a large number of investors have indirect exposure to tech stocks – leaving portfolios exposed to any major correction in the sector,” said Andrew Inwood, founder and principal of CoreData. “The recent retreat in tech suggests investors may be in for a bumpy ride in the months ahead. As always, having a diversified portfolio is key.”

Despite their optimistic outlook, almost half of advisors say stretched valuations (46%) and regulations impacting the tech sector (46%) could cause a potential crash in US tech stocks. Such concerns are translating into action for some — a quarter (26%) of advisors have recommended clients sell tech stocks to protect them from market falls.

In addition, more than half (52%) of advisors agree the pandemic has helped push FAANG stocks to valuations disconnected from their fundamentals. But at the same time, advisors do not think tech stocks will fall back down to earth upon removal of the Covid boost. Less than one in five (17%) say an end to the pandemic will cause a crash in tech stocks. And just 6% think an economic recovery will cause a crash in tech.

“This suggests that rather than seeing tech stocks as a pure Covid play, advisors think they will continue to benefit from long-term secular growth trends and shifts in consumer behavior,” added Inwood.

Key Findings

How do you think US tech stocks will perform compared to the broader market over the next 12 months?

Do you think there is a US tech stock bubble?

About CoreData Research

CoreData Research is a global specialist financial services research and strategy consultancy. CoreData Research understands the boundaries of research are limitless and with a thirst for new research capabilities and driven by client demand; the group has expanded over the past few years into the Americas, Africa, Asia, and Europe.

CoreData Group has operations in Australia, the United Kingdom, the United States of America, Brazil, Singapore, South Africa and the Philippines. The group’s expansion means CoreData Research has the capabilities and expertise to conduct syndicated and bespoke research projects on six different continents, while still maintaining the high level of technical insight and professionalism our repeat clients demand.

With a primary focus on financial services CoreData Research provides clients with both bespoke and syndicated research services through a variety of data collection strategies and methodologies, along with consulting and research database hosting and outsourcing services.

CoreData Research provides both business-to-business and business to- consumer research, while the group’s offering includes market intelligence, guidance on strategic positioning, methods for developing new business, advice on operational marketing and other consulting services.

The team is a complimentary blend of experienced financial services, research, marketing and media professionals, who together combine their years of industry experience with primary research to bring perspective to existing market conditions and evolving trends.

CoreData Research has developed a number of syndicated benchmark proprietary indexes across a broad range of business areas within the financial services industry.

- Experts in financial services research

- Deep understanding of industry issues and business trends

- In-house proprietary industry benchmark data

- Industry leading research methodologies

- Rolling benchmarks

The team understands the demand and service aspects of the financial services market. It is continuously in the market through a mixture of constant researching, polling and mystery shopping and provides in-depth research at low cost and rapid execution. The group builds a picture of a client’s market from hard data which allows them to make efficient decisions which will have the biggest impact for the least spend.