Most public companies should benefit from the new tax law, which lowers the corporate tax rate from 35% to 21%. Analysts expect the S&P 500 to see a profit boost ranging from 7% to more than 10%. Optimism over the impact of the new tax law helped the S&P 500 to a 6% gain in January.

Nevertheless, there are losers from tax reform, namely those companies with large net deferred tax assets (DTAs). These are companies that have overpaid tax in the past and therefore have will have relief on future tax bills. DTAs can come from net operating loss carryforwards, tax credits on research expenditures, changes in pension benefit obligations, and a variety of other factors.

Companies with significant DTAs receive a smaller benefit from the corporate tax cut, since they were already anticipating lower tax bills in the coming years. Many companies will see their balance sheets deteriorate significantly in the coming months as they write-down the value of their DTAs now that the lower corporate rate is coming into effect.

Identifying DTAs: Not as Easy as It Sounds

It sounds easy to just look for companies with large DTAs, but that process does not really work. Some companies don’t disclose DTAs on their balance sheet and only show them in the footnotes. Others might report DTAs on the balance sheet but also have offsetting deferred tax liabilities in the notes. Our machine learning Robo-Analyst technology helps us parse thousands of 10-Ks and 10-Qs to identify the true net deferred tax assets.

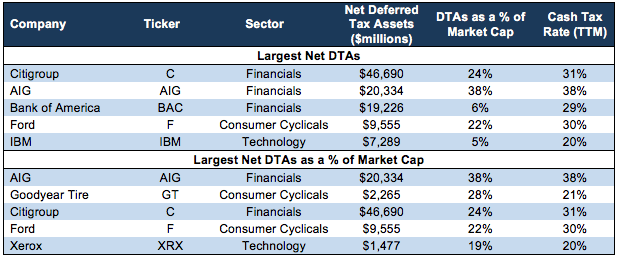

Figure 1 shows the five S&P 500 companies with the largest net DTAs as of their latest 10-K or 10-Q, and the five with the largest net DTAs as a percent of market cap.

Figure 1: Companies with the Largest Net Deferred Tax Assets

Sources: New Constructs, LLC and company filings

The Financials sector stands out as the biggest loser. Citigroup (C), AIG (AIG), and Bank of America (BAC) all carry large amounts of deferred tax assets on their balance sheets as a result of their massive losses during the financial crisis. We’ve been on the record since 2010 saying that Citigroup was overvaluing its DTAs, and sure enough, the company has already announced a $22 billion write-down.

Tech companies could also end up as significant losers. IBM (IBM) and Xerox (XRX) not only have significant net DTAs, but both companies already pay low cash tax rates of 20%. Their low current tax rates leave less room for the taxes to decline going forward. In fact, some analysts predict that IBM and other services-focused tech companies could see tax increases going forward.

This article originally published on February 8, 2018.

Disclosure: David Trainer, Sam McBride, and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Article by Sam McBride, New Construct