Chicago, IL, March 25, 2021 — With reports that it could take weeks to dislodge the container ship currently blocking the Suez Canal, and that containers might have to be unloaded to free the grounded vessel, supply chain visibility company project44 is projecting worsening delays across European ports in the weeks ahead. For supply chains already struggling with multi-week delays, the Suez Canal incident is on track to further disrupt business across the globe.

Q4 2020 hedge fund letters, conferences and more

The Suez Canal Incident: A 42.5% Increase In Stranded Vessel Capacity

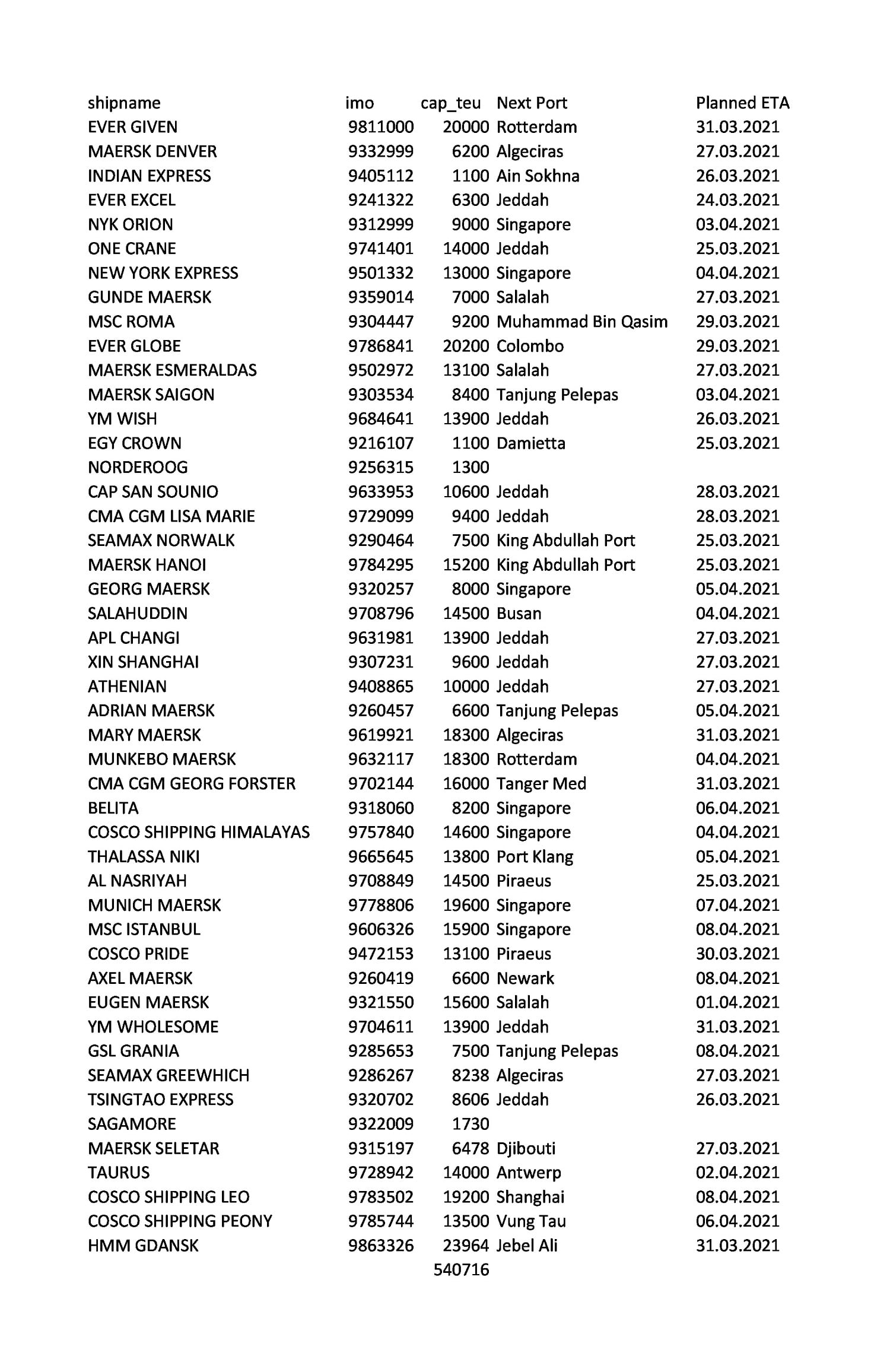

As of Thursday, March 25, 10:30 am CET, project44’s tracking showed 47 container vessels representing 540,716 TEUs vessel capacity currently impacted, a 42.5 percent increase over the 379,200 TEUs reported yesterday. Moreover, the chances of a quick solution seem to have disappeared.

Many waiting ships are mega-vessels navigating the Asia-Euro route, making multiple stops in European ports. With even more cargo waiting at Chinese ports for vessels to transport it to those European markets, the delays are equally problematic in the Euro-Asia direction. Given the number of vessels that are affected, carriers’ networks could be disrupted for weeks and months.

More than ever, visibility into floating inventory is critical. The ability to divert cargo, manage expectations, and make adjustments in real-time is imperative for shippers.

“Once the log-jam is broken, major ports in Rotterdam, Antwerp, and Hamburg will be swamped,” said Jett McCandless, CEO of project44. “That congestion will have rolling effects further down the supply chain for months to come, exacerbating an already problematic situation at major European ports. With inventories dropping as a result, unfortunately that means the costs will be passed on to the consumer.”

About project44

project44 is the world’s leading advanced visibility platform for shippers and logistics service providers. project44 connects, automates, and provides visibility into key transportation processes to accelerate insights and shorten the time it takes to turn those insights into actions. Leveraging the power of the project44 cloud-based platform, organizations increase operational efficiencies, reduce costs, improve shipping performance, and deliver an exceptional Amazon-like experience to their customers. Connected to thousands of carriers worldwide and having comprehensive coverage for all ELD and telematics devices on the market, project44 supports all transportation modes and shipping types, including Air, Parcel, Final-Mile, Less-than-Truckload, Volume Less-than-Truckload, Groupage, Truckload, Rail, Intermodal, and Ocean. project44 has placed second, behind only Amazon, on FreightWaves’ 2021 Freight Tech 25, a list of the most innovative companies across the freight industry, and received the 2020 SAP® Pinnacle Award as the Cloud Partner Integration of the Year.

Issued on behalf of project44 by https://www.pesti.io/