What’s New In Activism – Spirit Sells To JetBlue

U.S. budget carrier Spirit Airlines Incorporated (NYSE:SAVE) agreed to be acquired by JetBlue Airways Corporation (NASDAQ:JBLU) for $3.8 billion, a day after failing to convince shareholders to approve a lower offer from another airline. The deal ends a heated proxy fight during which two Spirit activist shareholders voiced support for a JetBlue deal.

JetBlue is to pay $33.50 per share in cash to Spirit investors, including a prepayment of $2.50 per share and a so-called ticking fee of 10 cents a month starting in January 2023 until closing, according to a July 28 statement.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

It means a monthslong bidding war is over between JetBlue and Frontier Group, which had an agreement to buy Spirit for $2.7 billion in cash that was terminated after Spirit shareholders opposed the plan.

As part of the agreement, Spirit shareholders are set to receive $400 million from JetBlue if the deal falls apart due to antitrust issues, with Spirit getting another $70 million.

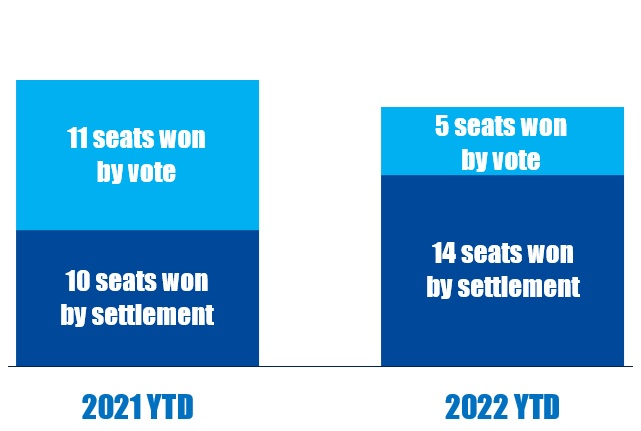

Activism chart of the week

So far this year (as of July 29, 2022), 14 of the 19 seats won by activist nominees at Australia-based companies were won via settlement. That is compared to 10 out of 21 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - West Virginia Bars Asset Managers

Five leading financial institutions were placed on West Virginia's Restricted Financial Institution List, making them ineligible for state banking contracts due to their stance on fossil fuels.

West Virginia State Treasurer Riley Moore announced on July 28 that BlackRock, Goldman Sachs, JP Morgan Chase, Morgan Stanley, and Wells Fargo are no longer eligible to enter into state banking contracts with his office due to their alleged "boycotting" of fossil fuels.

"As Treasurer, I have a duty to act in the best interests of the State's Treasury and our people when choosing financial services for West Virginia," Treasurer Moore said in a press release.

On June 10, Moore sent letters to six financial institutions, warning they could be placed on the state's restricted financial institution list within 45 days unless they demonstrate that they are not engaged in a boycott of fossil fuel companies.

U.S. Bancorp is the only company to not face exclusion, after demonstrating to the treasurer that it has "eliminated policies" against financing coal mining, coal power, and pipeline construction activities from its environmental and social risk policy, Treasurer Moore revealed.

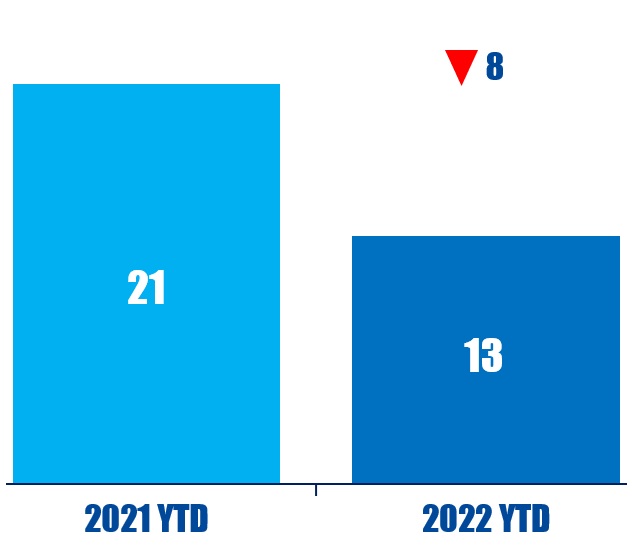

Voting chart of the week

So far this year (as of July 29, 2022), 13 U.K. companies have received 20% or more opposition to their binding remuneration policy votes. That is down from 21 over the same period last year.

Source: Insightia | Voting

What’s New In Activist Shorts - Muddy Waters At Sunrun

Muddy Waters questioned the financial models behind Sunrun Inc (NASDAQ:RUN)'s valuation and said the U.S. solar panel company may be heading for a funding gap that could bury it.

In a July 28 report, the short seller alleged that Sunrun was "an uneconomic business built on three shaky pillars," which in turn are built on a "foundation of dubious financial models."

The veracity of Sunrun's financials was also questioned with Muddy Waters saying these are based on "aggressive assumptions." The short seller also took issue with the way Sunrun calculates the tax bases of its power purchase agreements, saying the company is inflating the numbers and contending that this "abuse" may lead to a $948-million penalty if the allegations are confirmed.

Muddy Waters added that Sunrun relies on asset-backed securities to finance its growth. This system leaves these securities exposed to bankruptcy risk because Sunrun has not created a reserve to remove or service customers' solar systems.

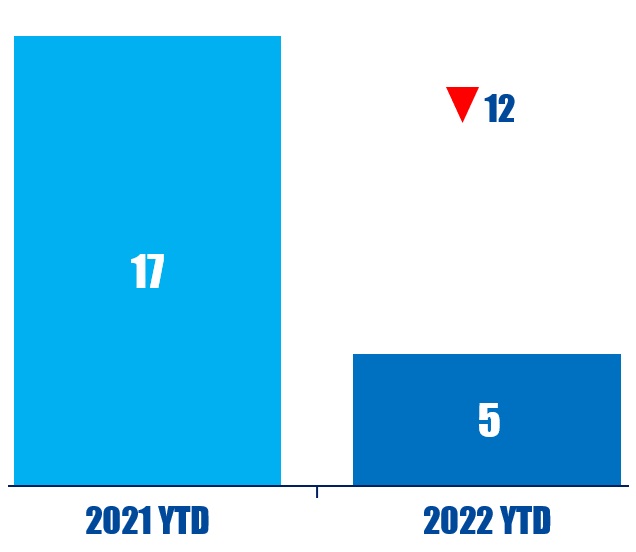

Shorts chart of the week

So far this year (as of July 29, 2022), five Asia-based companies have been publicly subjected to an activist short campaign. That is down from 17 in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Florida Governor Ron DeSantis in a Twitter broadcast on July 27. It came as a growing number of U.S. state senators were calling on financial institutions to cease or reduce their reliance on ESG considerations when managing their investments. Read our reporting here.

“We’re going to do what’s in their best interest, not whatever the delusion of some wealthy woke CEO wants to do.” – Ron DeSantis