The theme park provider beat expectations on strong cost controls despite lower admissions

Six Flags Entertainment (NYSE:SIX) announced first-quarter results to the market on Monday morning, reporting record sales despite a 6% decline in admissions. The result drove excitement with SIX stock posting one of its best trading days of 2023, rising 18.6%.

Six Flags Entertainment is the world’s largest regional theme park company and the largest operator of water parks in North America, with 27 parks across the U.S., Mexico, and Canada.

Despite severe weather at its California and Texas parks, Six Flags reported 3% growth in total revenue to $142 million, and more importantly outpaced analysts’ expectations for a decline in sales to $132 million.

Pandemic Recovery

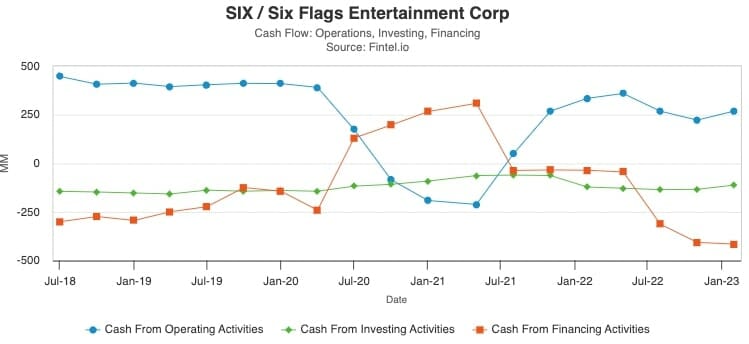

The chart below from SIX’s financial metrics page on Fintel shows the significant decline in cash flows from operations during the pandemic and the subsequent recovery that took place over 2022/23.

Whole cash from financing activities was used to fund operations, it has now become a drag on free cash flows as the cost of debt continues to rise with the interest hiking cycle.

Admissions fell to 1.6 million but were offset by an increase in total guest spending per capita across both lines. Total guest spending grew by 7%, with admissions spending rising 10% and in-park by 3%. These figures were driven by higher revenue from memberships beyond the initial 12-month commitment period.

Adjusted EBITDA was flat with a loss of $17 million which was a better outcome than the consensus forecast for a $24 million loss.

Net losses widened from $66 million to $70 million, translating to a loss per share of 84 cents, slightly better than analyst polled forecasts for a 90 cent loss.

New Strategy

CEO Selim Bassoul attributed the company’s success to its new strategy and culture that are “beginning to take hold.” He also highlighted a number of special events scheduled for this summer, including Viva La Fiesta, Flavors of the World, and Six Flags Fireworks Spectacular.

These events, combined with new rides and attractions and focused infrastructure investments, should help the company deliver an enhanced guest experience this year.

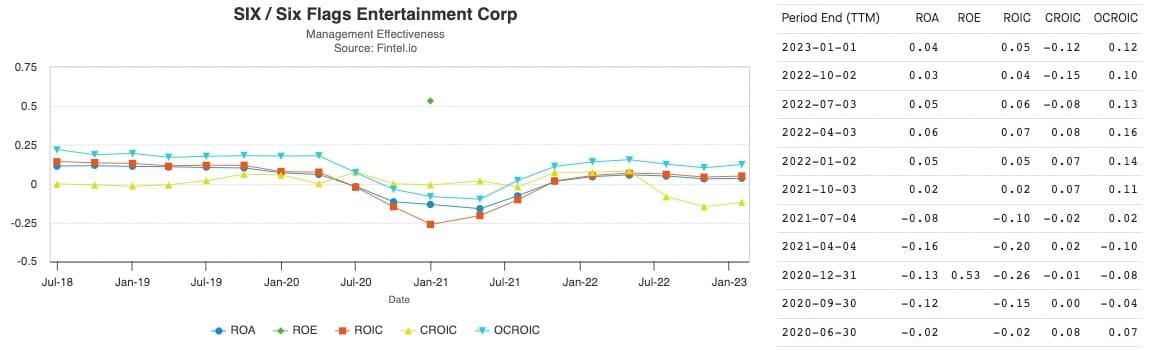

Fintel’s management effectiveness analysis chart shows how measures have improved in recent quarters but remain below pre-covid levels. The Fintel created OCROIC metric — operating cash return on invested capital — shows the underlying operational returns being generated by the company.

This metric makes it hard for management to use balance sheet manipulation to obscure metrics such as ROA/ROE. The OCROIC of the stock reached 0.12 last quarter, however was around the 0.18-0.22 level in 2018/19 for comparison.

Six Flags Entertainment’s strong performance in the first quarter of 2023, despite lower attendance, is a good sign for investors looking to invest in the amusement park industry as the world recovers from the pandemic.

The company’s increasing focus on memberships beyond the initial 12-month commitment period with “season passes” is an encouraging sign, as it could lead to higher revenue and improved financial performance over the long term.

Similar success can be seen in Vail Resorts (NYSE:MTN) EPIC pass which has dominated its snow resort industry.

Additionally, the company’s commitment to creating an inclusive environment that embraces the diversity of its team members and guests is commendable, and could help attract a wider audience to its parks.

Analyst Thoughts

Oppenheimer analyst Ian Zaffino thinks Six Flags posted a solid quarter overall in a seasonally slow period. He believes management’s focus on cost controls and the current pricing approach is a step in the right direction after its strategy in 2022.

The analyst maintained his ‘outperform’ call on the stock and $30 target price after the update.

Fintel’s consensus target price of $32.18 suggests analysts think the stock could recover 21% over the next year as operating conditions improve.

Cautious Options

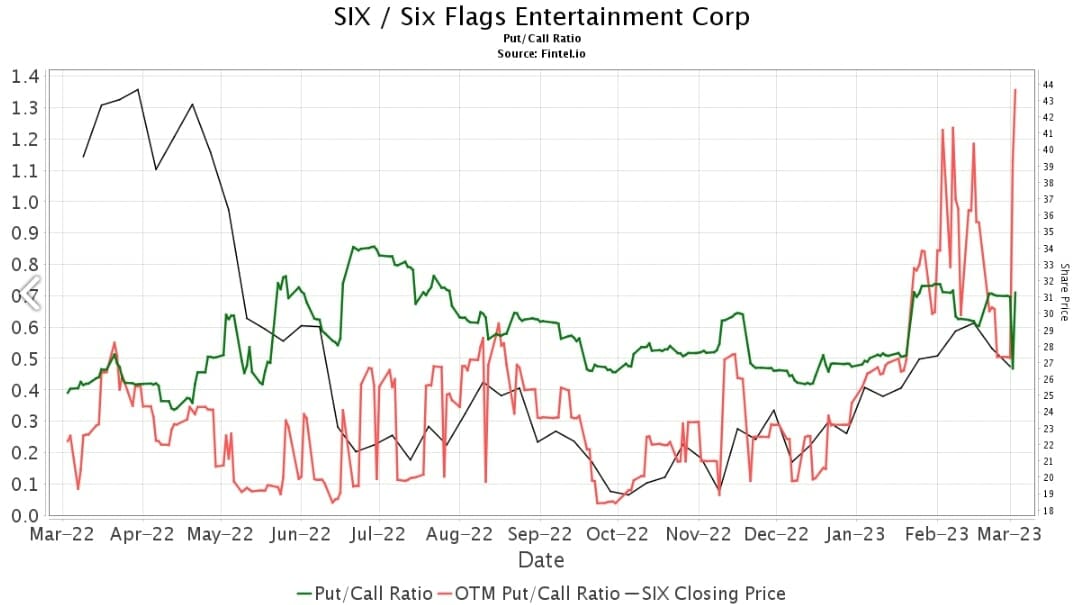

Fintel’s put/call ratio of 0.44 has risen since the beginning of 2023 with the share price rally. A rising ratio tells us that the amount of bearish ‘put’ orders in the market is growing relative to ‘call’ demand and could signal investor sentiment is cautious of the strength.

The chart below shows how this ratio has behaved over time against the share price.

The post Six Flags Result Gives Investors Thrills And Chills as the Stock Rollercoaster Rises 19% appeared first on Fintel.