What’s New In Activism – Sarissa Turns Up The Heat On Amarin

Activist investor Sarissa Capital Management upped its efforts to remake the board of U.K.-based drugmaker Amarin Corporation plc (NASDAQ:AMRN) with a lengthy investor presentation published on a newly set up website. Sarissa is seeking seven director seats and the removal of Amarin Chairman Per Wold-Olsen.

Sarissa explained in a 109-slide investor deck that Amarin has been poorly managed in recent years, with its lead product Vescepa facing competitive pressure from generic drugs in the U.S. and launch difficulties in Europe.

Q4 2022 hedge fund letters, conferences and more

The activist wants a board overhaul at Amarin, starting with the dismissal of Chairman Wold-Olsen, whom the investor holds responsible for failing to keep management accountable for a series of missteps that have cost shareholders dearly.

In a letter Monday, Amarin acknowledged shareholder frustration about its share price but said that its recently refreshed leadership is "working hard" to drive value for them.

Amarin shares closed down at 3% Friday at $1.89 each, giving the company a market value of $760 million. The stock was trading at around $3.60 a year ago and close to $9 in February 2021.

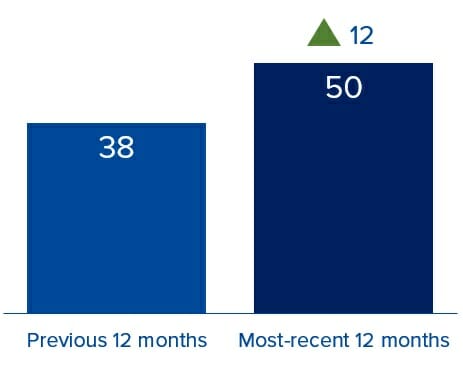

Activism chart of the week

In the 12 months ending February 2, 2023, globally, activists initiated campaigns at 50 energy companies, compared to 39 in the 12 months ending February 2, 2022.

Source: Insightia | Activism

What’s New In Proxy Voting - Department Of Labor Faces Lawsuit

A group of 25 Republican state attorneys is representing various stakeholders in a lawsuit against a Department of Labor ruling that permits fiduciaries to apply ESG investment strategies in employee retirement plans.

In a January 26 regulatory filing, the group raised concerns about the rule which came into effect on January 30 and permits, but doesn’t require, ESG analysis in retirement plans.

The lawsuit argues that the rule undermines protection for retirement savings and seeks relief against the “politicized ESG criteria.” It also seeks a temporary stay on the rule, with a decision awaited from the District Court for the Northern District of Texas.

The group, who includes Liberty Energy, Liberty Oilfield Services, and Western Energy Alliance, is primarily concerned with whether the use of ESG factors meets the standard of prudence and loyalty as required by the Employee Retirement Income Security Act of 1974.

The alliance argues that ESG factors are nonpecuniary, which would open the door for fiduciaries intentionally providing less attractive investment options merely for political purposes.

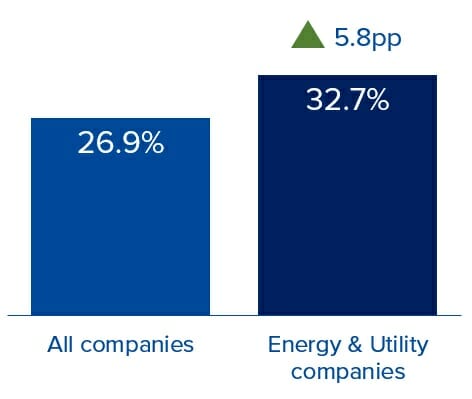

Voting chart of the week

Over the past 12 months (as of February 6, 2023), E&S shareholder proposals at North American energy and utility companies have averaged 32.7% support. This compares to 26.9% at all North American companies.

Source: Insightia | Voting

What’s New In Activist Shorts - Hindenburg's Latest Short Campaign

Adani Enterprises cancelled a record 200 billion-rupee ($2.4 billion) share sale after a report by short seller Hindenburg Research sent the Indian company's share price tumbling.

Adani's stock has fallen roughly 40% since January 24, when Hindenburg publicly claimed that the group is engaged in business and accounting fraud activities and stock manipulation.

Adani, headed by India's richest man Gautam Adani, has strongly denied the claims, though admitted that the resultant stock volatility was behind its decision to cancel the massive follow-on stock offering.

"Given these extraordinary circumstances, the company’s board felt that going ahead with the issue would not be morally correct," stated Adani. "The interest of the investors is paramount and hence to insulate them from any potential financial losses, the board has decided not to go ahead with the FPO."

Shorts chart of the week

So far this year (as of February 03, 2023), there has been 11 public activist short campaigns, up from eight in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week’s quote comes from Glass Lewis Executive Chair Kevin Cameron, in his response letter to 21 Republican state attorneys that suggested the proxy adviser’s ESG policies act in breach of its legal obligations. Read our coverage here.

“Most shareholders today believe robust oversight of ESG risks in critical to ensuring the long-term viability of companies and a failure to mitigate these risks poses real risks to shareholder value.” – Kevin Cameron