Bleecker Street Research’s short report on Retractable Technologies, Inc. (NYSEAMERICAN:RVP).

Q1 2021 hedge fund letters, conferences and more

Table of Contents

Show

An $83.7M Operation Warp Speed Contract

- Over the last year, Retractable Technologies, Inc. (NYSEAMERICAN:RVP) has seen its market cap inflate $300 million on the back of an $83.7 million Operation Warp Speed contract to distribute needles for the Covid-19 vaccine roll-out.

- RVP’s current second largest shareholder appears to have played a part in this contract.

- RVP has a long history of over-promising and under-delivering.

- RVP is structured as an insider enrichment scheme, with the company licensing the needle from the CEO, and paying him a 5% royalty on gross sales.

- RVP received a $54 million TIA after receiving this contract, it is not as advertised.

- RVP’s 2020 numbers are one-time thing. An almost exact replica of this scenario has played out before.

RVP’s History

- RVP was founded by Thomas Shaw in 1995. It received $650,000 in grants from the NIH to encourage U.S. production of medical supplies, and the town of Little Elm, Texas kicked in $350,000 based on the promise of 600 jobs coming to the area. Over twenty years later, 85% of RVP’s product comes from China and they employ just 182 people.

- RVP has been locked out of the commercial market for much of its existence, they argue it’s because larger competitors have engaged in unfair business tactics, RVP’s competitors argue it is because RVP’s needle is overpriced.

RVP’s Results Minus Settlements

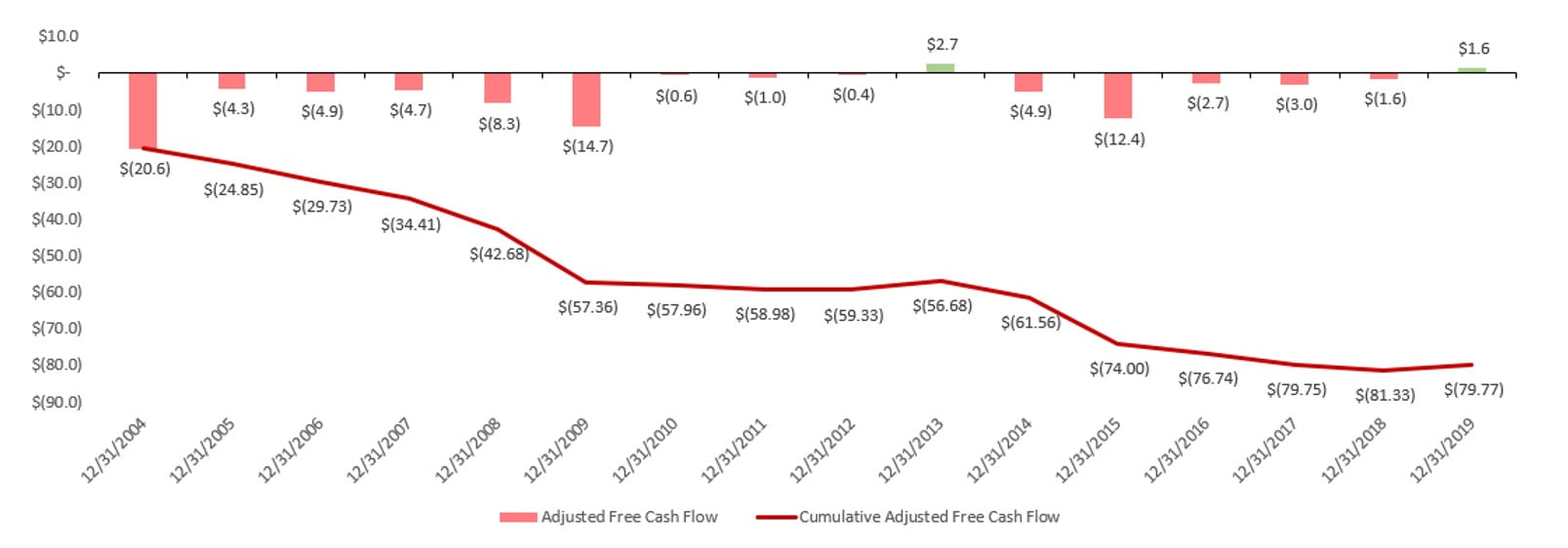

- RVP has spent much of its corporate history engaged in litigation with their competitors. On the eve of a trial in 2004, BD would settle for $150 million. RVP would win other settlements over the course of its life, but when you strip out these settlements a clearer picture emerges.

Covid-19 Operation Warp Speed Contract

- On May 4, 2020 RVP would announce that they had won an $83.7 million contract for needles. Shares would double over the ensuing month, adding $100 million in value to the company.

- Why did a tiny sub-$100 million market cap company that took PPP money just weeks before get the contract? We believe the answer could lie with Lillian Salerno.

- Salerno is the company’s second largest shareholder and has a long history of involvement with the company.

- She is currently listed as a “Senior Strategist” at LES Consulting, which according to her LinkedIn profile “provided innovative solutions to ensure that the essential supplies for a Covid-19 vaccine are manufactured in the US and while meeting an expedited timeline for successful delivery of health supplies as part of “Operation Warp Speed”

- Salerno has seen the value of her shares rise $13.1 million as a result of this contract.

- Despite lackluster results for shareholders, RVP has created fantastic results for insiders.

- RVP doesn’t actually own the patent for the VanishPoint syringe (which is 85% of their sales)

- Instead they license it from Shaw, paying him a 5% royalty on gross sales, not net sales.

- This unique arrangement means Shaw has been paid $57.5 million in royalty fees, while RVP has burned through $100 million in normalized losses from operations.

- When is a $53.7 Million Investment Not that

When is a $53.7 Million Investment Not that

- On July 8, 2020 RVP announced they were getting a $53.7 million “investment” from the government (BARDA) to help encourage domestic production.

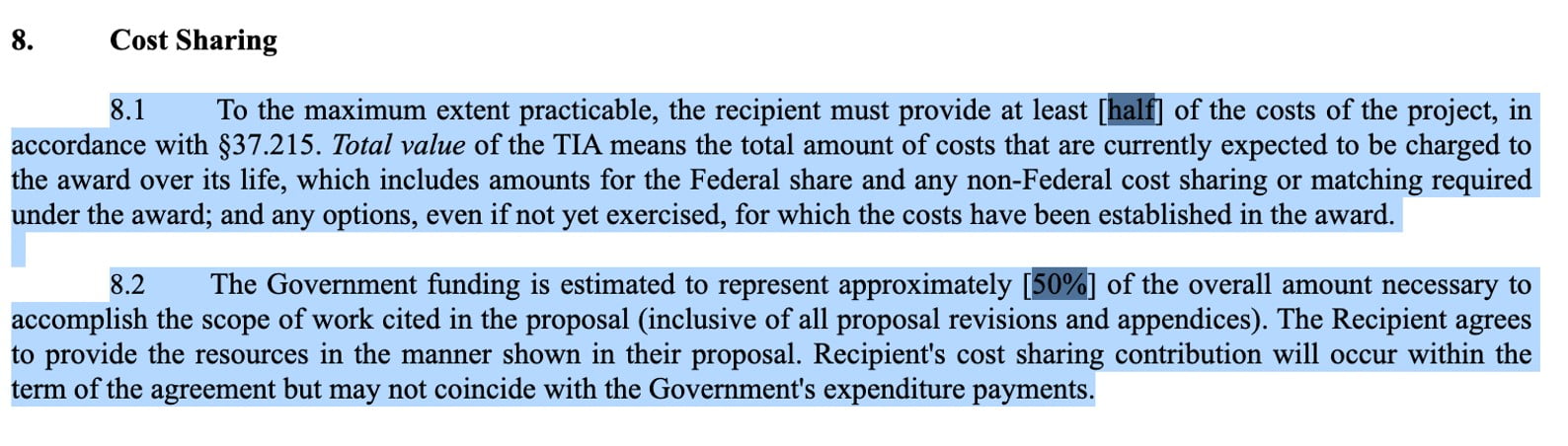

- The problem is that this Technology Investment Agreement (TIA) is not really an investment, but an 50/50 cost sharing arrangement with the government.

- RVP improperly redacted the document in an exhibit to their 10-Q and so far the government has only contributed $6.4 million or 11% of the total.