Informed retail investors: Evidence from retail short sales

- Keith Jacks Gamble and Wei Xu

- Journal of Empirical Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Check out our H2 hedge fund letters here.

What are the research questions?

This study uses a new classification system for informed vs. uninformed retail trades: short selling stocks without options available indicates more informed trading than short selling stocks with options available.

- Is there a difference in returns between shorted stocks without listed options and shorted stocks with listed options available?

- Using account level data for households, can a trading strategy be constructed that reveals the degree to which these types of trades from retail investors are informed vs. uninformed?

- Are there differentiating characteristics of the informed vs. uninformed investors?

- Are there differentiating characteristics of the informed vs. uninformed trades?

What are the Academic Insights?

- YES. Forming portfolios by purchasing shorted stocks produces a significant annualized alpha of -5.47% if options are not available to trade, and a non-significant 1.91% if options are available. Typical risk adjustments are applied to the results. Larger trades with shorter holding periods amplified the results.

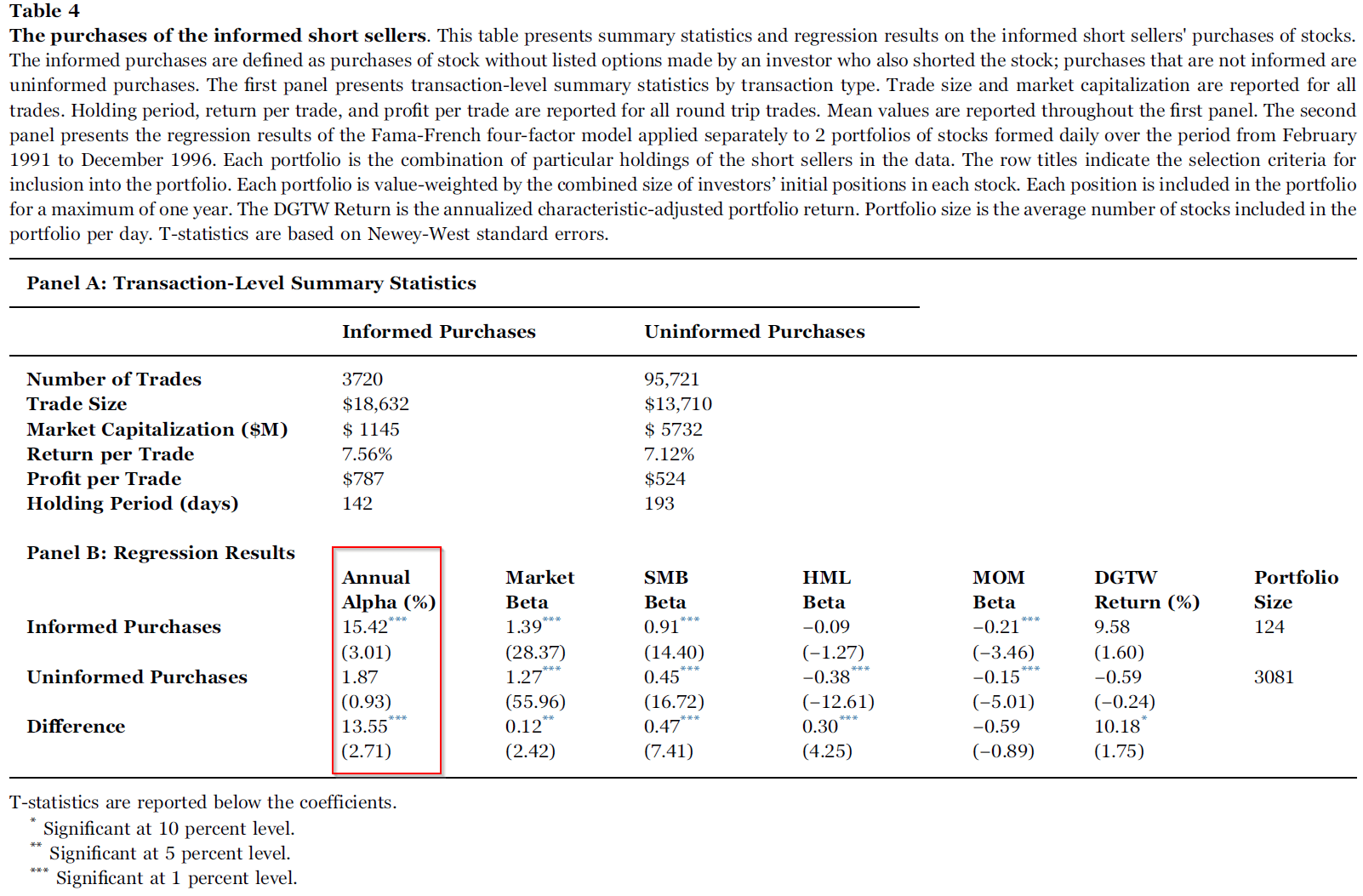

- YES. The Informed strategy consisted of the case where investors bought stocks without listed options once previously shorted and produced an annualized alpha of 15.42%. This result is in contrast to a non- significant 1.87% for the Uninformed portfolio consisting of all other stocks purchased by the investor. The authors argue the results are inconsistent with superior trading skills and consistent with the notion that the retail investors have information on specific stocks that provides benefits from both long and short positions.

- NO. The informed vs. uninformed investors exhibited no significant differences in wealth, age, gender, marital status and home ownership. Apparently, the demographic characteristics of the investors studied are unrelated to the opportunity to access private information.

- YES. Short selling is rare, 13%, among the households sampled over the six-year period studied. Informed short sales averaged 2.28 trades and 0.62 informed purchases of stocks. The largest concentration were in pharmaceuticals, electric services, computer equipment and computer services, although a wide variety of industries were observed. In contrast, there were 2.31 uninformed short sales and 15.96 uninformed purchases of stocks observed. The authors speculate that the low rate of incidence is related to very rare corporate events and were notably unrelated to earnings announcements. Just 7% of the informed trades occurred in the week before earnings were announced.

Why does it matter?

The novel approach to classification developed in this study is based on evidence suggested in several other published studies which are quoted in the article. The dataset utilized is the well-known Barber and Odean (2000) dataset which is considered standard to analyze the behavior of retail investors. It consists of approximately 78,000 households from a large discount broker. The dataset includes end-of-the-month position statements and daily trade records from 1991 to 1996. Although no longer recent, this dataset provides the most detailed information on account level trades and detailed demographics available on retail investors in the U.S.

This study provides insight into the profitability and the scale of informed trading among retail investors. The authors suggest that transactions costs of .81% to 1.7% round trip would eliminate the trading profits based on informed trades, a result inconsistent with market inefficiency. However, the evidence suggests that insider trades are not completely eliminated and the type of information accessed by informed retail investors remains unclear.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Our study suggests that despite the enforcement of insider trading laws, there are still some investors trading on their private information. Using account-level information, we show that some retail investors seem to be informed about particular stocks. When they sell short these stocks, they earn an alpha of 15%; when they purchase these stocks, they earn an alpha of 27%. Other short sales and purchases by the same investor do not earn significant alpha. These informed trades are rare and further evidence suggest that these informed retail trades are motivated by private information rather than trading skill.

- The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

- Join thousands of other readers and subscribe to our blog.

- This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

The post "Retail Short Sellers: Trading Skill Or Insider Trading?" appeared first on Alpha Architect.