Chances are, close to half the people you pass each day — at the office, on the train, in the park — are swimming in credit card debt.

[REITs]Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

That’s what the results of a recent Student Loan Hero study suggest. Forty-three percent of survey respondents had credit card debt topping $15,000. What’s more, 58% of all respondents have carried at least $6,000 in credit card debt for more than a year, and nearly a quarter of people pay above-average interest rates of 20.00% or more.

Those are a lot of numbers, but what they amount to is quite simple: A lot of people have credit card debt, and they pay high interest rates on what they owe.

If you’re in this situation, you know how easy it is for interest payments to balloon. When that happens, climbing out of credit card debt can seem impossible, and doing so can take years.

However, there are a few strategies that can help. Consider these three methods to kick credit card debt to the curb.

1. Consolidate your debt with a personal loan

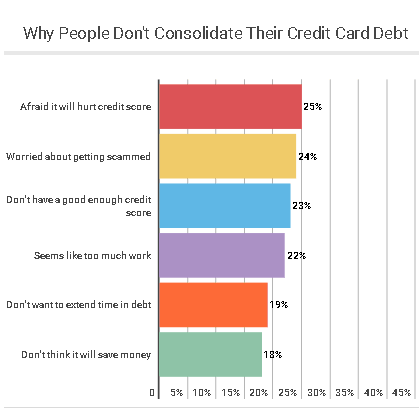

Almost one-half of survey respondents in the Student Loan Hero study had never tried to consolidate their credit card debt with a personal loan. Why? They cited fears of consolidation scams or potentially harming their credit scores.

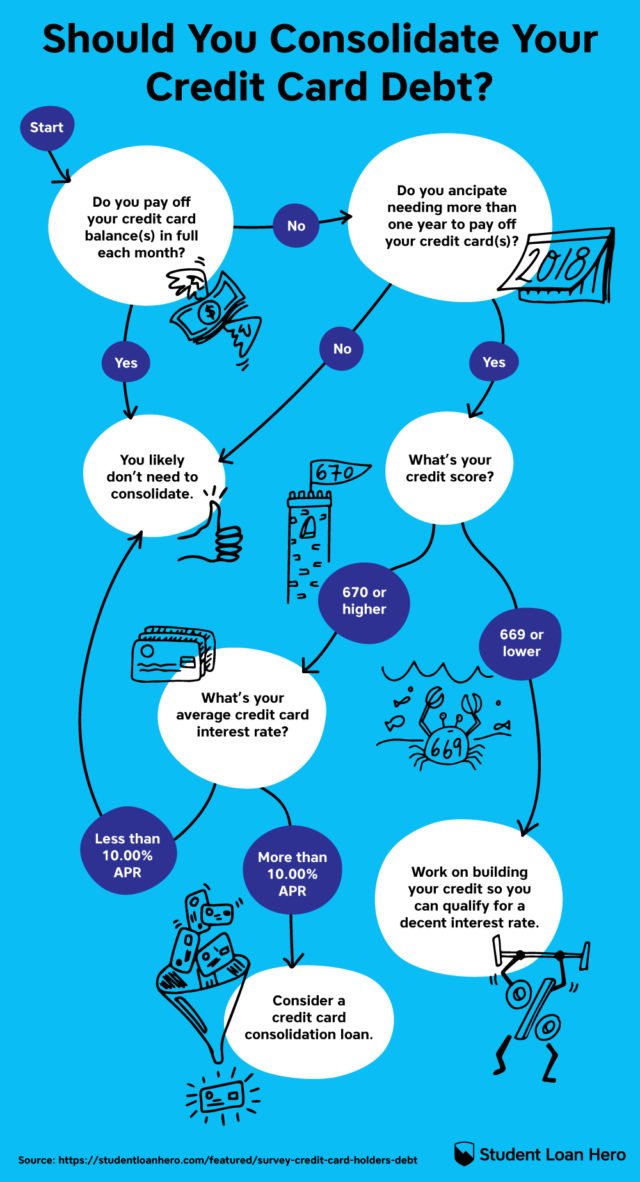

While those justifications could be true in certain scenarios, in many cases, consolidating can be a smart financial move. Consolidating your debt could be beneficial if:

- You have good credit. A healthy credit history means you could qualify for lower interest rates on a personal loan. You can use a loan to pay off your credit cards, leaving you with just one loan to pay at a lower interest rate. Depending on your debt, this could save you thousands in interest charges.

- You want one easy payment. If you’re having a tough time keeping track of multiple payments, consolidating your debt with one personal loan simplifies your dues each month.

You can apply for a personal loan online to consolidate your debt. Before you agree to a new loan, however, ensure that it’ll actually save you money by using a credit card consolidation calculator.

2. Use a balance transfer to lower your interest payments

Some people opt to pay credit card debt with a balance transfer instead of a consolidation loan. This method involves finding a credit card with a low introductory APR — preferably 0%— and then transferring the balance of your old debt to your new card. You then focus on paying off the new card as quickly as possible.

It’s a viable solution if you have excellent credit since you’re more likely to qualify for a low-interest card. Before you pursue this debt payoff strategy, however, check how long the introductory APR will last, what the interest rate will be after the introductory period ends, and if there are any fees associated with transferring your balance. You’ll want to do the math to make sure this method will actually be a cheaper way to pay your debt.

3. Tackle your debt with either the snowball or avalanche method

There are two popular ways to pay off debt: the debt snowball and the debt avalanche method.

With the snowball method, you continue to make minimum payments on all your debt. But, you make extra payments on the debt with the smallest balance. Once you pay it off, you focus on your next smallest debt, and so on. Many people like this method because it makes them feel successful each time they fully pay off a debt. Plus, you can often see results quickly.

The avalanche method follows a similar theory, but with one important difference. Instead of focusing on your smallest debt first, you tackle your credit card with the highest interest rate. Once you fully pay off your highest-interest debt, you move on to the next one, and so on.

This is often the cheaper way to pay off debt early, especially if you can’t consolidate at a lower interest rate. The avalanche method ensures you spend the least amount of time possible paying high interest.

Even though it can feel like you’ll never get out of debt, you will! Pick a debt solution and stick to it. You’ll see results if you’re diligent and purposeful.

Article by Jolene Latimer, Student Loan Hero