The pump fake. A move designed to shake a defender from your side in attempt to create an opening, it’s something of an art form in the world in sports. Basketball and football players specifically have adopted the strategy as a way to keep defenders honest. The execution of a good pump fake when the defense is feeling overly confident can throw a wrench in rhythm of the game, completely shifting momentum. Knowing this, defenders must keep a disciplined approach in trying to shutdown prolific scorers. If not, they run the risk of looking like this, and a lot less like this. Investors are often times in the position that many defenders are in when it comes to playing this game with Mr. Market. Keeping your head on a swivel is close to the only thing you can do as an investor. Studying fragile environments can help prepare yourself for the likelihood that you find yourself in one.

Q4 hedge fund letters, conference, scoops etc

Shooters Shoot And Cats Bounce

In basketball, an effective pump fake often times doesn’t need to be sold in order to be believable. The defender’s opinion on the player they’re guarding along with the shooter’s reputation can often times lead to defensive overreactions. Steph Curry perhaps is the greatest shooter in the history of the NBA. A guy who’s capable and willing to pull-up and shoot from just about anywhere on the court, and make it. If you’re attempting to guard him, you’re going to be anxious when trying to determine the appropriate time to try and contest a shot. His reputation, accuracy, speed of release and mechanics all help increase the likelihood of a defender leaping out the gym for all the wrong reasons.

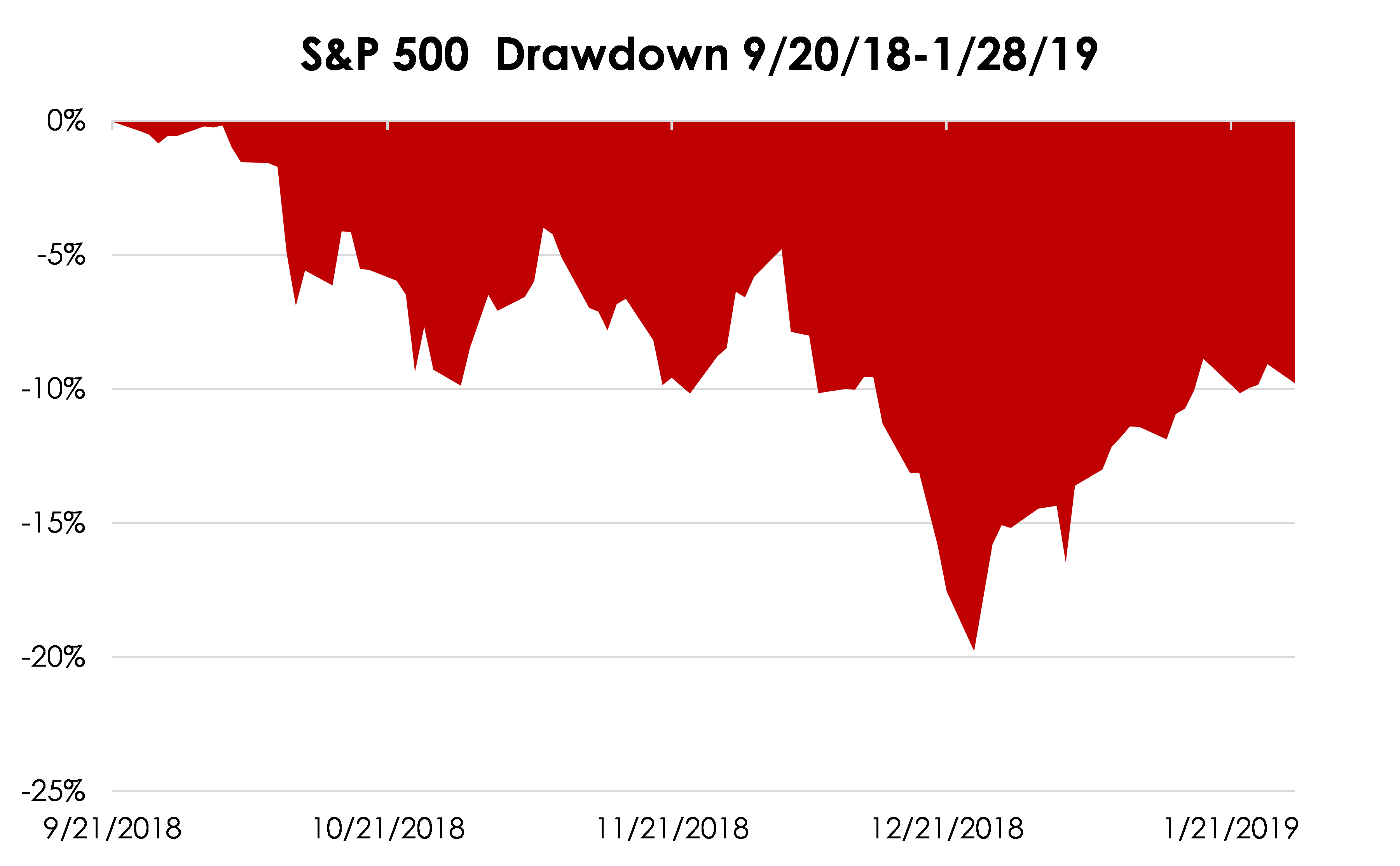

When you’re in a market environment that has seemed impervious for so long, investors’ can grow comfortable of certain routines. What we’ve seen for several years is the routine of buying the dip (#BTFD) when markets have taken a breather. However with the dip that began last September, market participants who’ve been quick to buy what looked like sustainable rebounds have found out what a dead cat bounce can look like[1]:

Since the drawdown just 82 trading days ago, there’ve been two separate 5%+ rallies after the S&P 500 hit correction territory at the 10% drawdown mark. Since the -20% intraday low back in December, investors are now seeing a 12% rally off the Bear Market lows through Thursday (1/17/19). So, is the market about to shoot its shot?

Big Moves Poppin

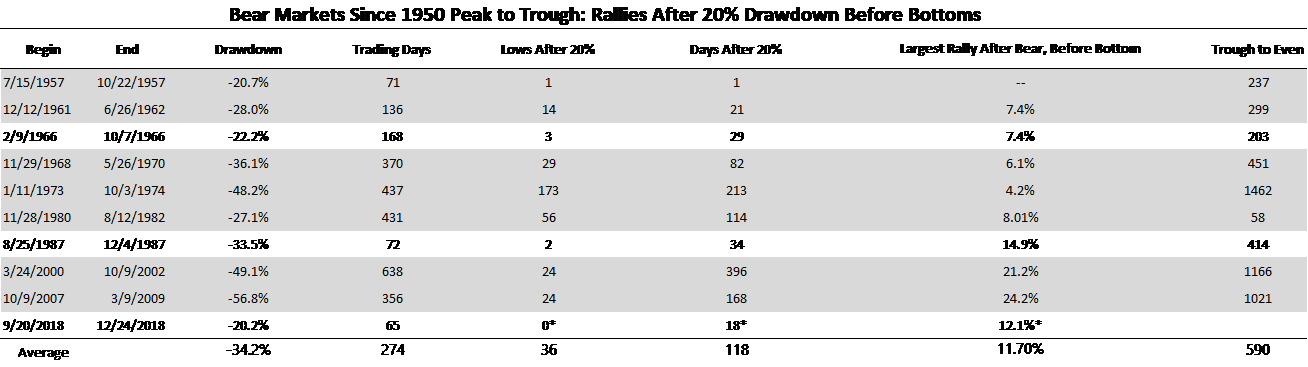

These bounces in price are what you get when you’re dealing with a market that is in an unhealthy state. Taking a look back at the last 10 Bear Markets since 1950, large moves to the upside are often times outnumbered by moves lower, but they’re significant in size when they happen.

The biggest 1, 2, 3 and 5 day moves within the context of a 20% drawdown have all exceeded what would register as a 3 standard deviation positive move for the entire period from 1950-2019 when looking at the S&P 500[2].

On average, the positive moves over the 1,2,3 and 5 day periods all exceed what the long-term average positive moves come in at as well, at a modest spread.

What’s most interesting about these tables above is this: yes, all of these large moves higher are more significant than historical norms. But they’re all being registered before the bottom in the selloff was put in.

Clearly, there’s no shortage of pump fakes investors must try to not fall victim to in these environments. And trying to figure out which move higher is the last one, before we’re out of the woods. That’s a task no investor should try to invest too much time in doing, as no Bear is the same. The circumstantial evidence that accompanies each market is often times unique to the economic environment it’s occurring in.

What’s been relatively consistent is that new lows are set, and retested, following the initial 20% decline. On average, there have been 36 additional lows set by the S&P 500 following the initial perceived 20% low[3]. The two events in our sample size (which is admittedly small) that occurred outside of a recession were the lone events which saw single digit additional lows in the route. But new lows, nonetheless.

Is the current march higher the beginning of the end of this bear? We could spend an entire separate conversation on each of these Bear’s bottoming process. But we know we’d be looking at 10 very different pictures.

There is no playbook for these types of situations. Just like how there’s really no playbook for guarding a prolific scorer like Steph Curry. You can only hope to contain players like Curry, not shut him down.

For investors, the defense in these markets is largely being played against themselves, not Mr. Market (a real Fight Club conclusion, we know). It’s easy for investors to dismiss broad, steep selling within the market as irrational. But the quick and vicious bounces higher can’t be perceived as any less irrational. Therefore, knowing you’re in a unique environment while digesting the data we’re given as investors is key to survival.

[1] Data from Bloomberg. Chart made by GFG Capital. [2] Data from Bloomberg, Tables made by GFG Capital. [3] Data from Bloomberg, Tables made by GFG Capital.

LEGAL STUFF

THE OPINIONS MENTIONED HEREIN ARE THOSE OF GFG AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. FOR FURTHER INFORMATION, PLEASE CONTACT GFG TO SPEAK TO AN INVESTMENT ADVISER REPRESENTATIVE.

PAST PERFORMANCE IS NO GUARANTEE OF COMPARABLE FUTURE RESULTS. THE INFORMATION PROVIDED SHOULD NOT BE CONSIDERED A RECOMMENDATION TO PURCHASE OR SELL ANY PARTICULAR SECURITY. YOU SHOULD NOT ASSUME THAT ANY OF THE HOLDINGS WERE OR WILL BE PROFITABLE, OR THAT THE INVESTMENT DECISIONS WE MAKE IN THE FUTURE WILL BE PROFITABLE OR WILL EQUAL THE PERFORMANCE OF THE SECURITIES REFERENCED. GFG INCLUDES INFORMATION RELATED TO VARIOUS INDICES. FINANCIAL INDICATORS AND INDICES ARE UNMANAGED, DO NOT REFLECT ANY MANAGEMENT FEES, ASSUME REINVESTMENT OF INCOME, ARE FOR ILLUSTRATIVE PURPOSES ONLY AND HAVE LIMITATIONS WHEN USED FOR SUCH PURPOSES. NONE OF THE MSCI INFORMATION IS INTENDED TO CONSTITUTE INVESTMENT ADVICE OR A RECOMMENDATION TO MAKE (OR REFRAIN FROM MAKING) ANY KIND OF INVESTMENT DECISION AND MAY NOT BE RELIED ON AS SUCH. HISTORICAL DATA AND ANALYSIS SHOULD NOT BE TAKEN AS AN INDICATION OR GUARANTEE OF ANY FUTURE PERFORMANCE ANALYSIS, FORECAST OR PREDICTION. ALL INFORMATION DERIVED FROM THIRD PARTIES IS TO THE BEST OF OUR KNOWLEDGE ACCURATE.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE AT BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV.

CERTAIN INFORMATION CONTAINED IN THE PRESENTATION DISCUSSES GENERAL MARKET ACTIVITY, INDUSTRY OR SECTOR TRENDS, OR OTHER BROAD-BASED ECONOMIC MARKET OR POLITICAL CONDITIONS AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. INCLUDED IN THIS ARTICLE ARE LINKS TO OTHER WEBSITES, INCLUDING LINKS TO THE WEBSITES OF COMPANIES THAT PROVIDE PICTURES, RELATED INFORMATION, PRODUCTS AND SERVICES. SUCH EXTERNAL INTERNET ADDRESSES CONTAIN INFORMATION CREATED, PUBLISHED, MAINTAINED, OR OTHERWISE POSTED BY INSTITUTIONS OR ORGANIZATIONS INDEPENDENT OF GFG. THESE LINKS ARE SOLELY FOR THE CONVENIENCE OF THE READER, AND THE INCLUSION OF SUCH LINKS DOES NOT NECESSARILY IMPLY AN AFFILIATION, SPONSORSHIP OR ENDORSEMENT.

OTHER SOURCES, LINKS, AND INFORMATION PRESENTED IN THIS ARTICLE ARE OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, BUT THEY ARE FOR INFORMATIONAL PURPOSES ONLY AND GFG DOES NOT GUARANTEE THEIR TIMELINESS OR ACCURACY.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.