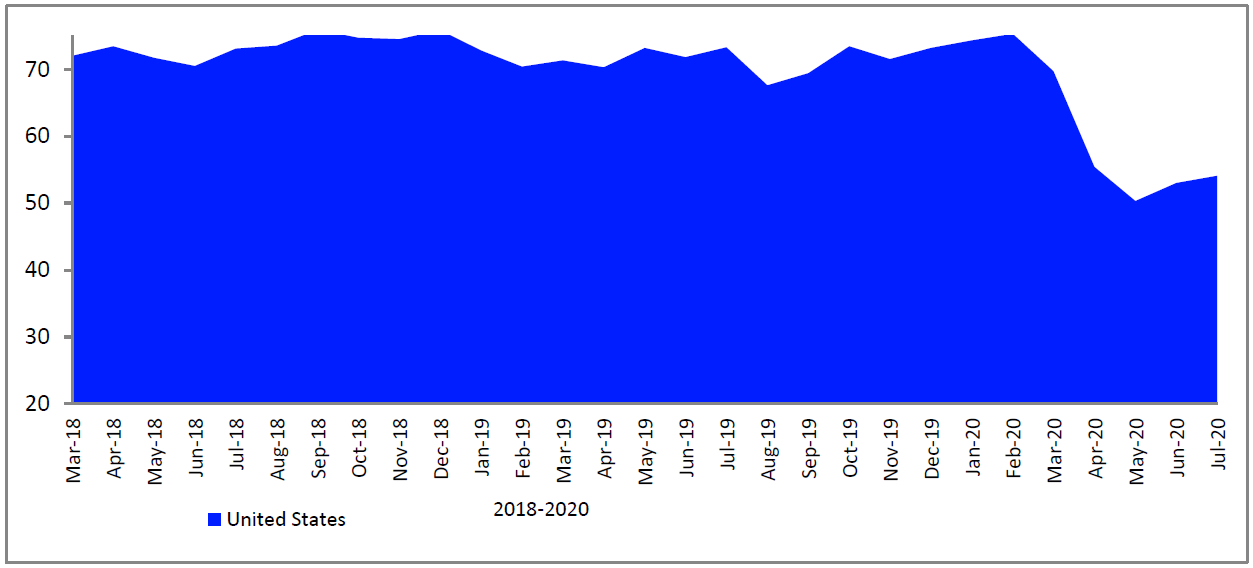

American consumer confidence, as measured by the Refinitiv/Ipsos Primary Consumer Sentiment Index, is at 49.6 for the month of July 2020, which is f lat from last month.

Q2 2020 hedge fund letters, conferences and more

Primary Consumer Sentiment Index Reveals Americans Are Beginning To Curb Their Worries

No movement in the overall Primary Consumer Sentiment Index suggests that consumers are beginning to curb their worries in regards to their personal situations as well as the economy overall. The Current, Investment, and Jobs indices all showed incremental growth while the Expectations index remained flat.

"Although Consumer Confidence has declined significantly since the pandemic began, American consumers are not feeling any less comfortable even as new virus hotspots are popping up across the country," reports Chris Jackson of Ipsos. "Consumers have grappled with the virus for several months now and are perhaps more relaxed in this new normal.”

Jharonne Martis, Director of Consumer Research at Refinitiv, said, "As consumers settle into the new "normal", health and wellness are a top priority for them, and they are spending more money online which is boosting ecommerce sales. They are gravitating towards online retailers like Etsy to purchase face masks, which is expected to see triple digit earnings growth in Q2 2020. Similarly, traditional retailers with solid e-commerce presence are expected to continue seeing healthy growth in 2020."

Primary Consumer Sentiment Index: Current

The PCSI Current Condition Index shows a n increase of 1.2 points since last month (currently at 38.0) As Americans are becoming more optomistic about the economy as a whole, their confidence on their current financial situations is becoming more optomistic as well.

Expectations

The PCSI Expectations Index is flat down 0.3 points standing at 65.3. Americans are feeling more confident about the economy's impact on their personal finances and their job security. Of all sub indices, the Expectations Index is the only one within one point of the prior year ( 0.3) while all other sub indices are down at least 13 points.

Investment

The PCSI Investment Index is up 1.2 points from last month to 42.5. Comfort in making major purchases as well as other household purchases are both up. Moreover, Americans are starting to feel more confident in their ability to invest in their future.

Jobs

The PCSI Jobs Index is up 1.1 points currently standing at 54.1. Despite record level unemployment, confidence around job security and expectations has actually increased.