S&P 500 upswing attempt rejected, again – and credit markets didn‘t pause, with the dollar rush being truly ominous. Sign of both the Fed being taken seriously, and of being afraid (positioned for) the adverse tightening consequences. Bonds are bleeding, the yield curve flattening, and VIX having trouble declining.

Q4 2021 hedge fund letters, conferences and more

As stated yesterday:

(...) It‘s nice to start counting with 5 rate hikes this year when taper hasn‘t truly progressed much since it was announced last year. The accelerated taper would though happen, and the following questions are as to hikes‘ number and frequency. I‘m not looking the current perceived hawkishness to be able to go all the way, and I question Mar 50bp rate hike fears. Not that it would even make a dent in inflation.

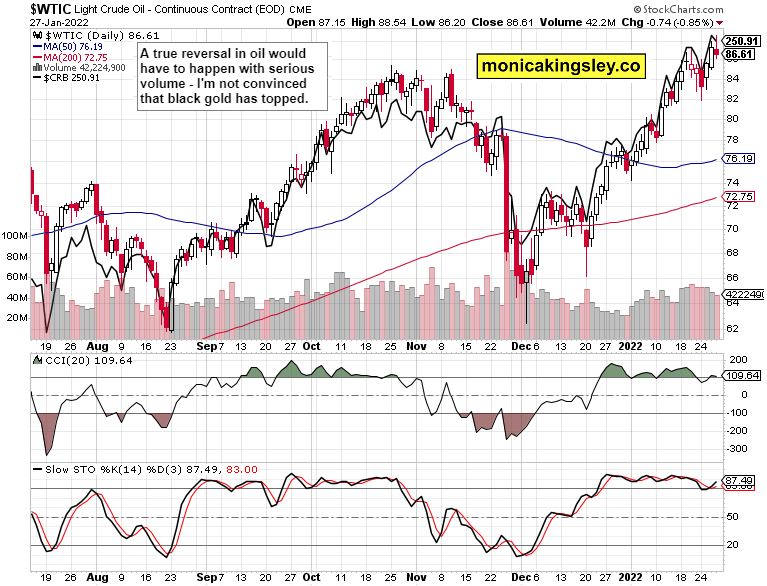

Not even the shock and awe 50bp hike in Mar would make a dent as crude oil prices virtually guarantee inflation persistence beyond 2022. The red hot Treasury and dollar markets are major headwinds as the S&P 500 is cooling off (in a very volatile way) for a major move. As we keep chopping between 4,330s and 4,270s, the bulls haven‘t been yet overpowered. I keep looking to bonds and USD for direction across all markets.

I also wrote yesterday:

(...) All that‘s needed, is for bonds to turn up, acknowledging a too hawkish interpretation of yesterday‘s FOMC – key factor that sent metals down and dollar up. While rates would continue rising, as the Fed overplays its tightening hand, we would see them retreat again – now with 1.85% in the 10-year Treasury, we would overshoot very well above 2% only to close the year in its (2%) vicinity.

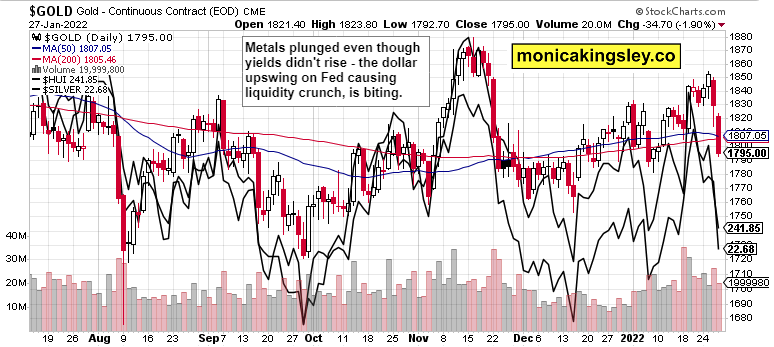

That just illustrates how much tolerance for rate hikes both the real economy and the markets have, and the degree to which the Fed can accomplish its overly ambitious yet behind the curve plans. Still time to be betting on commodities and precious metals in the coming stagflation.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

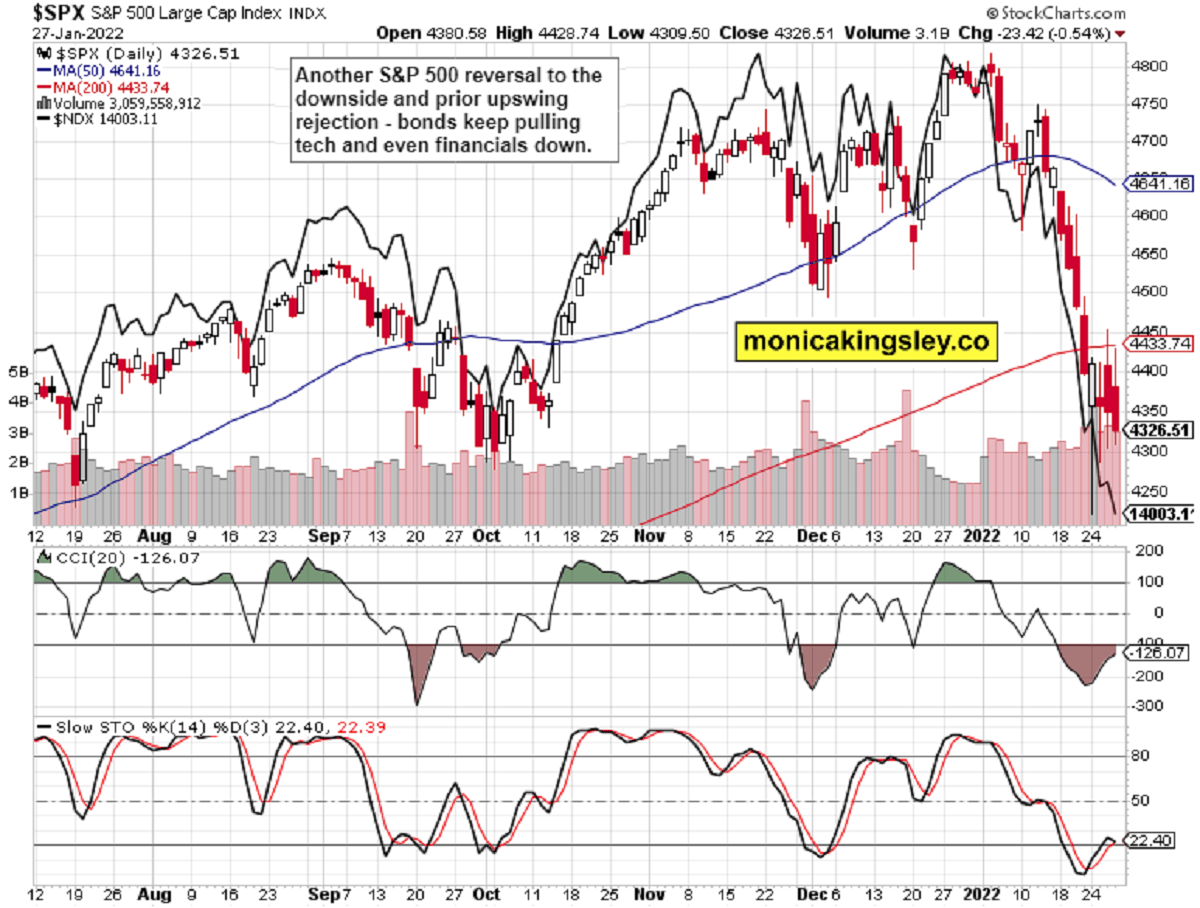

S&P 500 and Nasdaq Outlook

Another setback with reversal of prior gains - S&P 500 is chopping in preparation for the upcoming move. Concerningly, the bears are overpowering the bulls on a daily basis increasingly more while Bollinger Bands cool down to accommodate the next move. Direction will be decided in bonds.

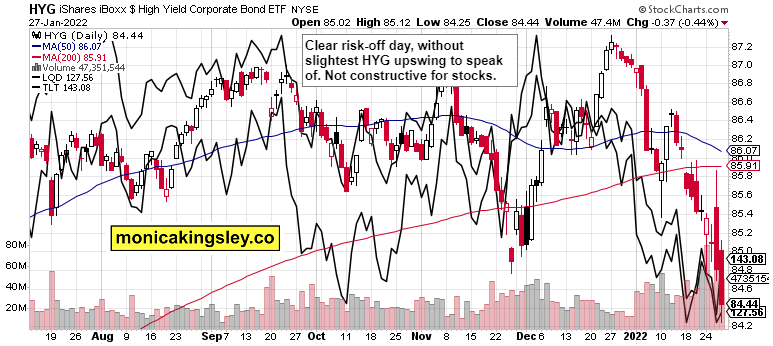

Credit Markets

HYG keeps collapsing but the volume is drying up, which means we could see a reprieve – happening though at lower levels than earlier this week. Quality debt instruments are pausing already, indicatively.

Gold, Silver and Miners

Gold and silver declined as yields moved sharply up and so did the dollar – but inflation or inflation expectations didn‘t really budge, and TLT looks ready to pause. The metals keep chopping sideways in the early tightening phase, which is actually quite a feat.

Crude Oil

Crude oil isn‘t broken by the Fed, and its upswing looks ready to go on unimpeded, and that has implications for inflation ahead. Persistent breed, let me tell you.

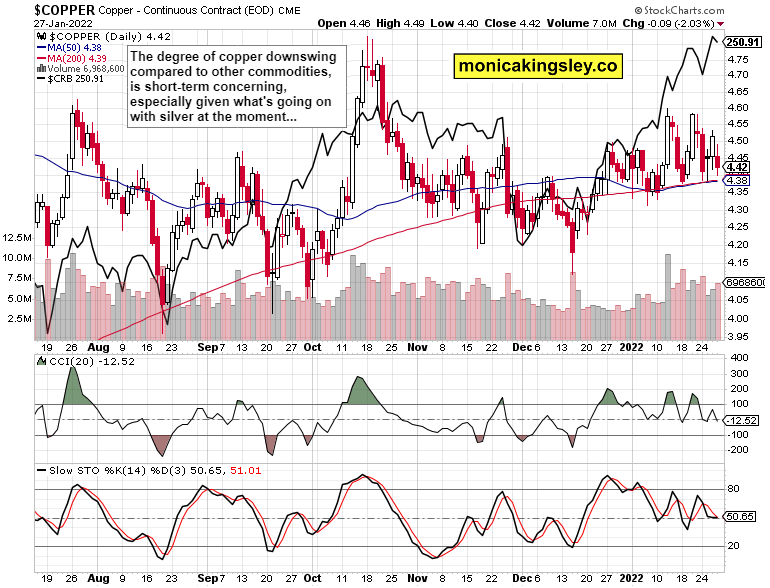

Copper

Copper is in danger of losing some breath – the GDP growth downgrades aren‘t helping. The red metal though remains range bound, patiently waiting to break out. Will take time.

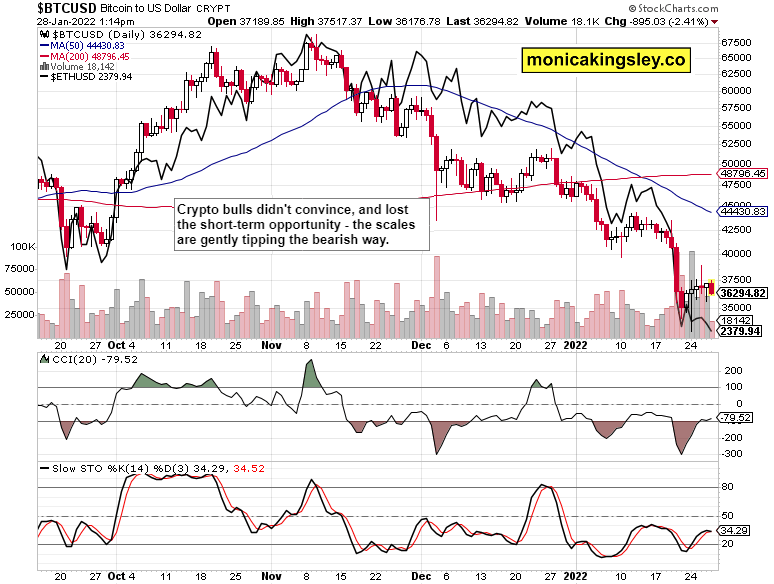

Bitcoin and Ethereum

Bitcoin and Ethereum are pointing lower again, losing altitude – not yet a buying proposition.

Summary

S&P 500 bulls wasted another opportunity to come back – the FOMC consequences keep biting as fears of a hawkish Fed are growing. Tech still can‘t get its act together, and neither can bonds – these are the decisive factors for equities. As liquidity is getting scarce while the Fed hadn‘t really moved yet, risk-on assets are under pressure thanks to frontrunning the Fed. The room for a surprising rebound in stocks is however still there, given how well the 4,270s are holding in spite of the HYG plunge. And given the recent quality debt instruments pause, it looks approaching. Look for a dollar decline next to confirm the upcoming risk-on upswing.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.