Discusses the trial and the results at hand, plus some useful insights from Fintel research

Sorrento Therapeutics’ Stock Rally

Biopharmaceutical outfit Sorrento Therapeutics (NASDAQ:SRNE) rallied +6.2% on Tuesday and extended gains by a further +2.1% in post market trading after the company released positive trial results from Abivertinib that was used for the treatment of Advanced Non-Small Cell Lung Cancer (NSCLC). The stock remains down 61% since the beginning of the year but staged an attempted recovery after bottoming out over May/June.

Q2 2022 hedge fund letters, conferences and more

Abivertinib is Sorrento’s third-generation epidermal growth factor receptor (EGFR) inhibitor that is used to target the EGFR in patients with advanced lung cancer that have been resistant to ‘first-line’ kinase inhibitor therapies.

Abivertinib is able to inhibit resistant mutations with almost 300x greater potency than a wild-type EGFR.

The trial discussed in the company's press release was conducted in China, where 209 NSCLC patients were assessed by an IRC.

The trail illustrated that Abivertinib generated significant treatment benefits.

The overall response rate as confirmed by the IRC was 56.5% (118 patients out of 209) and included 11 patients that had complete responses, equating to a CR rate of 5.3%. The median overall survival rate was 28.2 months.

Sorrento’s management noted that treatment is potentially superior than the current approved third generation EGFR inhibitor called osimertinib.

Based on the significant positive results from the assessment, Sorrento has decided to close the study to begin preparing the materials for a Pre-New Drug Application (NDA) meeting with the FDA.

Management also pointed out the potential to submit the results for approvals to regulatory agencies in other countries.

Previously, positive interim results were analysed by investigators who published a peer-reviewed article in the Clinical Cancer Research Journal.

Last week was also a large week of news with SRNE releasing second quarter earnings and announcing or clearance of a Phase I trial in China.

The Phase I trial will see the use of the oral Mpro inhibitor (STI-1558) to treat Covid-19 patients. The trial was approved by the China National Medical Products Administration (NMPA) and will allow SRNE to evaluate STI-1158 antiviral activity in patients across different dose levels.

Management plans to use the results from the study to facilitate the planned Phase II/III trials in Mexico and the U.S.

Sorrento’s second quarter earnings saw a reduction in group revenue to $11.5 million from $13.5 million in the prior year. The firm's research and development expenses fell to $48.5 million from $54.5 million in the prior corresponding period.

The company generated a net loss of $219 million, widening from the $166 million loss in the prior year.

At the end of the quarter, Sorrento had $70.3 million in cash on the balance sheet.

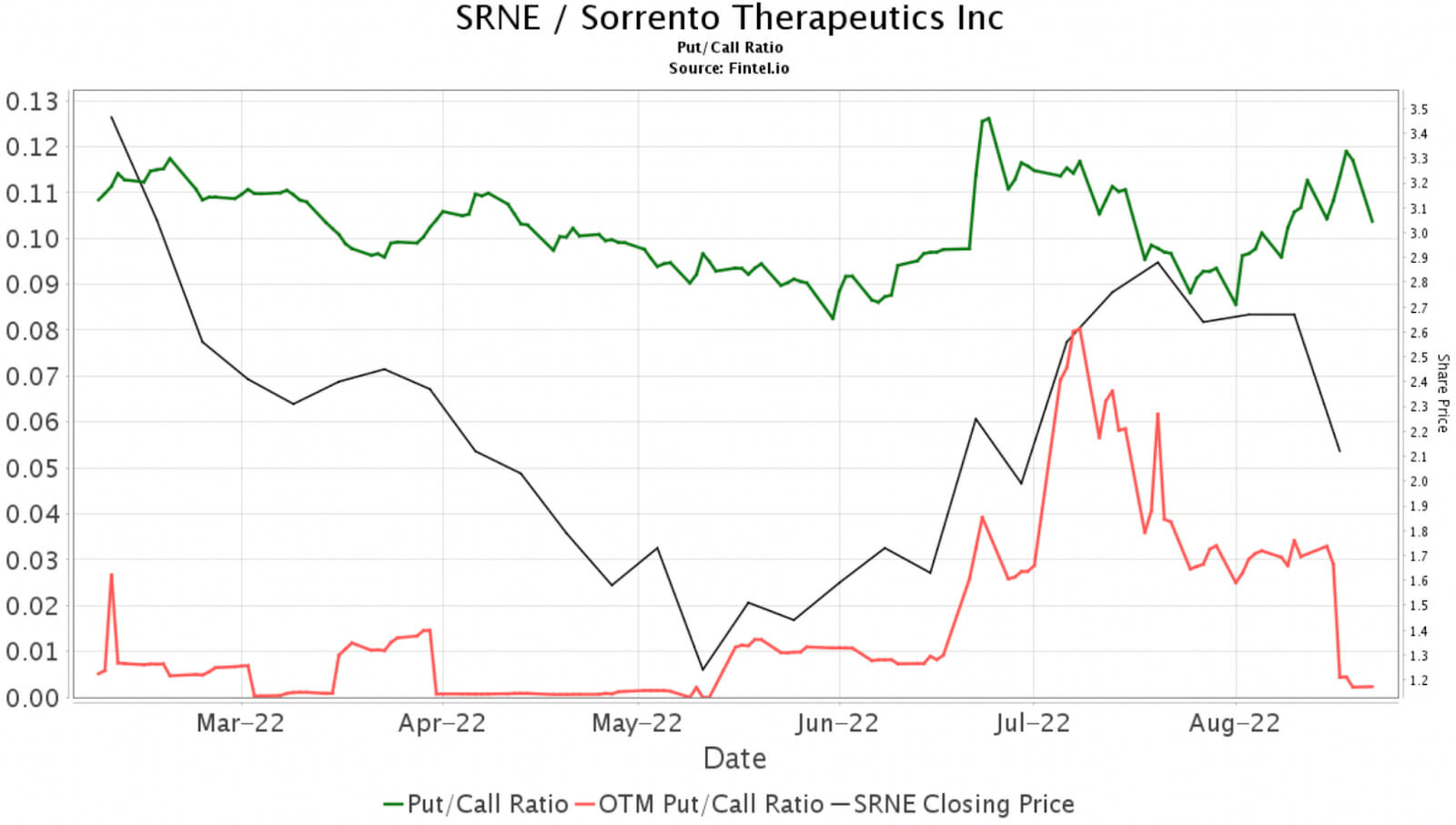

Options sentiment in SRNE remains positive with a bullish Fintel put/call ratio of 0.10. This ratio analyses the open put/call interest in the market and indicates bullish and bearish sentiment among investors.

The chart illustrates this ratio against the share price over the last few months.

SRNE fell 3 spots but remains the 13th most popular investment choice by retail investors who have linked their portfolio for free with the Fintel platform.

Article by Ben Ward, Fintel