With schools back for a new term, Matalan wanted to know what core subjects and skills people feel they missed out on in school.

Q2 2020 hedge fund letters, conferences and more

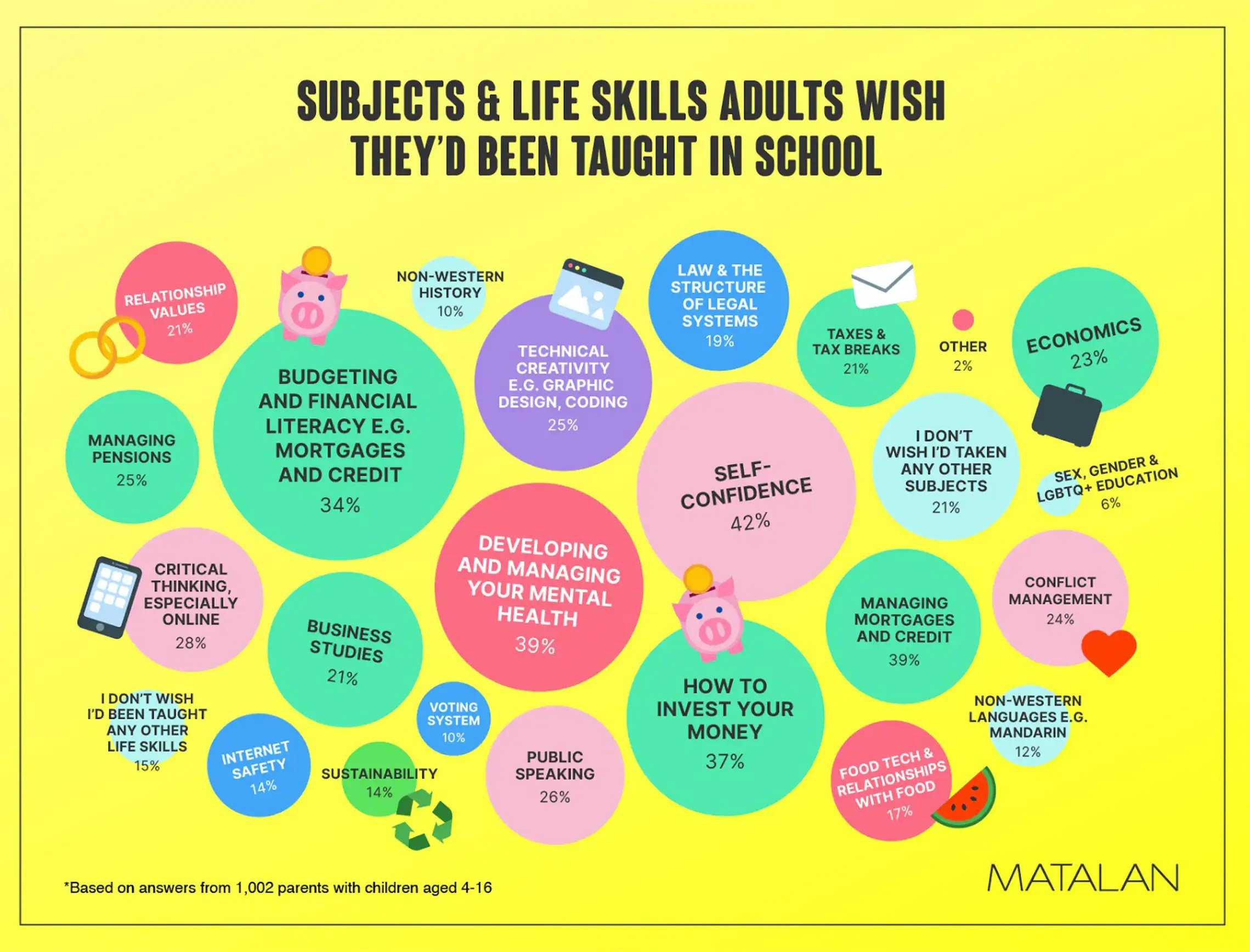

The findings of the study show there are key areas of life as an adult that people feel school simply doesn’t prepare them for. While core subjects like English and maths are incredibly important, many people feel there is a need for education on things that have a real-world application.

Key findings:

- 67% of people wish money management had been on the curriculum when they were in school, rising to 91% for 16-24 year olds

- The money management skills people wish they'd been taught are how to apply for a mortgage, how to apply for and manage credit, and how to create and maintain a budget

- 58% of 16-24 year olds want education about how to invest their money

- 25% of people think pension management should be on the curriculum

- 58% of 16-24 year olds want education on taxes, including how to make sure you're paying the right amount of tax and taking advantage of tax breaks

Top 5 financial subjects and skills Brits wish they’d been taught in school

| Rank | Subject |

Percent of Brits |

| 1 | Money management & investing | 67% |

| 2 | How to manage your pension | 25% |

| 3 | Economics | 23% |

| 4 | Business studies | 21% |

| 5 | Tax management | 21% |

The study shows that adults feel their formal education left them woefully unprepared for the real world, with 67% of people overall and a staggering 91% of 16-24 year olds feeling that they should have been taught money management skills at school.

The Average Brit Is In Debt By £31,845

With over half of the UK starting 2020 with personal debt of up to £100,000, the average Brit carrying £31,845 of personal debt, and warnings signs that COVID 19 could see more and more people struggle with unmanageable debt, it’s never been more important to teach young people the skills to manage their finances in order to prepare for potential financial difficulties.

Many people are even 'going back to school' to teach themselves money management, with Matalan’s study revealing that the Open University's ‘Academy of Money’ qualification was the 4th most popular free course during lockdown.

Brits Becoming Investors: 58% Of 16-24 Year Olds Want To Get Into Personal Investment

For the past few years, the number of people looking to side hustles to boost their income and broaden their career options has been on the rise, but now it seems the younger generation is keen to step into the world of investment opportunities.

58% of 16-24 year olds said they think lessons on how to invest your money should be taught in schools, and while this isn’t on the agenda yet, many are taking to YouTube to teach themselves. In fact, 17,070 people search on YouTube for ‘investing money’ every month.

345,550 people turn to YouTube every month to learn about pension management

Pensions might not seem like the kind of thing that’s likely to be on young people’s minds just yet, but that’s quite far from the truth. The study found that 25% of 16-24 year olds and 26% of 25-34 year olds want to see pension management on the curriculum. Amongst over 55-year-olds, 32% also wish they had been taught about managing their pension when they were in school.

People in Plymouth felt the least knowledgeable on pensions, with 45% of people from the region saying they wished they’d had more education on the subject at school. In Brighton, however, only 11% of people were concerned with having pension management on the curriculum.

Jeff Howarth, Director of Marketing at Matalan comments:

“While it may not be on the agenda to introduce personal finance to the national curriculum any time soon, it’s clear from young people’s responses there is a real need for it. UK schools do an amazing job and have shown incredible resilience and resourcefulness during these difficult times, but it seems despite teachers’ best efforts the national curriculum is falling short of preparing young people for the real world.

With ever-growing financial uncertainty surrounding many businesses and individuals, education on personal finance is becoming more important than ever. We owe it to our young people to give them the skills they need to manage and protect their finances in a world where financial stability is not guaranteed.”

To find out more about the study, see the full page on our site: https://www.matalan.co.uk/kids-clothing/school-uniform/back-to-school/school-of-life

Methodology

We asked a group of 1,002 people a series of questions about the subjects they would have liked to study in school. We gave them a list of subject options and asked them to rank them in order of preference, while also giving them the opportunity to submit any courses of their own. Additionally, we analysed YouTube search volume for terms related to the subjects and skills our respondents chose. Data on distance learning course uptake was provided by the Open University.