Whitney Tilson’s email to investors discussing that Paypal Holdings Inc (NASDAQ:PYPL) is scamming uers with payments sent to friend.

Q3 2021 hedge fund letters, conferences and more

PayPal Is Scamming Its Customers

I can't believe I'm writing again about being scammed by payments giant PayPal (PYPL)...

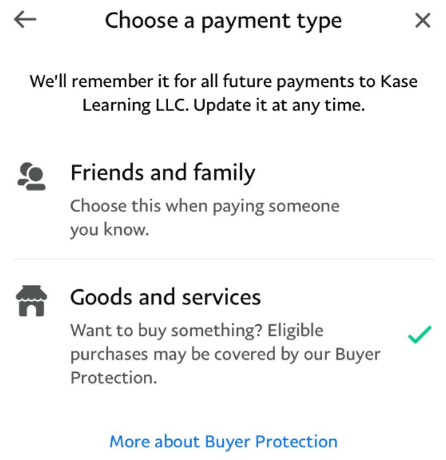

As I first wrote two years ago on December 2, 2019, PayPal offers two ways to send money: to "friends and family," for which there is no fee, and for "goods and services," for which there is a hefty fee.

If someone is engaging in a commercial transaction and wants PayPal's "buyer protection," then maybe it makes sense to pay the fee, but otherwise, it doesn't.

But that's bad for PayPal's bottom line, so, to pad it, the company engages in blatant trickery and deception – and, worse yet, when the customer realizes their mistake, PayPal refuses to rectify the situation.

Here's what just happened to me...

Over the weekend, my friend Charlie and I shared a rental car, hotel room, etc., at the World's Toughest Mudder. To make the accounting easier, I paid for everything and e-mailed him his share of the bill on Monday: $488. He immediately paid me via PayPal.

But when I checked my account, I discovered that the company had charged me a fee of $21.91, equal to a usurious 4.49% of the total.

Having made this mistake myself two years ago, I knew what had happened: Charlie had inadvertently clicked payment for "goods and services." It's easy to see how this happened. When you look at the screenshot that he sent me, it's the default option, and nowhere does it disclose that fees will be charged, much less the amount:

This lack of disclosure is deceptive and outrageous.

But wait, it gets worse...

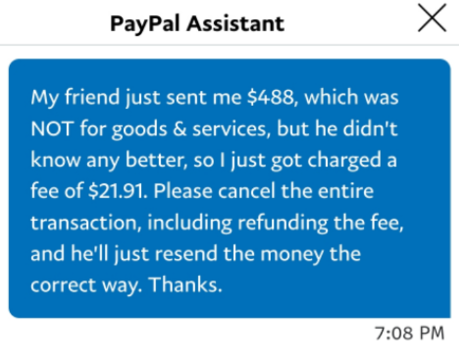

When I went to reverse the transaction so Charlie could resend me the money without a fee, I couldn't find any way to do so on the app or website. So, I sent this message to PayPal's customer support center:

More Deception

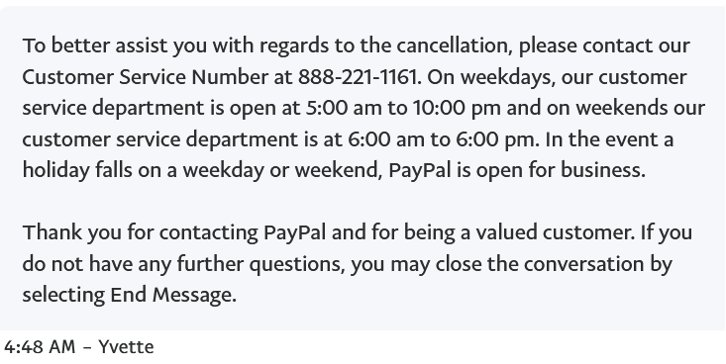

Rather than quickly resolving this issue, a representative sent me this reply, requiring me to call the next day:

When I called yesterday and finally got through to a customer support representative (after getting the run-around for 10 minutes in their automated system), she said all I had to do was refund Charlie.

What she didn't tell me, however (more deception), is that PayPal would keep the fee, per its website: "If you refund a transaction, we'll retain the fees you paid as set out on our Fees page."

When I pointed this out and asked for a refund of the fee, she told me she couldn't do that. I said that was unacceptable and asked to speak to a supervisor. She promised to have one call me, but I'm still waiting...

None of this is by accident... Every sophisticated company carefully designs and tests every element of their website and purchase/payment process. So, I'm certain that this is a carefully orchestrated plan to increase the number of people paying fees unnecessarily.

An honest and ethical company would have a screen that pops up after a customer chooses the payment type confirming the transaction, which clearly says something like:

You are sending $488 to Whitney Tilson. Because this is for goods and services, we will charge a fee of 4.49% or $21.91, so the recipient will receive $466.09.

In addition, there would be a quick and easy way to cancel a mistaken transaction within, say, 24 hours (just like Congress forced the airlines to do).

But of course, PayPal doesn't do this because it must be making an absolute fortune by deceiving unsuspecting customers in this way.

PayPal is huge, so if its deceptive and misleading process that fooled Charlie results in charging unnecessary fees on even a small percentage of its transactions, the company could be harvesting big money.

$580 Million Of Pure Excess Profit

In my e-mail two years ago, I did some back-of-the-envelope math to estimate that this deception could result in "$580 million of pure excess profit for PayPal, equal to 22% of the company's trailing 12-month operating income of $2.6 billion." Those numbers are almost certainly much higher today...

Shame, shame!

Why am I making such a big stink about a tiny amount of money? Because, on principle, I hate being scammed. In addition, I know if it's happened to me twice in two years, then it's surely happening every day to many other people who might not be in as good of a position as I am to draw attention to what's going on.

I plan to send this e-mail to PayPal's senior executives and board, as well as the relevant regulators. I'll let you know if and when I hear anything...

Have you been scammed by PayPal or another public company? If so,

I'd love to hear about it – just send me an e-mail me at [email protected].

The best way to get companies to stop doing things like this is to call them out publicly!

Best regards,

Whitney

P.S. Despite my criticisms, I don't recommend shorting PayPal's stock. It's an insanely great business, and its stock has doubled since I last wrote about it two years ago. That said, if I owned the stock, I'd be looking hard at this issue and trying to estimate how much of PayPal's profits could suddenly go away.