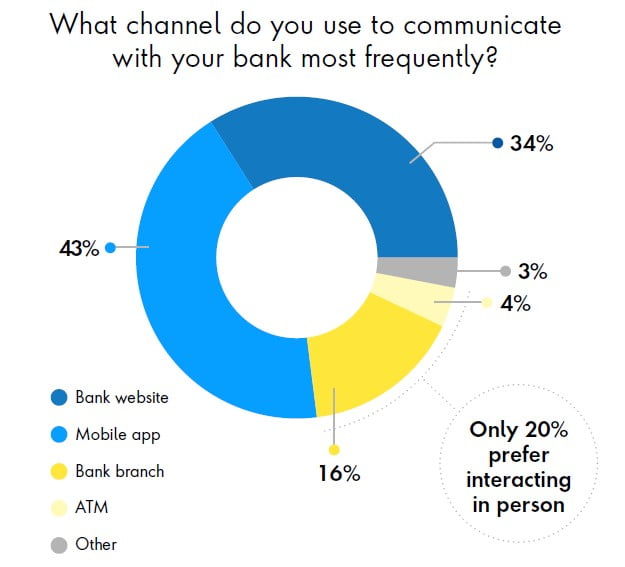

The days of the brick and mortar bank branches could be numbered, as a landmark survey of global consumers reveals the vast majority of customers — 77% — now communicate with their banks online more often than they do face to face.

Q3 2021 hedge fund letters, conferences and more

How Customers Communicate With Their Banks

Almost 90% of bank customers use mobile apps, and the vast majority are satisfied with them, a global survey from digital consultancy Publicis Sapient revealed.

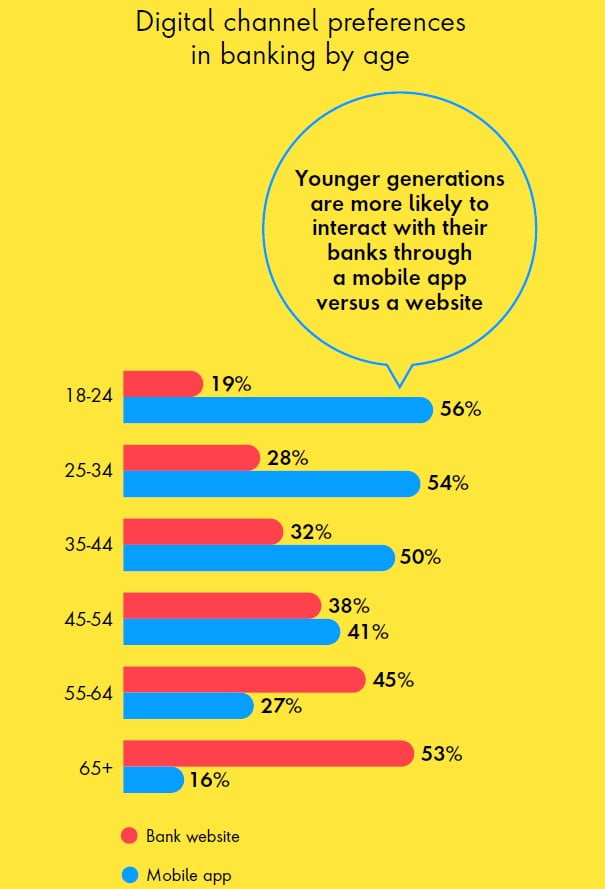

Consumers of all ages report feeling confident about using the technology with over 65s – often late adopters – actually feeling most confident about managing their money online.

But banks face serious challenges in the near future. While consumers are happy using their banking apps, Publicis Sapient’s Digital Life Index survey of more than 9,000 consumers worldwide shows that they are more skeptical about banks themselves.

- Only 39% of people felt supported by their banks during Covid

- A total of 37% now say they plan to or are considering changing financial institutions in the next year

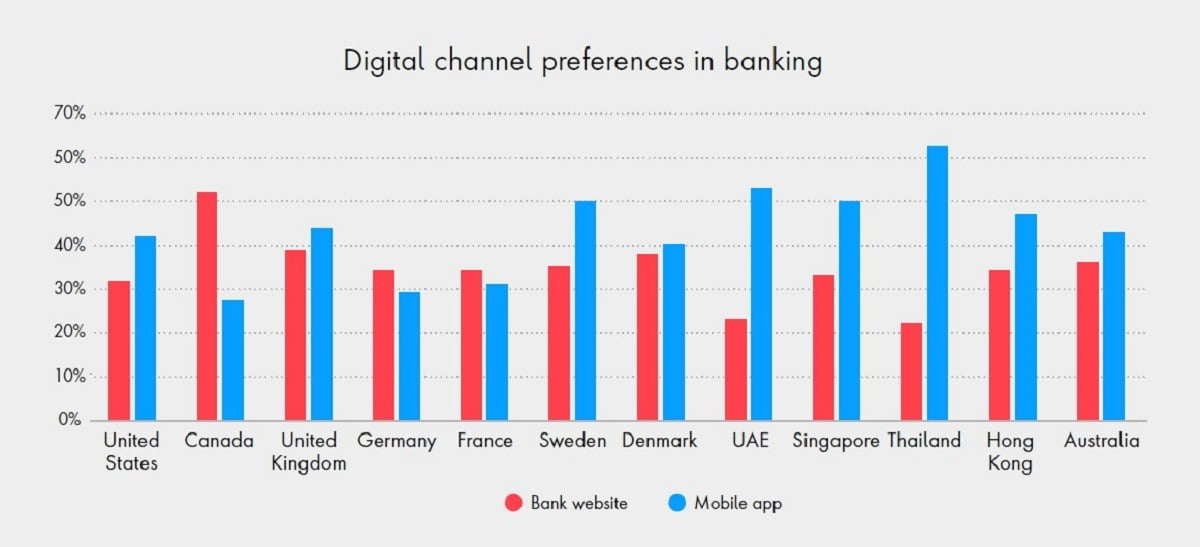

A fifteen-minute survey was conducted with 9,300 respondents. 1,000 respondents took part in each of the US, UK and Australia. 700 took part in Canada, Germany, France, Sweden, Denmark, UAE, Singapore, Thailand and Hong Kong.

Meanwhile, banks face serious challenges as they compete in an artificial intelligence-enabled world. Public Sapient’s Guide to Next report on digital trends warns that institutions risk being left behind without competitive AI strategies.

Making The Most Of AI

Publicis Sapient’s Head of Financial Services for North America Dave Donovan said: “Inadequate and outdated technology threaten banks’ ability to collect and organize the data they need to make the most of AI. That amounts to a threat to their futures. Banks need to deliver much improved personalized services to engage and retain customers, and that will be impossible without AI systems that work well, and the technology infrastructure to deliver this change.”