In a game-changing turn of events, yesterday’s FOMC meeting shattered hopes of a quick, dovish U-turn as the Fed announced the possibility of raising rates twice this year.

Yesterday’s FOMC and the following press conference were groundbreaking. Rates stayed, but Fed said about raising them twice this year = no U-turn!

This is a game-changer because so many investors were still believing in a quick, dovish U-turn. And those dreams were just dispelled. The fact that rates were not hiked yesterday doesn’t matter as much as the fact that their expected future path is still to the upside.

While the core CPI didn’t move recently, inflation is moving down. With inflation moving down and interest rates going higher, what does that imply?

Much higher real interest rates!

And this is one of the two key fundamental drivers for gold prices. The other is the USD Index, and yesterday’s FOMC was a game-changer for its short-term trend as well.

The USD Index Soars On FOMC

All intraday breakdowns below the flag pattern were quickly invalidated. And given the Jun. 14 reversal, the odds are that the correction is over.

The invalidation of the move below the 50% Fibonacci retracement suggests the same thing.

This means that gold price now has not one but two headwinds.

And boy, did the gold price react!

Gold was initially hesitating to decline, which is normal, given that the investment public didn’t necessarily fully grasp the implications of what just happened yesterday, and it might be starting to realize it fully only in the following days.

Gold overnight trading, however, showed where the next move is going to take the yellow metal – lower.

It’s currently trading at new June lows, but it seems that we’ll see a move below May lows any day (or hour) now.

Silver price is down significantly, but most importantly, it just moved below its rising support lines. The next big decline is likely underway.

And junior miners?

Junior Mining Stocks Already Broke Lower

Even though it might not be clear on the above chart, the fact is that junior miners closed the day below their rising red support line. This is a breakdown that didn’t happen in May, so the situation is now more bearish than it was back then.

Let’s keep in mind that it was before gold’s overnight decline! This means that junior miners are likely to catch up with gold by sliding more. This will likely cause the breakdown to be verified and lead to a bigger decline in the following days.

The next short-term stop is at about the $33 level, as that’s where we have the 61.8% Fibonacci retracement and 2023 low (so far).

In fact, please take a look at what the GDXJ is doing in today’s London trading.

The GDXJ just briefly moved below its May lows, indicating what comes next. It might need the U.S. trading hours to break below this level, though.

And given that the investment public is just starting to realize what the implications of yesterday’s FOMC were (after they read reports prepared by professionals), the odds are that the decline in the GDXJ will continue – and accelerate.

Please note that you knew about the upcoming decline in advance – well before the FOMC, based on technical analysis, relative valuations, and other things that I’ve been describing recently.

I saved the best for the last part.

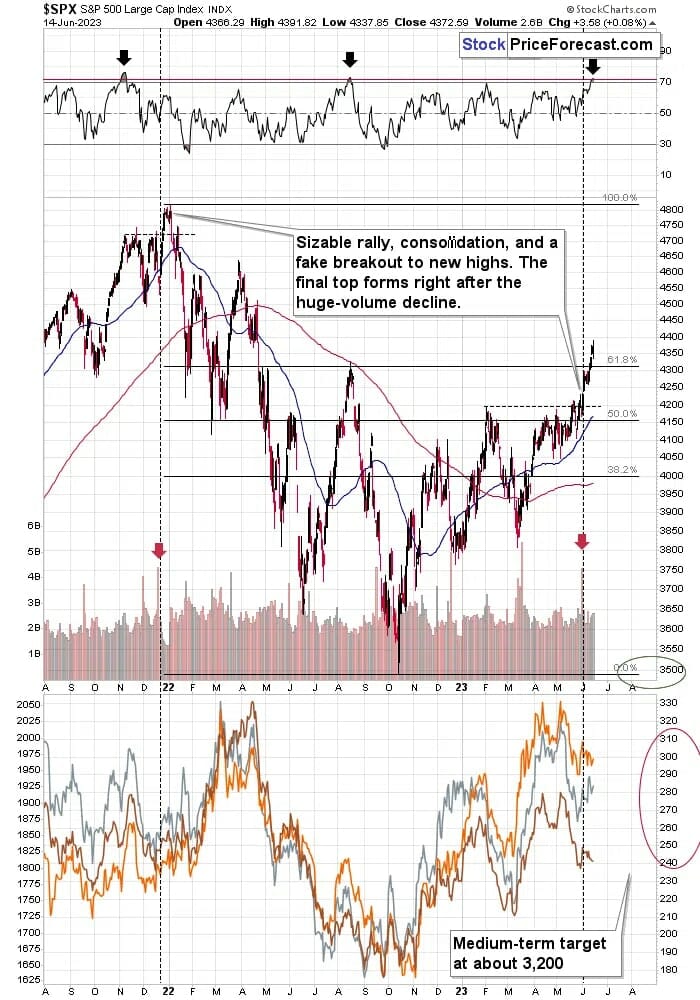

In my analysis yesterday, I focused on the stocks and why they are not as bullish or invincible as many claim.

The rally stopped, and the S&P 500 futures are down in the pre-market trading. This – plus the fact that the investment public is likely to still digest what just happened – implies that the momentum is gone. And with the momentum gone, rising rates, and RSI at extremely overbought levels, there is one very likely action that stocks are going to take.

Slide.

Please remember that junior miners broke below their rising support line even without the stocks’ help. But as soon as they get it, they are likely to truly tumble.

PS. To clarify some confusion and misleading information that you might find “out there” (probably spread by those that are not analyzing the precious metals market but that rather cheerleading it) regarding my profitability and the kind of positions that I’m opening in my Gold Trading Alerts (both: long and short), here’s a complete (!) list of trades that I featured since 2022.

“A trade” means that it was completed, I am not featuring the currently open positions (we have two: in GDXJ and FCX), but details of those positions are available to Gold Trading Alert subscribers.

Whenever discussing profits, I mean the nominal profits based on the basic, unleveraged instrument, like GDXJ and FCX); selection of instruments is not something I’m accountable for, and each investor determines it on their own, thus I’m not responsible for using options, leveraged instruments like futures / leveraged ETFs etc., and the way it might affect the rate of return.

Yes, all eight out of eight were profitable. And while I can’t promise any kind of performance of the current positions (nor any other), in my opinion, their potential is enormous.

Here’s the complete (!) list in inverse chronological order (please click the links for the actual analyses in which I described when the profits were taken; feel free to verify hours at which it was posted and where markets were trading at those times):

- On May 25, 2023 we took profits from the short position in the FCX(practically right at the bottom; opened on Apr. 5, 2023).

- On Mar. 17, 2023 we took profits from the short position in the FCX(almost right at the bottom; opened on Mar. 8, 2023).

- On Mar. 1, 2023 we took profits from the LONG position in the GDXJ(very close to the local bottom; after the “easy part” of the rally).

- On Feb. 24, 2023 we took profits from the short position in the GDXJ(almost right at the bottom; and that’s where I wrote about the long position from point 3).

- On Jul. 28, 2022 we took profits from the LONG position in the GDXJ(entered on Jul. 11, 2022; we were buying around and very close to the bottom).

- On Jul. 8, 2022 we took profits from the short position in the GDXJ(very close to the bottom).

- On May 26, 2022 we took profits from the LONG position in the GDXJ(very close to the top; just several days before the top).

- On May 12, 2022 we took profits from the short position in the GDXJ(that was exactly the monthly low and reversal; and that’s where I wrote about the long position from point 7).

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief