S&P 500 rejected shallow downside, and easily continued pushing higher – bonds aren‘t turning risk-off, but HYG is getting into an extended (vulnerable) position. So far, markets have largely ignored three latest data pieces in – Empire State manufacturing index plunging (both in orders ahead and shipments), positive quarterly results by WMT and HD, and sharp deterioration in actual housing starts (permits are fine, but they‘ll catch up – it‘s the action that counts, and that‘s reflected in the not too encouraging prospects of the real market market). Willingness to sell and fast, is there. Deterioration ahead – and the pace could turn quckening on any good uptick in offers to sell stocks.

Q2 2022 hedge fund letters, conferences and more

To feel the daily pulse, let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

S&P 500 and Nasdaq Outlook

S&P 500 hasn‘t yet reached the 200-day moving average, let alone attempted to overshoot it. The prospects of successfully doing so, are slim, and the declining volume means that the sellers can move fast (should they finally decide to step in en masse).

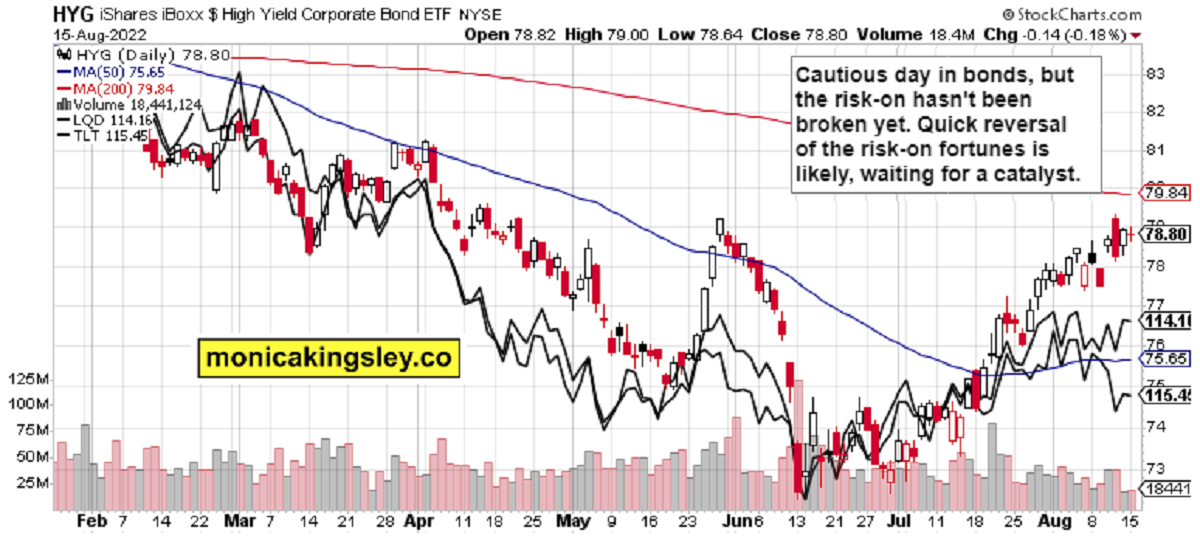

Credit Markets

HYG is hanging in there, refusing to decline at the moment, but the low volume is a watchout – for the bulls. This can all turn risk-off pretty fast, but likely won‘t today – with full force, that is...

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.