Much has been laid on the backs of the generation that is seen as coming of age during the years surrounding 2001. There are many derisive ways those who are called Millenials have been described — including as narcissistic, and participating in (as one New Yorker article implies) the “demise of civilization.”

[REITs]Q2 hedge fund letters, conference, scoops etc

Those of this defined generation have also been presented as killing off an assortment of cultural traditions including television advertising, golf, land based phone lines and even doorbells. However, one of the most structural institutions that millennials have been accused of stifling is marriage.

Many Millenials are choosing to get married later in life or not at all. One of the major reasons cited for this change is financial.

While the generation is given grief for myriad cultural issues, one place that they are thriving is in the care they are taking with their finances. An article in Forbes says that over three quarters of millennials closely track their expenses (in comparison to just 64% of Boomers) and are 12% more likely to stick to a budget.

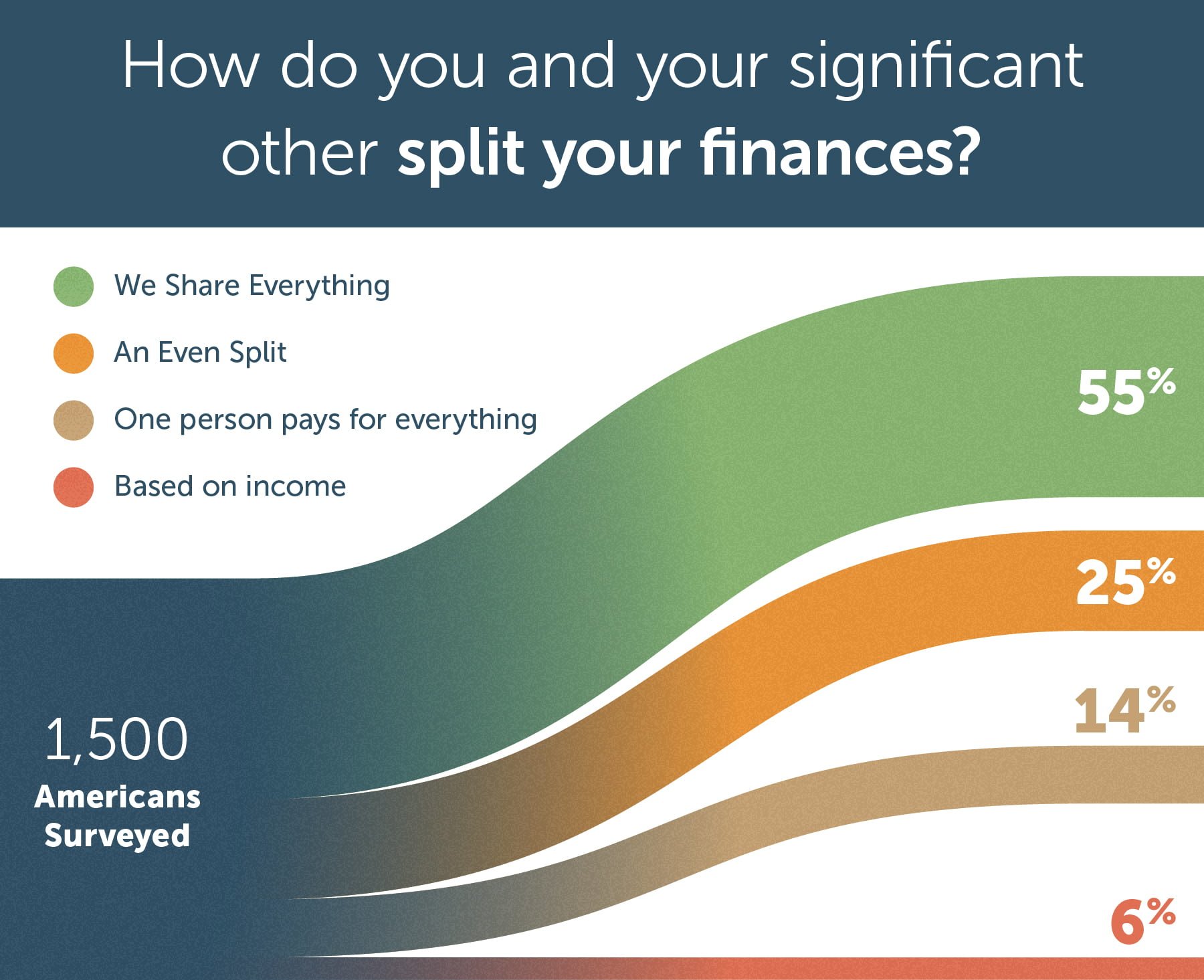

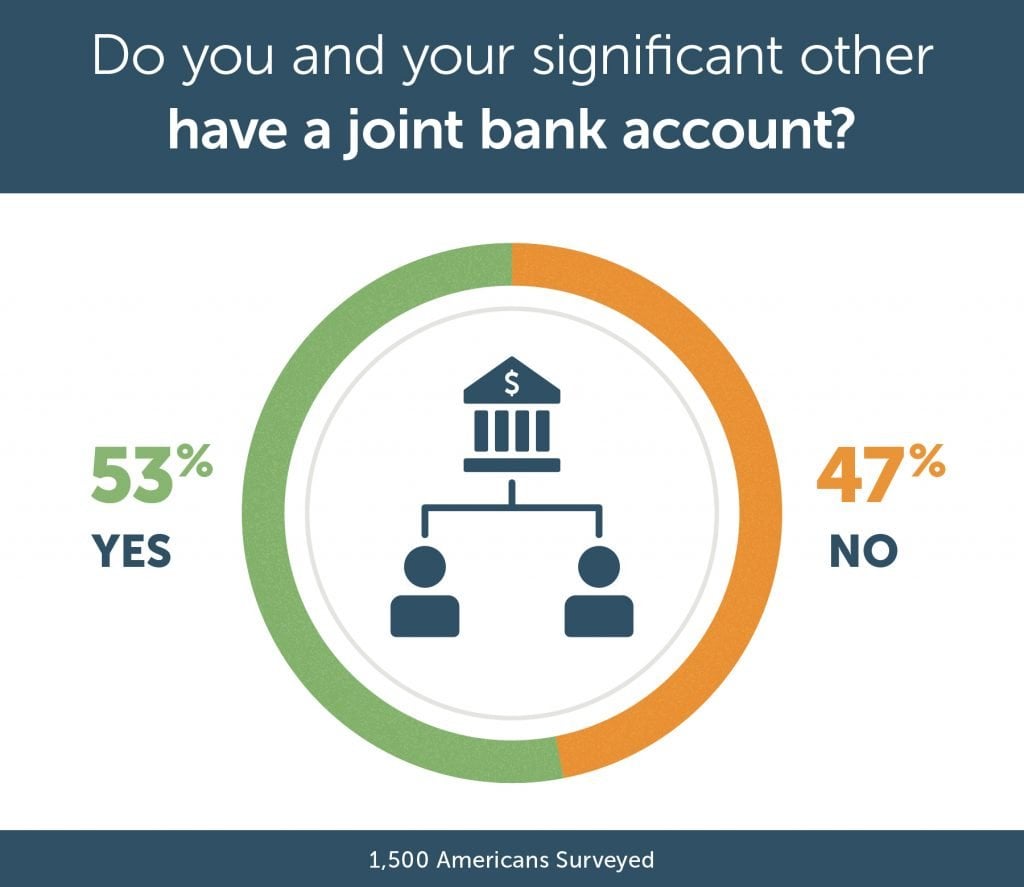

What does this say about the growing trend among Millenials to maintain financial independence from their spouse or significant other? A recent study by lexingtonlaw.com demonstrates that the age range of 25 – 34 has the highest percentage of couples that are not participating in joint accounting. While about half of all serious relationships do share accounts, the metric trends older and therefore may have reached a tipping point.

What is to be learned from Millennial couples financial habits.

A study from Bank of America demonstrates that 28% of Millennial couples keep separate bank accounts which is 15% greater than Baby Boomers and 17% more than those of Gen X. There are several lessons to take as to why maintaining separate accounts may be a positive step for modern couples.

- Avoiding taking on the debt of another person

Should something catastrophic happen, separate finances allows a partner to avoid being saddled with the debts of their significant other. While it is not the most romantic reason for financial security, Millenials, who are saddled with an average of $30,000 of student loan debt, are increasingly wary of being overwhelmed. However, avoiding partner debt doesn’t have to involve catastrophe. If one partner in a couple has some financial woes, joint accounting will make it more difficult for the two of them to procure loans or mortgages. One financially healthy partner will then be able to take the lead in these endeavors.

- Marrying smarter (financially)

Getting married later in life allows for millenials to have established finances prior to tying the knot. This means that couples do not feel the need to entangle themselves in the accounts of their partners. The assumption is that the other person has a healthy status and that it is unnecessary to do too much crossover.

- Avoiding debt from splits or divorces

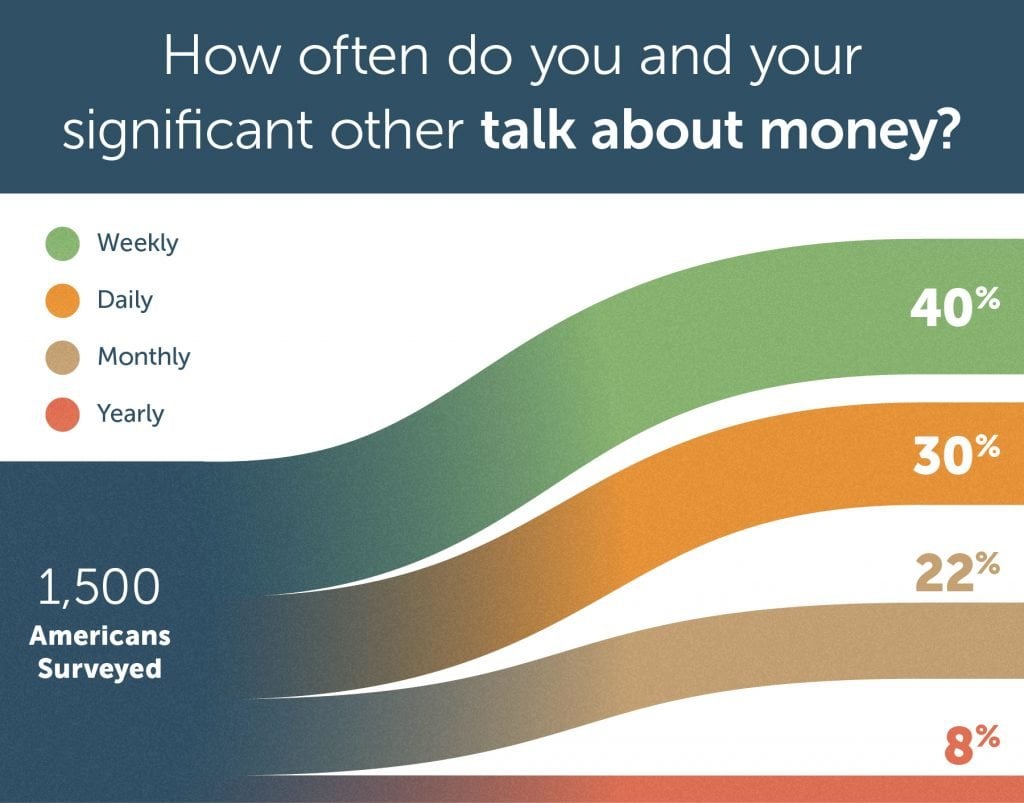

The divorce rate rose dramatically during the 1980s and Millennials disproportionately saw their parents split, leading to financial burdens. This is likely a factor in why many of those 25-34 choose to maintain financial independence. That being said, perhaps partially due to a better financial status, and to being married later in life, Millennials are experiencing a much lower divorce rate. Many cite financial arguments as a major cause of relationship strife.

- Better relationships?

Couples state that having no involvement in the finances of a partner demonstrates a level of trust that cannot be achieved where there is total financial connection. The level of independence this gives each member of a relationship allows for improved power dynamics between couples and does not burden either member. Though one person may clearly make more money than the other, each wants to feel they are contributing. In fact, the same Bank of America study referenced above states 1 in 5 millennials do not even know what their spouse makes.

All this being said, there are certain dangers of remaining completely financially independent in a couple.

- Surprises: Many loving couples are uncomfortable about debt and will not disclose their true financial situation to their partner. This could be compounded in couples where they are not in joint accounts. A recent Wall Street Journal article points to this being a problem specifically in retirement when investments made (or not made) can start to really come to the fore.

- Legal issues: Again, in the unfortunate situation of something happening to one member of a couple, legalities are burdensome. Those who have combined finances have less to worry about here.

- Burden sharing: It can be tricky to work out collective expenses including items such as child care or purchases for a home. Though there are strategies that make this less onerous and couples are taking advantage of these to make financial equity achievable along with independence.

- Stay at home parenting: With child care expenses being what they are in the US — this has to be a consideration. If one partner needs to drop out of the workforce for a period of time to take care of a child, separating finances makes this very difficult.

While there is no right way to dictate how a couple maintains financial health, it is no longer a given that collective wealth in a couple makes solid financial sense. Some might site filing joint taxes as an incentive to put everything in one pot, however the benefits of maintaining individual status may outweigh any gains, both personally and financially. And with the trend growing, it might be worth checking into just why the Millennial generation is killing the old model.