Spruce Point Capital Management is pleased to announce it has released the contents of a unique research report on Mercury Systems, Inc. (Nasdaq: MRCY) (“Mercury” or “the Company”).

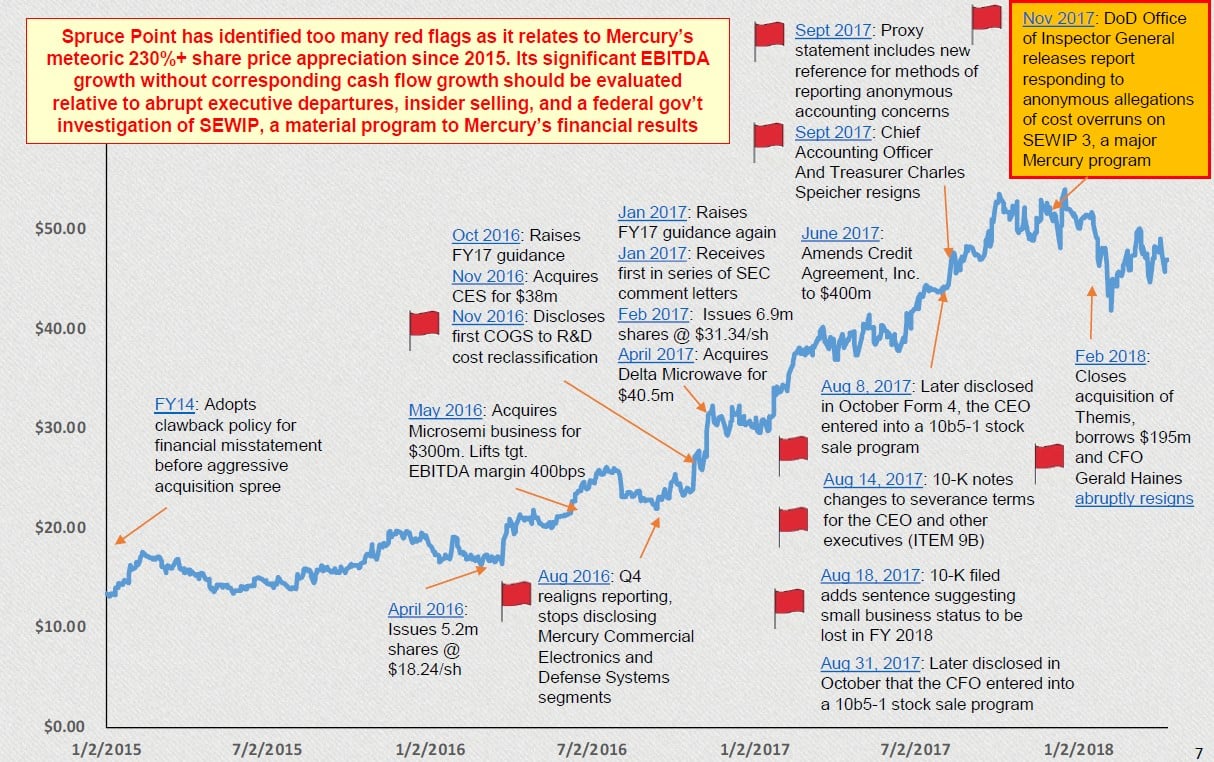

Spruce Point has conducted a critical forensic and fundamental analysis of the Company. In our opinion, Mercury’s business is showing extreme financial strain, and has multiple material adverse effects converging on its business in 2018. Notably, we observe that while Mercury’s Adjusted EBITDA has grown 113% in the past three years, its free cash flow has been stagnant. This has coincided with a recently declassified government audit report by the Dept. of Defense Inspector General validating allegations and evidence of material cost overruns at SEWIP 3, a Navy program which has been a large growth driver of Mercury’s recent financial out-performance. Spruce Point finds recent public comments made by management on SEWIP conflict with SEC disclosures, which suggests a material loss to Mercury. Furthermore, both Mercury’s CFO and Chief Accounting Officer and Treasurer recently resigned, shortly before the initiation of an insider sales program, the disclosure of new company mechanism to report accounting concerns, and amendments to executive severance terms to define conditions of fraud and dishonesty.

Our report will detail why we believe Mercury’s recent acquisition of Themis Computers days before Christmas, appears motivated to replace slowing organic growth. By funding the deal with $190m on its line of credit (utilizing nearly 50% of borrowing capacity), Mercury is very likely to issue over 4 million of new shares to deleverage. Mercury’s growth by acquisition strategy also jeopardizes its status as a small business contractor, which will have Material Adverse Effect on its business in 2018, by making it ineligible for certain small business opportunities, and increasing its operating costs.

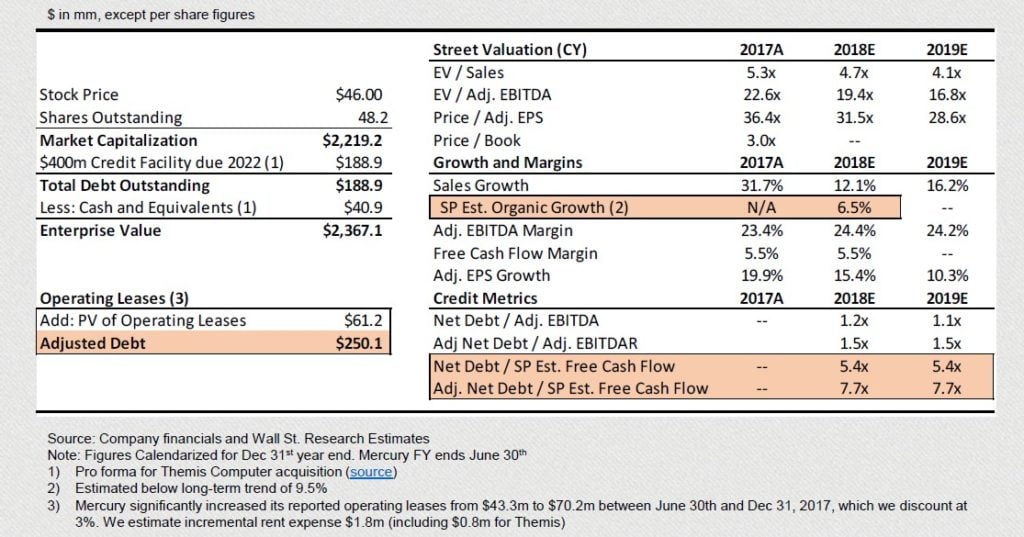

We believe none of these factors are being incorporated into Mercury’s current valuation, which is among the highest in the Aerospace and Defense industry at 4.7x, 19.3x and 31.5x sales, Adj. EBITDA and Adj. EPS, respectively.

As a result of our investigative analysis, we have issued a "Strong Sell" opinion, and a long-term price target of approximately $7.00 to $23.00 per share, or approximately 50% - 85% downside risk.

Spruce Point Believes Mercury Systems Inc (MRCY) Is A "Strong Sell"

Mercury appears to be caught in the perfect storm of slowing growth, rising costs and debt. There are multiple material adverse changes currently facing Mercury which suggest 50% to 85% downside risk ($7 to $23 per share).

Numerous High Level Signs That Mercury Is Under Extreme Financial Pressures:

- Mercury's Adj. EBITDA margins of 23.4% are extremely high for a government subcontractor, and have grown 450bps in the last three fiscal years, allowing Adj. EBITDA to balloon 112% while its free cash flow grew zero over the same period. Free cash flow is now trending down over the last 12 months. Days inventory and its cash collection cycle are near all-time highs; accounts receivables recently started to exceed sales

- Management’s annual cash bonuses are based solely on Adj. EBITDA, providing material incentive to inflate this financial metric

- Historically, radar systems is Mercury’s largest business, but now appears to be declining, while “Other Revenues” is the fastest growing segment. Mercury changed its financial presentation to bolster gross margins, while guidance for gross margins has quietly been talked down. For the first time in Q2’18, Mercury missed its gross margin (and EPS) target

- Mercury uses three different accounting methods for sales, but appears to be moving towards greater use of complex, subjective methods tied to percentage of completion accounting, an area notorious for accounting issues in the Aerospace & Defense industry

- Mercury sells itself as growing revenues organically 9.5% (double its end markets), yet we find evidence these results are not sustainable and growth may slow to 6.5% in CY 2018. Mercury announced the purchase of Themis Computer on Dec 21, 2017 (four days ahead of Christmas). It paid a rich 13.7x EBITDA multiple, and borrowed $189m on its line of credit. In our opinion, thedeal appears motivated to avoid missing Wall Street’s expectations. Consistent with prior practice, we expect Mercury to issue stock to pay down its line of credit, which at the current share price, amounts to 4m new shares

- Mercury added one sentence to its latest 10-K to disclose it expects to lose its Small Business status in FY 2018, a factor thatwill cause a Material Adverse Effect by disqualifying it from certain business opportunities and increasing costs of compliance

Newly Declassified DoD Inspector General Report Validates Problems At SEWIP Block 3, Mercury’s Material Business Program:

- Three of seven allegations against SEWIP 3 prime Northrop Grumman related to cost overruns have been validated by investigators,and two other allegations have been partially validated. Material cost overruns may suggest sales overstatement at Mercury

- Mercury talked about SEWIP Block 3 adding >$140m of revenues and that it is a material driver of its results. Mercury has warnedthat the loss of SEWIP would have a Material Adverse Effect on its business. We find material inconsistencies between management statements and SEC disclosures on recent SEWIP revenue contributions

- Management enacted a 10b5-1 stock sale program in August 2017 (not disclosed until Oct 2017), ahead of the Inspector General audit report in Nov 2017

Spruce Point Believes Sees 50% To 85% Downside Risk To Mercury’s Shares

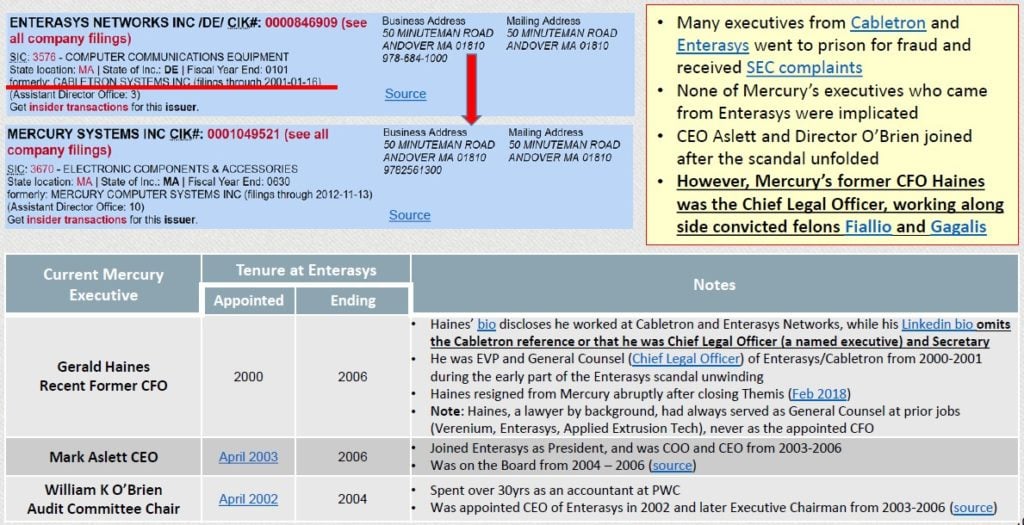

Mercury’s Fmr. CFO Was EVP Strategic Affairs, Chief Legal Officer, and Secretary At Cabletron/Enterasys Networks A Business Fraud

- Mercury recently moved its headquarters into the exact same office where the Cabletron/Enterasys fraud unfolded

- Mercury’s long-time CFO Gerald Haines omits from his biography that he was the Chief Legal Officer and Secretary at Cabletron, making him a named executive and Board member. He abruptly resigned from Mercury in Feb 2018 after the closing of the Themis deal. Four of his colleagues at Cabletron were sentenced to prison, but Haines was not implicated

- In Sept 2017, Mercury’s Chief Accounting Officer and Treasurer also abruptly resigned. Shortly before, and for the first time, Mercury’s proxy statement revealed a new anonymous hotline, email and website for reporting accounting concerns

- In Aug 2017, subtle changes to executive severance agreements were made to define conditions for termination for “Cause” and called out “Fraud” and “Dishonesty”

- Mercury’s audit fees per $ of sales and employee are the highest in the Aerospace & Defense industry, adding to our concerns of potential issues. The Audit Committee is chaired by William O’Brien, a colleague of the CEO dating back to 2003

Analysts See 25% Upside In Mercury, But Miss Key Material Risks, And Take Results At Face Value. We See 50% -85% Downside:

- Mercury lacks meaningful institutional support from fundamental owners. Many have been decreasing ownership over time, while passive index buyers accumulate Mercury for its exposure to the Aerospace & Defense industry

- Mercury’s 2018E valuation of 4.7x, 19.3x and 31.5x sales, Adj. EBITDA and Adj. EPS is the highest in the Aerospace & Defense industry for peers over $1.5bn in value, and its multiple is stretched near all-time highs. Analysts assume its financials are fairly stated, and that it can achieve 16% and 10% sales and EPS growth in CY 2018. However, with issues at SEWIP, loss of its SmallBusiness status, and the recent acquisition of Themis, we estimate actual organic growth is set to decline significantly in CY 2018

- Mercury’s leverage should come into focus for investors. Having borrowed nearly $190m on its line of credit, and expanded itsoperations to materially increase its operating leases, we estimate Net Debt / Adj EBITDAR of 1.5x. However, investors are better served looking at its debt load relative to its thin free cash flow. We estimate Net Debt / Free cash flow of 7.7x

- Given our accounting concerns that Adj. EBITDA is not reflecting Mercury’s underlying economics, we believe Mercury should bevalued on its stagnant free cash flow, which at a 20x-25x multiple, justifies 75% -85% downside. Alternatively, taking sales at face value and applying a normal multiple to reflect its reduced organic growth, we arrive at 50% -75% downside

Mercury's Share Price Appreciation Merits Significant Scrutiny

Capital Structure and Valuation

Mercury is currently borrowing on its credit facility to fund the acquisition of Themis Computer, which closed on February 1,2018. Consistent with prior deal funding practices, we expect the Company to issue equity, which would dilute investors with 4 million new shares. Our report will illustrate that Mercury’s valuation is the highest in the Aerospace & Defense industryonthe belief that its industry leading Adjusted EBITDA margins are fairly stated, and its organic growth can continue at high single, low double digits per management’s comments. Our critical forensic analysis will suggest otherwise. We think investors should focus on its free cash flow, which is trending down, while its leverage is rising meaningfully.

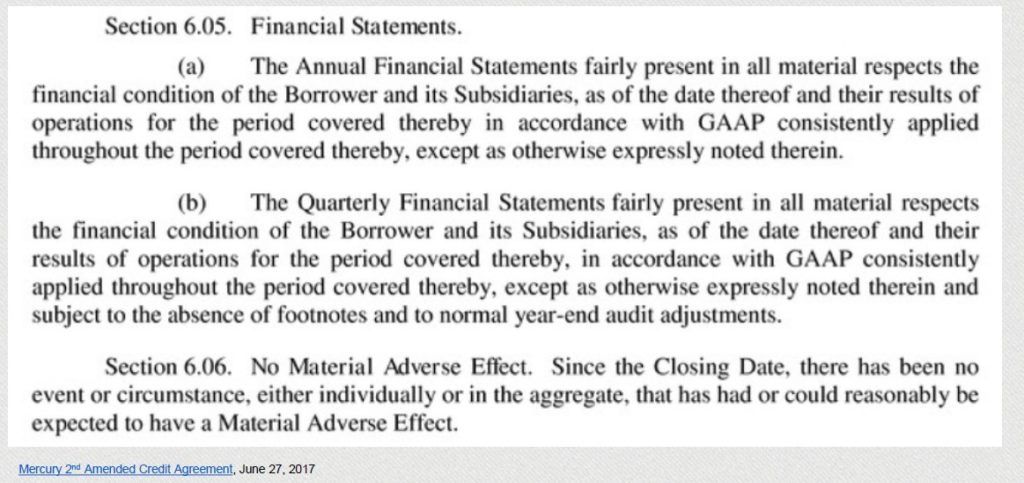

Mercury’s Now $190m In Debt And Beholden To Its Creditors

Mercury amended its credit facility in June 2017 to increase its revolver to $400m, and made certain reps and warranties that its financial statements were accurate, and post closing, there were no material adverse effects. Our research questions the accuracy of Mercury’s financials, and provides evidence that indicates Mercury is experiencing material adverse changes related to SEWIP, its largest revenue program, and the upcoming loss of its Small Business status. Since signing this agreement both Mercury’s CFO, Chief Accounting Officer and Treasurer resigned.

Mercury Systems Connection To Enterasys Networks, A Former Fraud

Three key members of Mercury came from Enterasys Networks (formerly Cabletron), where they were credited with turning around the troubled company and selling it to Gores in 2006 (source). Many Enterasys executives went to jail and others settled with the SEC. Mercury’s recently resigned CFO, Gerald Haines, worked at Enterasys prior to the scandal unfolding as its Chief Legal Officer and Secretary, which he omits from his biography. It is unusual that Mercury management recently decided to move offices back into the site of Enterasys (source)

See the full PDF below.