Background/ The Company

During part 6 of my “All Swiss Series” I mentioned that Meier Tobler Group AG (SWX:MTG) looks interesting, at least if one likes “boring” stocks which I do.

Q2 2021 hedge fund letters, conferences and more

Meier & Tobler these days is a Swiss focused company that is active in heating, cooling and ventilating homes and buildings. They are both, distributing appliances and spare parts as well as offering direct maintenance services.

Until 2013, the predecessor company Walter Maier was a pretty diversified company, with the main areas of cooling/climate (DACH) , tools (Us) and machinery (among others wood working machines). In 2013/2014, they completely changed their strategy: They sold the tools division and the German climate business and spun-off all manufacturing activities that they had bundled under the name WM Technology.

In 2017 they took over/merged with Swiss competitor Tobler, creating the clear market leader in Switzerland.

The business as such was a quite stable one over the years, although already at the time of the merger, the core business encountered some difficulties, such as increased transparency via Websites and slowing renovation/construction activity in Switzerland as well as increased competition from European players due to the CHF appreciation made things more difficult.

To say that the merger was bumpy would be an understatement. Profitability decreased and Meier Tobler had to show losses, both in 2017 and 2018. As of the time of writing, full integration still has not been achieved. According to some press articles, for instance the full integration of the distribution logistics will only be achieved in 2023.

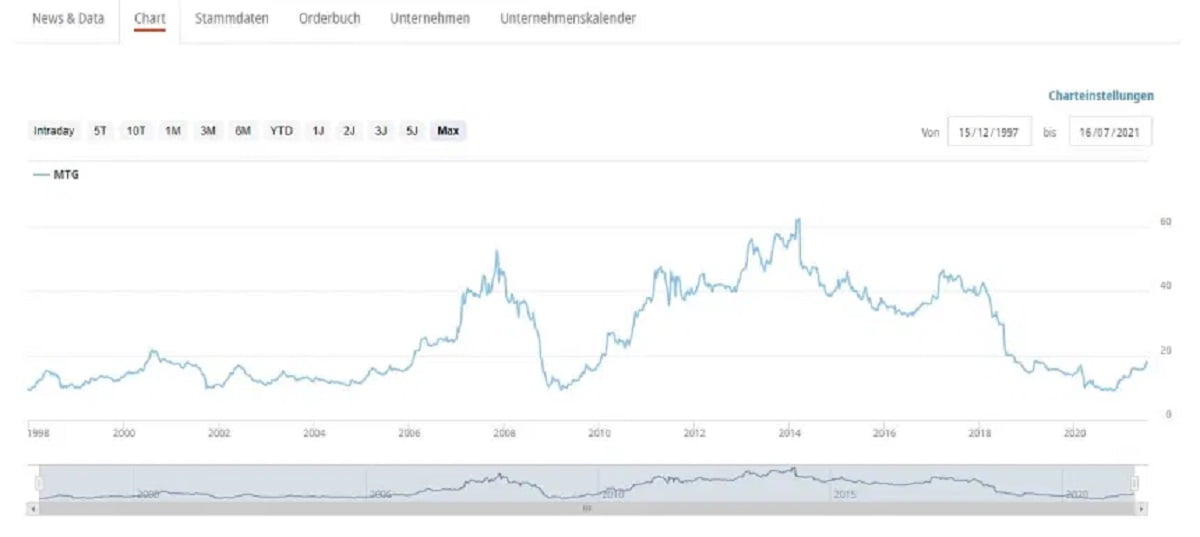

They had to cancel both, the 2018 and 2019 dividend which then bombed the share price even before Covid:

So What Has Changed?

The big question is: What’s next ? The bungled merger is a good excuse for a year or two and Covind-19 counts for 2020. So why should things change going forward ?

New CEO / Founding Family

Since September 2020, Meier Tobler has a new CEO and I assume that the messy integration might have been one of the reasons for this. They also seem to be quite successful in using E-Commerce channels (40% of sales in 2020 were online) and they are very active in creating new retail concepts such as 24/7 automated solutions.

In the past, not everything was great in the founding family. According to a Swiss article, the exit of long term CEO Reto Meier was not very harmonic. His heir Silvain, who had been CEO left the active role in 2013 but remained Supervisory Board head until today.

What I liked was the fact that when Ferguson sold their 29% share at 8,50 EUR in 2020, Silvain offered all minority shareholders to buy at roughly the same price. Also in the past, the company has treated minority shareholders fairly. i didn’t find any instance where they tried something fishy.

Interestingly, with the annual report in 2020, for the first time in several years they actually made a cautious forecast: 2021 should be better than 2020 and in the mid term they target EBITDA margins of at least 8%.

Structural Tailwinds

I do think that all areas have some structural tailwinds. In the heating area, the move to heat pumps gathers momentum. This could be attractive for Meier Tobler, both to increase sales in the short term but also to do more service long term. Heat pumps are very efficient, but need more maintenance than for instance a typical natural gas burner. The service business, which is around 1/4 of the sales nicely increased even in 2020-

Cooling gets more important with hotter summers but also with an increase in data centers. And ventilation has become a focus topic since the pandemic hit and people have learnt what an “Aerosol” is.

So overall I do think that they should be able to grow at least modestly for some time to come, even within the Swiss market boundaries.

Balance Sheet Repair

By the end of 2017, Meier Tobler had loaded up 150 mn CHF in net debt, by the end of 2020, this number stood at 33 mn CHF. This 120 mn CHF decrease was driven both, by asset sales but also very good operating free cashflow.

For instance, they managed to reduce net working capital from around 14% of sales down to 6%, which released 40 mn CH. In general the business is relatively capital light and cash conversion is good.

I assume that by the end of 2021, the company will be net debt free (excluding financial leases which are not shown under Swiss GAAP). This will allow them to pay again a dividend or even start a share repurchase program which they sometimes did in the past.

One interesting feature of Meier Tobler’s business is that the service business generates a decent float. Heating service Clients seem to prepay service charges one year in advance which creates around 50 mn CHF in “float”.

Valuation:

Meier Tobler currently trades at a 2020 trailing EV/EBITDA of around 10. Assuming a 3% growth rate from 2022 (assuming no growth in 2021), and a return to 8% EBITDA margin in 2025, this could translate into 44 mn CHF EBITDA in 2025 (from 24 in 2020). Including the cash that will be generated until then, and holding the EV/EBITDA multiple constant, this would translate into a price target of 45,6 CHF or an upside of +165% (5 year IRR of 21,6%). In my opinion this is a very adequate return compared to the risks, especially as it is based on constant multiples. An increase in multiples would be a further upside.

When looking at the EPS or PE, one should deduct the 10 mn CHF annual depreciation on Goodwill which would not show up under IFRS. In FCF terms, Meier Tobler is currently trading at ~11% FCF/EV yield which is very cheap.

Why Is The Stock Cheap / Major Risks?

My best guess her is that it might be a combination of investors losing patience, a lack of analyst coverage for the stock and the missing dividend that makes the stock unattractive for many investors. In combination, the stock might be just too boring for many investors.

There is clearly a risk that the integration with Tobler will never really work out. There is always a risk when two companies that combine and have a similar size, infighting goes on for a very long time. Also other risk factor are there. In 2019 for instance, a Cyber attack stopped all activities for 4 full days and cost them a few millions. As the final integration of the logistic center will only happen in 2023, a lot of problems could pop up then.

Another point is that as a company pure focused on Switzerland, the company cannot diversify or grow outside Switzerland. A lot of the very successful Swiss companies are active global, which for the time being is not the case for Meier Tobler. On the other hand, it will be also not so easy for foreign competitors to enter the market.

Summary:

Overall, what I like about Meier Tobler is the fact, that the underlying business model is a good one (stable, little capital intensity), there is some longer term fundmental tailwind and that the worst seems to be behind them.

The risk return profile looks attractive. therefore I allocated 3,5% Portfolio weight into Meier Tobler at an average price of 17,25 CHF/ per share. Target holding period is minimum 5 years, target price (including dividends) is 35-45 CHF.

The stock will be part of my “boring” bucket, which also includes G. Perrier, Netfonds and Bouvet. The boring bucket has become very small and I intend to increase it further going forward.

As a side remark: I do like the fact that they only give half-year updates. That makes the stock even more boring and less maintenance intensive.

Article by memyselfandi007, Value And Opportunity