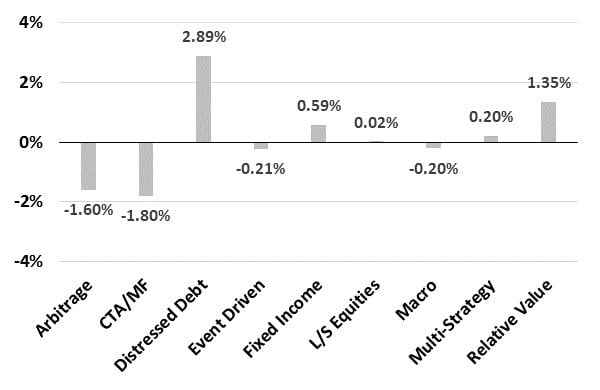

Best and Worst Performing Strategies

Q1 hedge fund letters, conference, scoops etc

Distressed Debt

+2.89% YTD

+US$0.61 billion AUM YTD

Distressed debt continued to be the best performing strategy on a year-to-date basis as corporate debt exposure to oil and Puerto Rican debt contributed to gains for some managers in March.

CTA/Managed Futures

-1.80% YTD

-US$13.52 billion AUM YTD

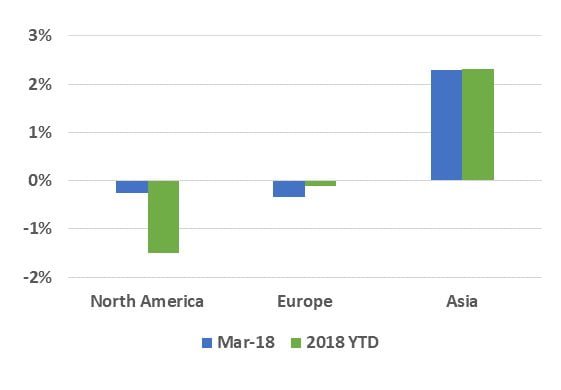

The significant losses incurred by CTA/managed futures fund managers in February completely depleted the gains they made in January, and left their year-on-year AUM growth deep in the red. Among regional CTA/managed futures focused strategies, Asian CTA/managed futures hedge fund managers generated the best returns in Q1 2018, up 2.32%

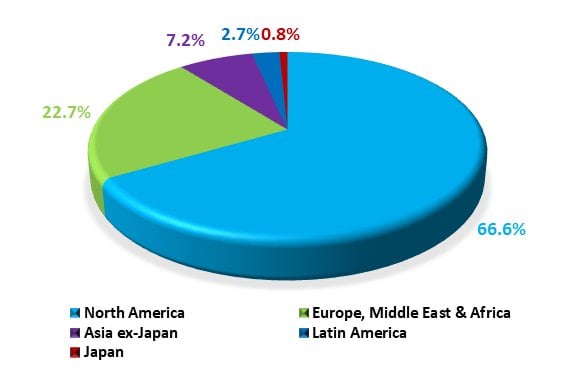

The North American hedge fund industry accounts for 66.6% of the total hedge fund assets as of March 2018.

Global hedge fund fees climbed to three year highs

| Year | Performance Fees (%) | Management Fees (%) |

| 2015 | 14.27 | 1.28 |

| 2016 | 15.56 | 1.31 |

| 2017 | 15.64 | 1.24 |

| 2018 | 15.76 | 1.36 |

Article by Eurekahedge