Article By Maneesh Shanbhag, CFA – Greenline Partners

The return of any strategy is composed of the three components shown below. While this is elementary, we find that most investors do not separate each piece when analyzing managers. This leads many to buy strategies that deliver only expensive beta instead of actual alpha.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Through this lens, as one example, we are able to see that hedge funds as a group deliver equity-like exposure that is simply muted on the downside as well as the upside. From our calculations, a good replication of the HFRI index is 50% S&P 500 plus 50% cash.We think investors would benefit from analyzing their managers and portfolios through this lens.

We use the example of a single long-short equity hedge fund that claims to deliver “low net” exposure to illustrate further. This is just one of many examples of how statistics can fool us relative to taking a common sense approach to evaluating complex strategies.

Example: Market neutral hedge fund with a 10-year track record

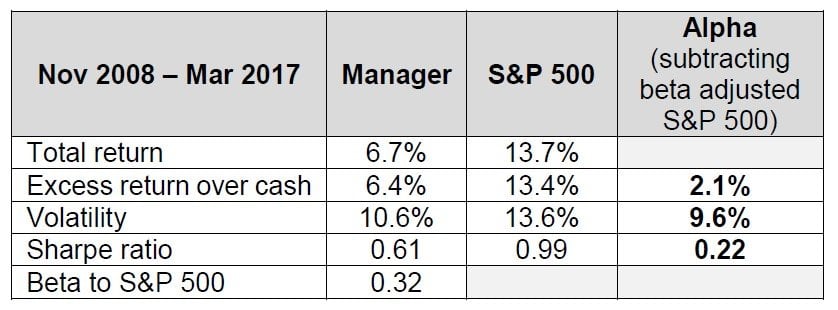

The manager analyzed here is an actual market neutral equity strategy with <$500 million under management and a track record that begins in late 2008 (which raises a question in itself, as this inception may be cherry picked). Since inception, they delivered 6.7% annualized return with a beta to the S&P 500 of only 0.32. While this is a high beta for a market neutral manager, using this beta alone to derive their skill-based return (alpha) shows an impressive positive outperformance of over 2% annualized:

We think the goal of analyzing a manager’s return stream is twofold: first, to inform questions that will help us develop a deeper understanding of the strategy and its benefits to our overall portfolio, and second, to understand whether the strategy is replicable more cheaply than investing with the manager directly. Many managers, especially in equities can be easily replicated, but for the sake of this thought piece we focus only on the first goal.

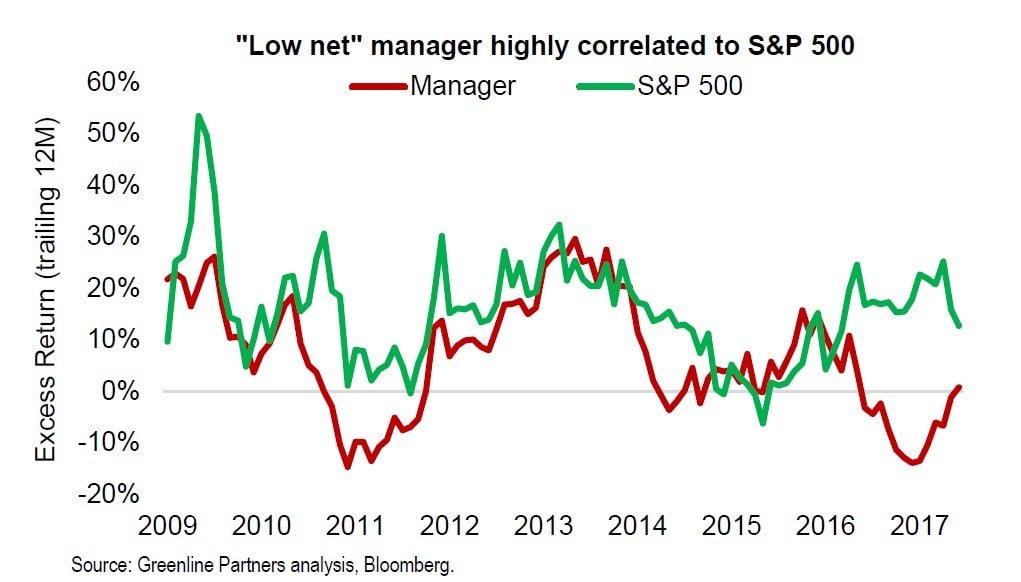

This manager is focused on US equity markets, so an appropriate benchmark to assess their beta exposure is either the S&P 500 or Russell 2000. Below we show their trailing 12-month excess returns versus the S&P 500. We see returns are highly correlated to the broad equity market, so the manager is taking a lot of market exposure (whether they know it or not). Their excess return looks even more correlated when compared to the Russell 2000. This should help inform the type of questions to ask a manager.

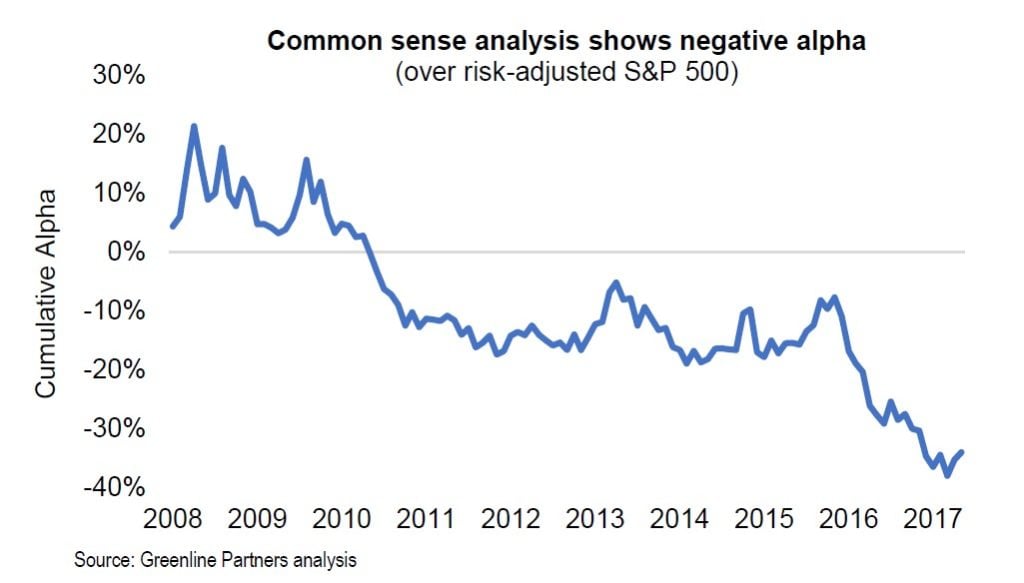

Now with a better understanding of the return profile of this manager, we provide a different and we think more realistic perspective on their true historical alpha. Instead of adjusting their returns by beta, we subtract the volatility adjusted S&P 500 returns, or about 70% of the S&P’s excess returns. The result is quite different as shown in the chart below of their cumulative alpha since inception. Our perspective shows annualized alpha of -4.0% versus +2.1% if relying solely on the statistical alpha that managers often present.

Conclusion

Avoid paying for something you can get more cheaply by using the appropriate framework for evaluating quality. In every case, ask whether you’re getting true alpha or just expensive market returns. We think it pays to take a step back and ask common sense questions that are not dependent on the story that statistics may convey. In the case of the market neutral manager profiled here, a simple replication of 70% S&P 500 + 30% T-Bills (same volatility as the manager) would have outperformed.