Group strategy changes are paying off, with acquisitions stoking lower operating expenses as a percentage of sales

MamaMancini’s Holdings (NASDAQ:MMMB), a leading manufacturer of gourmet Italian foods, announced its fourth-quarter results on Wednesday after markets closed, topping market expectations with bullish management commentary.

The news has MMMB stock 3.7% higher in Thursday’s pre-market trading.

The East Rutherford, New Jersey company reported earnings per share (EPS) of 6 cents versus the consensus estimate of 2 cents and was a significant improvement on the 4-cent loss reported in 2022.

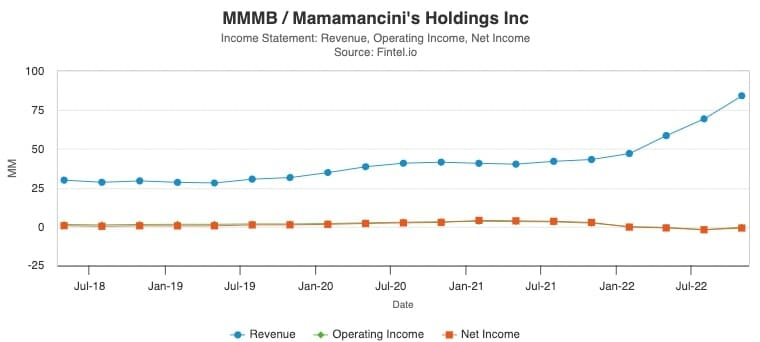

MamaMancini’s said sales grew of 64% to $22.8 million, which was slightly ahead of consensus expectations of around $22 million. The Q4 revenue increase was due to organic growth and acquisitions, including the purchases of T&L Creative Salads and Olive Branch. On an annual basis, revenue grew 98% to $93.2 million.

The chart below from Fintel’s financial metrics and ratios page for MMMB shows the rapid scale up in sales in recent years.

Operational Improvements

The company’s gross profit in the fourth quarter of fiscal 2023 increased 147%, to $6.4 million, or 28.2% of total revenue.

MamaMancini’s management told investors that gross margins could return to levels above 30% in the future and attributed this increase to the normalization of commodity costs, successful pricing actions, and improvements in operational efficiencies.

Operating expenses decreased as a percentage of sales due to synergies created through the acquisitions of T&L and Olive Branch. The company’s adjusted EBITDA for Q4 increased to $2.3 million from a loss of $0.8 million in the prior corresponding period.

Analysts were expecting a softer adjusted EBITDA figure of around $1.2 million.

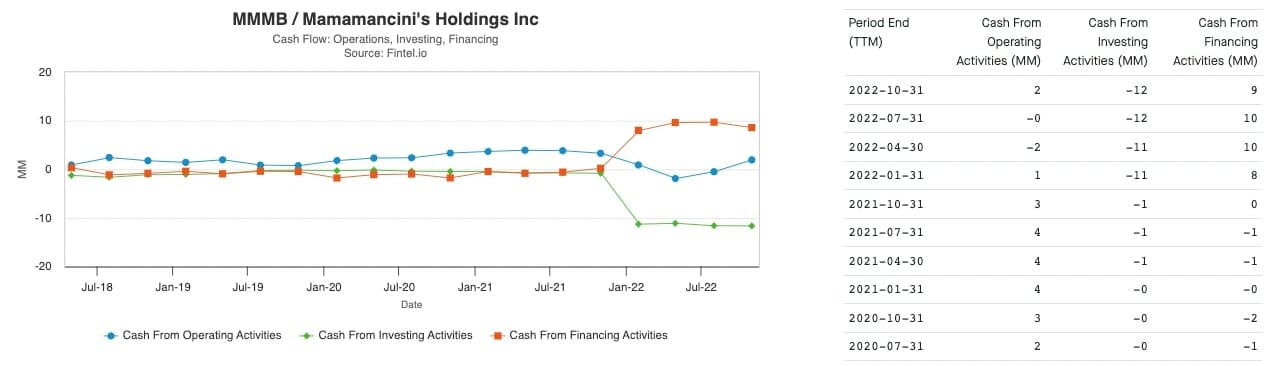

Fintel’s quant models reflect the food maker’s improving trends in cash flow from operating activities in recent quarters. The positive cash flows driven by operations were used to pay down long-term debt which is a positive sign for the company.

MMMB ended the year with cash and cash equivalents of $4.4 million, up from $0.9 million at the end of the previous year.

MamaMancini’s impressive performance can be attributed to strong organic growth across all divisions, especially through cross-selling, as well as inorganic growth fuelled by acquisitions.

Analyst Thoughts

Lake Street analyst Ryan Meyers earlier in April reported hosting the group’s CEO Adam Michaels in a series of investor meetings. The analyst came away feeling optimistic about the CEO’s ability to build the business going forward.

Lake Street highlighted that the industry is highly fragmented and believes the company could emerge as an industry leader, which is part of the basis for its ‘buy’ recommendation on MMMB stock and $4 per share target price.

Fintel’s consensus target price of $3.44 suggests the Street thinks MMMB’s share price could rise 80% over the next 12-18 months if business performance continues as planned.

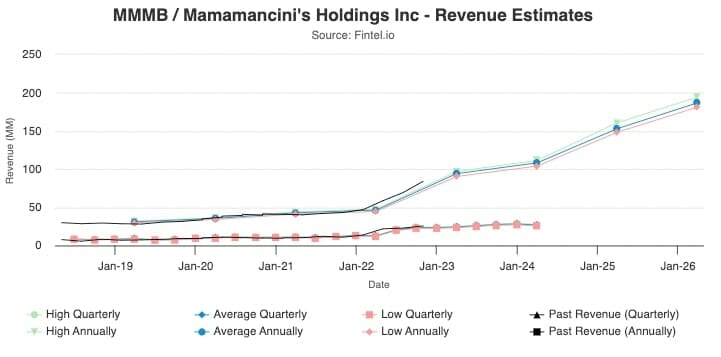

The chart below shows the forward forecast estimates for company sales through to 2026. There is an expectation that revenue will continue its strong growth path.

Institutions Take Interest

The Fintel platform also highlighted that the level of institutional ownership in the stock has grown by 6.3%, to 34 holders. The average position size has increased by 43% to 0.09% during the most recent quarter.

Fintel’s Fund Sentiment quant indicator gives MMMB a score of 87.78, ranking the company in the top 5% out of 36,677 globally screened securities.

The post MamaMancini’s Gains on Q4 Beat as Management Thinks 30% Margins Are Possible appeared first on Fintel.