“The deflationary period we’ve been in has come to an end.”

– Louis-Vincent Gave, Founding Partner & CEO, Gavekal Research

JHL: Amazon Anti-Trust Scrutiny Could Be The Straw To Break The Bull's Back

China and Trump escalated the Trade War fist fight this week and the markets are having trouble digesting the dire news. Is Trump picking a fight with the wrong guy at the wrong time? I’m all for a better deal but there is great risk in creating extreme to advance your negotiating position. And China has big plans. What you’ll find in today’s On My Radar is that what is happening in China has global implications. With or without a fist fight.

When Louis-Vincent Gave stepped on stage at the Mauldin 2018 SIC conference, I thought to myself, he’s sharp and smart, but here comes his annual “all things are bullish” China presentation. But he surprised me with his shift in view. I found his presentation to be outstanding. “The deflationary period we’ve been in has come to an end.” If he’s right, it has important implications for your portfolio and mine.

I loved how my father used to teach me. He was a CPA and I’d come to him for help with my accounting studies. He would always take me first to the big picture conclusion. Let’s figure out what-and-why and then work our way to that conclusion, he’d say. I found that if I knew the end conclusion, I could better connect the dots on the way. At least, that seemed then and now to work for me. So today, let’s start from the end and work our way towards it.

Last week, I shared with you my notes from Jeffrey Gundlach’s presentation. If you don’t know him, he’s touted as today’s new “bond king.” The famed manager runs DoubleLine Capital. On the margin, Gundlach sees rates breaking higher and the end of the 30+ year bull market in bonds; though it won’t be a one way straight up move in yields. Higher rates is not a good environment for bond investors.

His presentation was entitled, “Inflation is Inflationary.” He believes that CPI (Consumer Price Index) will come in at 2.6% in June 2018 based on his proprietary indicator he says “is much more accurate than most of the economists on Wall Street. …So if that’s the case, I don’t believe you can keep things together. That’s why I believe yields break out to the upside. The markets will not be ok with 2.6% inflation that looks to be trending higher.” That pretty much tells you his view on inflation. It’s coming.

On the dollar: Gundlach showed in the next chart that it goes in sweeping trends that persist for extended periods of time. And the trends for the dollar seem to last six or seven or eight years with regularity. His base case for the dollar is that it is now in a down trending cycle. The chart dating back to the ‘70s looks like this:

The reason I begin with a look back to last week, (end of the bond bull market, rising rates, inflation and the dollar) is that Louis-Vincent Gave took a different path (a discussion on China) and came to a similar conclusion. I find it hard to ignore his research insights.

With my old man on my mind (for more than one reason as you’ll learn below), let’s take a look at Louis-Vincent’s conclusion then work our way through his presentation to hopefully make the review more meaningful. I hope you find my notes useful.

First his conclusion, “I think we are seeing two very, very important paradigm shifts in China.”

- The first is a paradigm shift from expansion of production at whatever cost, expansion of debt at whatever cost model to a model of much more sustainable growth, ecologically more sustainable, socially more sustainable, and, of course, lower growth. This has big implications for the whole world.

- The second big paradigm shift in China is that China is now an imperial power looking to project itself far, far beyond its borders, which again, China has not done for four, five hundred years.

- This has deep, deep investment implications, not least of which for global bond markets, for exchange rates, for a lot of things.

I found this next chart particularly meaningful and in line with Gundlach’s higher inflation and higher interest rates view. Louis-Vincent in the following chart signals a secular change in trend from a “Disinflation era” to an “Inflationary era:”

How to read the chart:

- The red line tracks the ratio between gold and bond returns.

- The light blue line is a plotting of the 4-year Moving Average of the gold/bond ratio.

He says, “At the very least, it could very well mean that we’re back to a period like we had in 2005, 2006, 2007 of the US dollar going down, materials going up, emerging markets massively outperforming the rest of the world. Alternatively, it means we are moving to an inflationary boom and bust period.”

Look at the performance of stocks, bonds, gold and cash in the next chart comparing the 1982 to 2017 inflationary period vs. the 1965 to 1982 deflationary period.

Clearly, getting this right matters. When I started in the business in 1984, everyone owned gold and no one was a buy-and-hold stock/bond investor. You had to be a trader to be successful. Think about that compared with were we sit today.

Grab that coffee and find your favorite chair. I realize the read prints long as I story and quote Louis-Vincent through many charts, but I feel it is important material to digest and hope you feel the same. Next week’s post will be shorter. I promise. You’ll also find the latest Trade Signals and I share a personal story about my father and the Masters. This weekend is always a bit emotional for me. I miss talking, playing golf and watching the Masters with him.

Included in this week’s On My Radar:

- Louis-Vincent Gave — China’s Game-Changing Policy Shifts

- Trade Signals — A Special Note on Recent Market Volatility & Latest Signals

- Personal Note — The Masters and My Old Man

Louis-Vincent Gave — China’s Game-Changing Policy Shifts

Louis-Vincent Gave on China and what it means to the world’s markets and economies.

“One belt one road” is China’s grand logistics plan to connect itself to markets throughout Asia and Europe. Also known as The Silk Road Economic Belt, it is a Chinese government development strategy that focuses on connectivity and cooperation between Eurasian countries, primarily the People’s Republic of China. It is both a land-based and ocean-going strategy that underlines China’s push to take a larger role in global affairs with a China-centered trading network. It was unveiled by Xi Jinping in September and October 2013.

“In the past three years, the focuses were mainly on infrastructure investment, construction materials, railway and highway, automobile, real estate, power grid, iron and steel. By various estimates, it is one of the largest infrastructure and investment mega-projects in history, covering more than 68 countries, equivalent to 65% of the world’s population and 40% of the global GDP as of 2017,” says Wikipedia.

Louis begins, “One of the low-lights of my year is every year for Ash Wednesday I go for a confession. I sit down with my priest, and it’s never that fun to go back through a year’s worth of failings. I sat down with my priest this year and went through confession. At the end of confession, my priest asked me, “What are you giving up for Lent this year?” I said, “This year I’m gonna give up value investing. I’m no longer buying energy stocks. I’m no longer buying Japan. I’m no longer buying emerging market financials.” And he looked at me and said, “No, no, no, no. That doesn’t work. That’s like giving up spinach or giving up broccoli. You have to give up things that feel good.”

So instead I’m giving up investing in things… like Amazon. I’m giving up investing in things like Tesla that have two quarters worth of cash in front of them. And I’m gonna explain to you today why I think that basically investing in growth stocks, at this point, is no longer right for this cycle.

I usually start talking about China because that’s where I’ve spent the past 20 years of my life. It’s hard not to be caught into the China limelight. It’s been, of course, an amazing story. 500 million people taken out of poverty and put into the middle class in the space of one generation. It’s been a big driver of growth globally. It’s been a big driver of asset prices.

If you’ve heard me present over the years, you know I’ve been a little bit of a China permabull. I’ve tended to always look at the brighter side of things in China. The reason for that is I fundamentally believe in Charlie Monger’s saying that, “Show me the incentives and I’ll tell you the outcome.” For the past 20 years or so, the incentive structure in China was a very, very simple one to understand. What you had is a technocratic class that was in charge of most of the important decisions. This technocratic class was told, if you were a young, bright technic party member of this technocratic class and you were sent to be mayor of Wuhan or party secretary in Chandon or governor of Anhui or wherever else, you were given a very simple brief. The brief was “deliver strong growth and you can aspire to the next job. At some point, some day, you can leave the sticks and come back to Beijing.”

With that incentive structure in place … deliver strong growth, you get the next job … you could bet your bottom dollar that growth in China would always be fairly decent, number one. Number two, that China would always add over capacity pretty much regardless of where you were in the cycle. Because again, if you were the mayor of Wuhan and you’re thinking about your next job, and you’ve got a permit application for a new real estate development, you take your big stamp and you say, “Approved.” Next, you get a big permit application for a new factory and you say, “Approved.”

That was the incentive structure. Show me the incentives, and I’ll tell you the outcome.

Today, I believe we are going through a paradigm shift. It’s a paradigm shift that started a couple of years ago, but that was really crystallized at this year’s 19th Party Congress. When Xi Jinping stood up and gave a three-and-a-half-hour speech, which I will summarize for you so that we don’t have to go through the three-and-a-half-hour speech, and told the 3,600 party delegates that were there, “We used to measure you guys on growth. Now you’re gonna get measured on the environment. You’re gonna get measured on your social housing. You’re gonna get measured on healthcare outcomes. You’re gonna get measured on education outcomes.”

Louis-Vincent said, “Xi Jinping has changed the incentive structure for the technocratic class in China and I believe this will have deep and profound investment implications that most people have perhaps not thought through. Imagine again that you’re the mayor of Wuhan. You’re sitting in that room and Xi Jinping is changing your incentive structure. The first thing you do when you get back into your town, you bring all the most polluting industries in town to your office, and you say, “All right, boys. No more coal. From now on we’re using natural gas.” In China we’ve already seen the consequences of this.

- What you are now seeing is industries like cement, steel, and others under pressure, being told that you have to cut back your production.

- As a result of that, you see higher prices, which brings me to Xi Jinping’s main buzzword. Xi Jinping keeps talking about supply side reforms. Now for most of us in this room, when we hear the word “supply side reform,” we think Margaret Thatcher, we think Ronald Reagan, we think the government coming out of the economy, and we think this is awesome. If, like me, you’re a right wing nut.

- But when Xi Jinping talks about supply side reform, he means something completely different. He means less supply. He means significant consolidation of supply … what you’re seeing in steel, what you’re seeing in textiles, what you’re seeing in coal, what you’re seeing in cement, it is what you’re seeing in industries across the board.

Now why should all of you in this room care? Why does this matter? I think it matters because the bull market that we’ve been enjoying for a while now rests on two pillars.

- The first pillar is the belief that companies are ever-more efficient thanks to big data, thanks to artificial intelligence, thanks to technology in general. Companies are getting smarter, and smarter, and smarter. As a result, we’re willing to pay higher P/Es, and that makes sense… If I take a highly inefficient company, I might be willing to pay 12 times P/E. If I take a highly efficient company, I might be willing to pay 20 times P/E. So the market gets re-rated.

- The second pillar of the bull market that we’re enjoying is the belief that we live in this world with excess capacity everywhere. That anywhere we care to look, there’s deflation. As a result, central banks can add a lot of liquidity in the system, keep interest rates very low. That, of course, leads to higher P/Es. Low interest rates, high P/E. High interest rates, low P/E.

But inherently, isn’t there a contradiction between these two pillars? If companies are ever smarter, if companies are ever more efficient, why do we have all this excess capacity in the system? Well the answer is pretty simple. To go from A to B, you have to assume that there’s an idiot in the system who keeps adding capacity year in, year out regardless of the returns of that capacity. I think we all know who that idiot has been.

- It’s been China because of the incentive structure that was put in place.

When we look at the deflation that we’ve lived under for the past 20 years, it’s, of course, hard to know the exact cause of deflation… success has many fathers. It’s hard to know what was the most responsible part of the deflation.

- Was it the aging of our societies?

- Was it the technology revolution?

- Or was it the fact that China kept adding capacity year in, year out and all the manufacturing moved to China?

Because if it was, then undeniably we’re moving to a different world. Because again, the incentive structure in China has changed, and the days where China just adds over capacity year in, year out are over.

(SB here) What he is saying is that if there is so much excess capacity in the system, manufacturers will fight for business and lower their prices to their clients to produce goods. When capacity contracts, manufacturers gain the ability to increase prices. More demand + less capacity = higher prices. Those higher prices will pass through to you and me. Inflationary.

Louis-Vincent continues, “And so with Xi Jinping’s speech at the 19th Party Congress, what we, as investors, should now take in is that the days … We should take in two things actually.”

- First, the days where we can anticipate China delivering stronger growth or as good of growth as people expect are now over. There will now be downside growth surprises in China, number one. Number two, the things we should anticipate is that the days where China just exports deflation year in, year out are also over.

The days of me being a permabull in China are over.

Now for the Western world, I think this could not come at a worse time because we, in the Western world, of course, are now A), embarking on protectionism trade wars, which fundamentally lead to higher inflation. But it’s also coming at a time when, frankly, we have invested so little money in our own production capacity which is odd. Because if you look at recent years, money has poured in to vehicles like venture capital private equity. I was once told that a year where venture capital raises $30 billion is usually the top of the VC cycle. Last year, SoftBank, all by itself, launched a $100 billion fund.

Where was all that money invested? In the past, it would have gone to things like Xerox, Hewlett Packard, Cisco. Today, it goes mostly in social media, number one. Or number two, it goes into what I would call overcapacity optimizers. You have a spare car? Uber. You have a spare room? Airbnb. And so on. But it hasn’t really gone into productive investments that add to the manufacturing base, to the production base of our economy. If it’s true for the US, it’s also definitely true for Europe.

Or look at private equity as another example. We’ve just had five years in a row where private equity has raised over $300 billion US dollars. This has never happened before. I mean the amounts raised … There’s more than a trillion dollars today of supposedly dry powder waiting to be reinvested. Has that money funded new businesses, new ventures? Well, not really.

Let me ask you a question. It sounds a lot like who’s buried in Grant’s tomb. But how many stocks are in the Wilshire 5000? When it started it was 5,000. Today, it’s 3,600 because in the US you’ve gone from 8,100 listed companies to 4,300 listed companies in the course of the past couple decades. That is where the private equity money has gone, so much so that when you look at the average age of the capital stock of US corporates, we’re basically at multi-generational highs.

And the picture is worse in Europe because in Europe we had the European crisis in between which cut back capital expenditures a lot. We’re moving to a world where we haven’t invested in production capacity, and China’s saying, “I’m done over-investing in production capacity,” which brings me to one of my most important charts from last year.

Next chart: This is the Japan MSCI Index in US dollars basically going nowhere from 1994 to 2017. And in 2017 all of a sudden having a massive breakout.

SB here: Note the last bullet bottom right of the chart. What Louis-Vincent is saying is if this is true, “…then the guys who own the remaining excess capacity make out like bandits.” And it’s showing up in the charts (note technical breakouts – next chart: South Korea and China).

SB here: And is it showing up in a secular bear market shift in the bond market? The next chart shows yields breaking to the upside. I shared similar charts with you last week, here.

Louis-Vincent continued, “Or simply look at this (next) chart. I mean this is obviously the 30-year US Treasury bond yield, which is now, of course, broken out decisively from its downtrend, which makes sense if this deflationary environment that I’ve described is now coming to an end. And here, I just want to spend a quick second on this because I think this is very important. The markets today are giving us a very important signal.

Dave (Rosenberg, SB notes here), earlier on, was describing the lack of … well, how hard it is to build diversified portfolios today given all the correlations between asset classes. But isn’t it odd that we have a 12% fall in global equity markets in early February and bond yields don’t come down? (Emphasis mine)

- I mean isn’t that the market telling us something?

- Isn’t that the market telling us the investment environment has changed when equities get clobbered, when we have a trade war unfolding, and still bonds can’t rally?

- Isn’t the zeitgeist of our investment environment changing? I believe it is.

SB here: I believe this will turn out to be prescient.

Back to Louis-Vincent: “Staying on the bonds for just a second, I spent my whole career in emerging markets.”

- In emerging markets, when you have bond yields going up, and your currency going down at the same time, that is not a good sign.

- Investing in Indonesia, when I see the bond yield go up and the currency go down, that’s usually time to ask for the check and head for the exit. And try to do so quickly.

And, of course, this is what we’ve now had in the US.

- We’ve had massive market turbulence, and the US dollar has struggled to rally. The bond yields have struggled to come down.

- We are, today, in a very different investment environment, and perhaps this shift in investment environment isn’t because of what’s happening in the US, isn’t because of what’s happening in Europe, but it’s because of what’s happening partly in China. Although what is happening in the US is, of course, very, very important.

There’s a couple of charts I’d like to leave with you, mentally, and this is definitely one of them. This is the US budget deficit as a percentage of GDP. Last year was a highly unusual year. Last year we witnessed a second-year deterioration in the US budget deficit in spite of the fact that we’ve had no recession. I mean think of it. We have record low unemployment. We have very good tax receipts thanks in part to all-time highs in equities, all-time highs in real estate, so on and so forth. With all of this, the US records a deterioration in the budget deficit.

The reason for that is obvious and it’s simple. The US government spending is accelerating fast because demographically, the US is entering a tough time. This is a simple chart (next chart) of the annual growth rate of 18 to 65-year-olds in red and the annual growth rate of over-65-year-olds in blue. The fact that the growth rate of the over-65-year-olds is gonna be in double digits and the working population is gonna be in single digits, obviously shifts and has a dramatic impact on government spending.

- Or here’s another way to look at it. This is your simple ratio of over-65s to your working population. That ratio was roughly 20% in the US right here for a couple of generations. From now on it shoots up.

In fact, what we could say is that the US today is where Europe was 20 years ago. (SB here – note the blue line in the next chart. It was pulled forward to compare where the US is today relative to where Germany was 20 years ago and Louis-Vincent suggests that the US is likely to follow the same path.)

Now, in Europe 20 years ago, Europe had a simple choice. It was facing this. And the simple choice was do we cut back our entitlement spending, or do we sacrifice our armies? And Europe, by and large, made the political choice of let’s sacrifice our armies, cut back on military spending dramatically, keep our entitlement spending. I’m not putting a value judgment on it. It’s a policy choice.

What baffles me when I look at the US is that there’s a refusal to even have a discussion on this very policy choice. Instead, I think what you had was President Obama who came in eight years ago, looked at the situation, and said, “You know what? I’m gonna turn European. The US is gonna go European. We’re gonna cut back military spending.”

- (next chart) What you see in blue here going down during the Obama years—”and we’re, in fact, gonna ramp up our entitlement spending with Obamacare.”

- In comes President Trump, and President Trump says, “Not at all. We’re gonna ramp up defense spending again, and we’re not gonna touch entitlement spending.” So much so that if you look at the CBO projections, the US budget deficit, under the best of conditions … 3% growth, no recession, et cetera … moves from 3% of GDP down to 5% of GDP over the next decade.

Now why does this matter?

- It matters because I tend to believe that foreign exchange markets are serial monogamists. They never get hitched to one factor, but they get hitched to one factor for a couple years. So at some point, all the markets will care about is the current account deficits. At other points, all they’ll care about is the exchange rate differentials. At other points, all they’ll care about is the risk to safety and so forth.

- In the past, I think, six to nine months what we’ve seen is a shift of the markets going from caring about interest rate differentials, and now the FX markets are very clearly dating … they’re going out with … the sustainability of fiscal policy.

- This is what markets have now decided to worry about. When you look at the US, frankly, there is a lot to worry about because if you look at the coming year, the US Treasury is gonna have to issue a net increase of $1.3 trillion US dollar debt.

The question we should all have here is … I mean $1.3 trillion is a lot of money. Who’s gonna fund that when the Fed has already said, “I’m done funding this”? And when central banks around the world—whether the ECB, the BOJ—are increasingly moving towards shrinking the size of their balance sheets themselves. It’s either gonna have to be the US private sector—and they’re gonna ask a higher yield for it unless there is a crisis in between—or it’s gonna have to be foreigners. And foreigners will most likely ask for a much weaker dollar to fund this runaway US fiscal policy.

Of course, the US dollar matters a lot. It’s one of the three important prices in the system, the other being US interest rates, and the third being oil prices. Basically the fluctuation of these three prices determine most of the other asset prices.

- Very simplistically, when the US dollar is too high, emerging markets get smoked. They can’t fund their growth.

- When the US dollar is too low, Europe or developed Asia can’t compete. You see that in ’92, Japan goes bust. In 2011–2012, Europe goes bust.

- Today, the US dollar isn’t weak enough, but when you look at how it is behaving—basically incapable of rising when US interest rates go up, incapable of rising when you have massive turmoil in equity markets—it is, frankly, not very positive for the long term.

SB here: carefully read this next chart:

Louis-Vincent turns back to China and their push to be a global reserve currency. Something that also spells trouble over time for the dollar. First, next is a look at the ‘One belt one road’ plan:

Louis-Vincent said, “If you want to be the dominant market in the world, you can’t build your empire on somebody else’s dime. If you want to be the dominant empire, you can’t get there in a world where trade is totally dominated in US dollars.” Next chart – China is on the path to internationalize the Reminbi (RMB). Concluding, China has to move the trade to Reminbi.

Next Louis-Vincent says, “Take a step back and imagine for a second that you are a Chinese communist technocrat, which is probably a pretty big departure for most people in this room. But imagine for a second you’re a Chinese communist technocrat. What are the best things to control? What are your best tools in your toolbox?”

- Surely it has to be the interest rate and the exchange rate. I mean what’s better if you’re a control freak technocrat than to control the interest rates and the exchange rates? Nothing, right?

- And yet they’re giving that up.

Ask yourself this: Why would China liberalize its exchange rate, liberalize gradually its interest rates, open up its bond market to foreign investors?

- Surely the only reason they’d do that is they think they have something better on the other side.

- And the something better on the other side is the ability to fund your trade in your own currency.

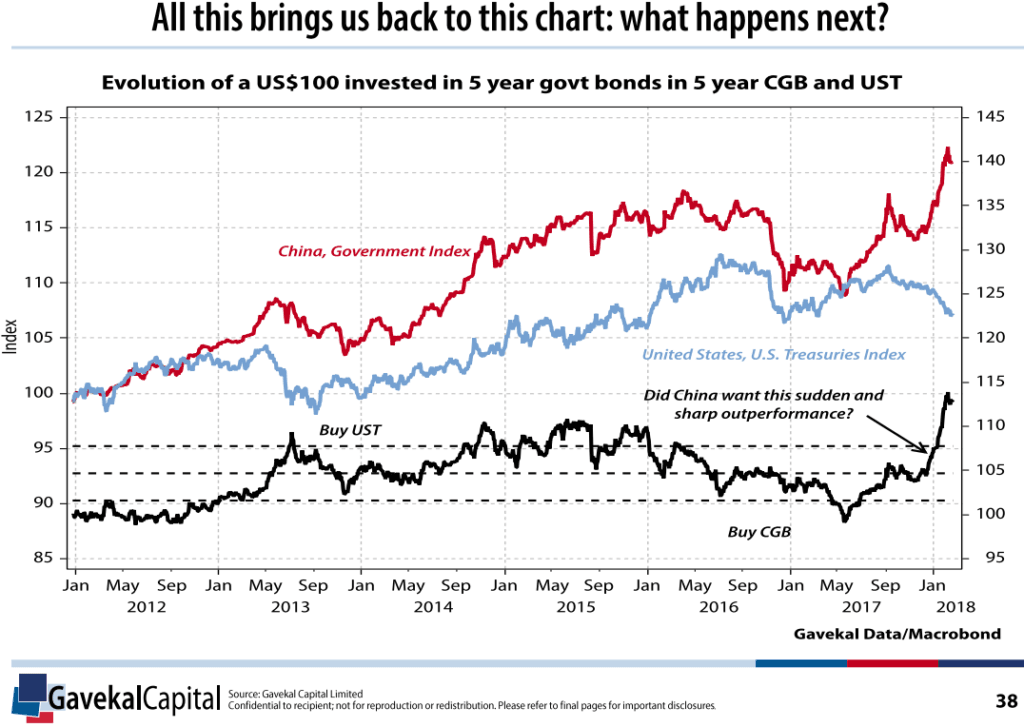

That’s why you started to see China open up its bond market to foreign investors five years ago. This (next chart) is a chart I’ve shown time and time again in this room.

- The red line represents a hundred US dollars invested in Chinese government bonds, five-year bonds.

- The blue line represents a hundred US dollars invested in five-year US Treasuries.

For the past five years, what China’s done is make sure that basically the return on Chinese bonds were always a little bit above the returns on U.S. bonds so that China could go to Korea, to Thailand, to Indonesia and say, “Hey, instead of keeping your reserves in US dollars, keep your reserves in renminbi, and let’s trade in renminbi so that we’re no longer dependent on the ability and willingness of American banks to fund our trade.”

Now, of course, if you’re the Thai Central Bank you’re on the other side of the table. You say, “Okay, that’s great. That sounds good. Are you gonna screw me on this? I mean am I gonna put my reserves in renminbi and then next thing I know, I take a big loss?” So China says, “No, no, no. You won’t take a big loss.”

And this is why if you look at the past, really, five years, the two have really traded it in a fairly narrow range except for the past six months. Look at the big breakout in relative performance we’ve had between Chinese government bonds and US government bonds in the past six months.

When you look at this, you have to ask yourself is this just an anomaly and we’re about to have a massive US Treasury rally? For the life of me I can’t really anticipate why we’d have that except if we had a massive crisis around the world, a massive crisis in the system. Or we are entering a new paradigm. My belief is we are entering a new paradigm where the renminbi increasingly is gonna become Asia’s Deutschmark. It is gonna become Asia’s trade and reserve currency. And it is gonna become Asia’s trade and reserve currency partly because increasingly people look at US fiscal policy and say, “This is just not sustainable.”

It’s also, I think, shifting because … and this is something very important that happened last year … where for the first time ever, China imported more oil than the US. US oil imports go down and down because you produce more and more domestically—not because you consume less. Chinese oil imports keep going up partly because China’s getting richer and richer. For the first time ever last year, China imported more oil than the US. So now China can turn to countries like Qatar, like Russia and say, “Hey, instead of paying you in US dollars, I’m gonna pay you in renminbi.” The more that gap opens up, the more China’s ability to do that will increase. And, of course, if you’re China and you have the ability … Today, China has to pay most of its oil in US dollars, which means it has to earn the US dollars first. If it moves that equation to shifting to paying for its oil in renminbi, then all it has to do is print it. That basically cuts your dependency on the rest of the world absolutely dramatically.

Which brings me to the final point I’d make today in the shift that I think is unfolding in our very markets. Because for the past, really, two years we’ve lived in a world with very, very low volatility in foreign exchanges. With this low volatility in foreign exchanges, we’ve had low volatility pretty much across asset classes. This is somewhat reminiscent of what happened in the mid-80s.

Back then, this was a real concern because it hurt trade. It hurt economic growth. So policy makers got together first at the Plaza in New York, then at the Louvre in Paris, and said, “All right, let’s coordinate monetary policies so that from now on, exchange rate volatility will be kept to a minimum.”

Now if you’re a market participant, you love this. You’ve got the policy makers telling you, “I’m gonna squeeze down the volatility of foreign exchanges so you don’t have to worry about it anymore.” So if I’m investing, then great. One less thing to worry about. I’ll take on more risk. In the mid-80s, you see markets shoot up everywhere. Until, of course, bond yields in the US and across the world start to creep up, the Bundesbank panics, and starts to raise interest rates.

Jim Baker goes on TV on “Meet The Press” on Sunday—back then he was Treasury secretary—and blasts the Bundesbank and says, “If the Germans think that they can influence US monetary policy, they’ve got another thing coming.” At that point, everybody realizes, “Darn, the Plaza Accord is dead.” The next morning, everybody sells. Dow down 27%. We all know the rest of the story.

Well, look at what just happened.

- Late 2015, Japan’s talking helicopter money, Europe is printing like crazy, bigger QEs than even the US had.

- China’s starting to get pissed off because everybody’s devaluing left and right, says, “Well, maybe I’m gonna devalue as well,” throws a warning shot across the bow.

- All the finance ministers of the G20 get together in Shanghai. And if you look at the Shanghai agreement communique, it reads pretty much just like the Louvre report. The first point in the Shanghai G20 finance minister communique … you can Google it now … was “We will now coordinate monetary policies to avoid excess volatility on currencies.”

- Unsurprisingly, the markets love it. One less thing to worry about. No more FX volatility. Everything rips up. Then US Treasury yields start to rise. And then we come to January 24 in Davos and Treasury Secretary Mnuchin—it’s always the US Treasury Secretary for some reason—but the US Treasury Secretary Mnuchin stands up at Davos and says, “Isn’t the weak dollar great? I hope it goes even lower,” to which Draghi responds the next day and says, “Are you kidding me? If the US dollar goes lower, that compromises my recovery.”

- At that point everybody realizes, “Hmm, is the Shanghai agreement still on?” Before you know it, January 26, volatility on the equity market picks itself up from off the floor.

Now one of the discussions in the previous panel was how do you protect your portfolio against such a rising volatility today? Well, if you go back to ’87, your only hedge really in the system was bunds, German bunds because that was the central bank doing the tightening. German bunds were your hedge in the portfolio. That was basically the only thing you could have.

In this latest sell off that we just had, the only thing that really didn’t go down were Chinese government bonds. I’m making the case right now that your new hedge for your portfolio is Chinese government bonds. And why? Because the PBOC is the new Bundesbank.

It’s the new Bundesbank for a number of reasons. First, as I started with, you don’t have to worry about China just printing money to hit certain growth targets anymore. Basically, the days of China trying to hit certain growth targets are over. You will be able to get growth disappointments out of China. But secondly, and perhaps most importantly, the Chinese Central Bank is really the only inflation hawk out there. Why? Because Chinese policy makers may not look and feel very communist today to most of you, but they were still brought up in the Marxist church.

Now I grew up in the French educational system, so I was brought up in the Marxist church as well. In this Marxist church, you’re taught to believe that big historical shifts, big historical revolutions, are not the results of individuals or ideas, instead it’s the result of economic forces. For a Marxist there is no more important economic force than inflation. Now whether you believe this or not doesn’t matter. They believe it. And for example they’ll tell you, “Look, Tiananmen in 1989, when we had to kill our own kids, when we had to shoot down the students that we taught wasn’t because they wanted democracy. It wasn’t new ideas. It was because inflation at the time was running at 20% in China.”

Now again, I don’t believe that and you probably don’t either, but that doesn’t matter. They believe that. As a result, China, today, is a genuine inflation hawk at a time when inflation is starting to creep up all over the system. It is probably the only central bank in the world that is an inflation hawk, which brings me back to this breakout. And again, if I can leave you with one chart (next chart) today, I think this breakout shows that we are in the midst of an important paradigm shift.

I’ve got another chart that illustrates how we are in the midst of an important paradigm shift, and I’ll get to it in a second because first, as a setup to that chart, I want to go back to our Four Quadrants framework. I’ve spoken in this room many times over the years and every year, pretty much, I show this (next) chart, which simply states that asset prices are driven by the interaction between inflation and growth. (Emphasis mine)

And that gives you four different kinds of investment environments that you see here, and that basically tells you which asset classes you want to be into and which asset class you don’t want to be into.

The reality is the system tends to move from the left to the right every seven to 10 years, usually because of what the private sector does, usually because of over-investments, people getting too optimistic, people leaning too far above their skis.

- We’ll spend seven or eight years on the right and then we’ll spend a year and a half or two years on the left. A gain, typically because of what the private sector does.

- Shifts from the top to the bottom occur roughly once a generation, and they’re usually the result of policy choices. They take a long, long time to unfold.

Note the next chart:

- The red periods are the inflationary booms.

- The yellow periods are the inflationary busts.

- The blue periods are the disinflationary booms.

- The gray periods are the disinflationary bust.

We clearly had a shift around the mid-80s where for roughly 30 years, we’ve known nothing but disinflationary booms and busts. Pretty much all of us in this room have always invested in a period of disinflationary boom and bust. It matters—getting back to the question of how you diversify your portfolio— because whether you’re in a deflationary boom or deflationary bust, you might own very different things. (Emphasis mine.)

Now how do you know where you’re gonna be? One of my rules of thumb is … First, a little bit of a disclosure. I don’t like gold. I am not a gold bug. I see gold and I think, “This is just a rock. It shines. It’s pretty.” Sure, I’ll buy some for my wife for Valentine’s Day or Christmas, but the utility of gold I can’t get my head around. Most importantly, it doesn’t yield anything. I look at gold and I think, “Why would people invest in this, especially because it yields nothing?”

My starting point is always that gold … Over a four-year period, bonds should always outperform gold. Bonds are safe. Bonds give you yield. Take a four-year period, bonds should outperform gold. When they don’t, when bonds underperform gold, that’s the market giving you a very important signal.

It seldom happens, and it is quite trending. The outperformance of gold relative to bonds is quite trending. So what you have here (next chart) is a simple gold/bond ratio, the total return of bonds relative to total returns of 10-year US treasuries, and the four year moving average (trend line) in blue.

- Gold is now outperforming bonds for the past four years.

This, to me, is an important message. It’s not a message I particularly like. It’s not a message that I embrace, but it’s a very important message nonetheless. At the very least, it could very well mean that we’re back to a period like we had in 2005, 2006, 2007 of the US dollar going down, materials going up, emerging markets massively outperforming the rest of the world.

Alternatively, it means we are moving to an inflationary boom and bust period. That top quadrant, that top part in my four quadrants.

- And if so, then your portfolio construction needs to change completely because if you think that your US treasuries are good diversification for your portfolio, well look at the right hand (next) chart.

- From 1966 to 1980, long-dated US Treasuries were obviously horrible diversification for your portfolio. Gold was a much better diversification for your portfolio. In fact, US dollar cash, as Dave Rosenberg said earlier, was a much better diversification for your portfolio than bonds were.

In conclusion, I think we are seeing two very, very important paradigm shifts in China.

- The first is a paradigm shift from expansion of production at whatever cost, expansion of debt at whatever cost model to a model of much more sustainable growth, ecologically more sustainable, socially more sustainable, and of course lower growth. This has big implications for the whole world.

- The second big paradigm shift in China is that China is now an imperial power looking to project itself far, far beyond its borders, which again, China has not done for four, five hundred years.

- This has deep, deep investment implications, not least of which for global bond markets, for exchange rates, for a lot of things.

I think as you look to your portfolios, you want to buy assets that benefit from the renminbi becoming a trade and reserve currency for Asia. That includes RMB bonds. That includes Chinese financials. That includes the Chinese consumer plays. Frankly, that includes Asian equities in general. I think you want to buy assets that benefit from the Chinese infrastructure rollouts.

SB here again: Over the last four weeks, I’ve shared my notes and views reviewing David Rosenberg’s, Dr. Lacy Hunt’s, Jeffrey Gundlach’s and now Louis-Vincent Gave’s Mauldin Economic’s 2018 SIC presentations. David and Lacy see transitory short-term inflation pressures leading us into the next recession in which we will see U.S. Treasury note and bond yields lower. Lacy believes we may even make a new all-time low.

Jeffrey’s presentation was entitled, “Inflation is Inflationary.” He believes the long-term bull market in bonds is over and sees higher U.S. interest rates. Louis-Vincent’s presentation was outstanding and looked at the pressures of diminishing excess manufacturing capacity in the system and the rise of China concluding that we are moving into a period of higher inflation and higher interest rates.

My view is closer to Dave and Lacy’s in terms of lower interest rates in the next recession. My best guess is #2019Recession. But I want to note that we can get recession and also see higher rates. A debt blow-up of mass proportion could be the trigger. I do believe we are heading to what Mauldin calls, “The Great Reset.” We are going to concoct something along the lines of “The Great American Debt Restoration Act,” which in English means the Fed and the Treasury will find a way to do a swap for 40% or 60% of the current outstanding debt and evaporate it. Laws will need to be changed but that’s where I think we are going. Best guess #2019-2021GreatReset but no guarantees of course.

Lastly, what can you do? I’m not sure how many of us are going to rush out and buy Chinese bonds. Gold makes sense for 10% to 20% of a portfolio depending on how aggressive you are and materials and commodities make sense to me as well. We all do tend to have a home country bias so I just don’t see many of us straying too far. Some “rifle shot” positions may be appropriate, but what do you do with your core?

I know I’m talking my business here, but I believe it is important to overweight to active risk-minded strategies. Volatility can create great opportunity and I believe you should add to strategies that are more nimble and tactical in approach… that seek growth opportunities but do so in a way that can provide a level of protection in down markets. Diversify to several experienced managers. No strategy is perfect nor is the bull market biased 60/40 bet.

Everyone is loaded on the same side of the buy-and-hold passive trade. I’m suggesting that’s not a good idea today. Switch to active. The passive investing buy-and-hold risk reward dynamics (uber high valuations and near 5,000-year lows in yields) are not good.

Finally, I hosted a one hour webinar last week about how to invest in a rising interest rate environment. You can watch it here. (The webinar starts at the 2:00 minute mark.)

Trade Signals — A Special Note on Recent Market Volatility & Latest Signals

S&P 500 Index — 2,580 (04-04-2018)

Notable this week:

Clearly, there are cracks in the long-term secular bull market trend. The number of S&P 500 Index stocks below their 200-day MA is now 60%. CMG NDR U.S. Large Cap Long/Flat Index is close to signaling a reduction to 80% large cap exposure from 100% and the 13-week trend line vs. the 34-week trend line is turning down (though still bullish). Sell signals occur when 13-week MA line crosses below 34-week line. It looks like this (red circle current level). Note too the prior bull and bear market cycles:

The S&P 500 is challenging the 200-day MA line (next chart). As of the time of this post, it is below the trend line (red circle). PM update: The 200-Day MA held as the market closed higher.

The immediate technical question is does the market hold the 2525 to 2586 price levels… noted below “closing support” and “intra-day support.” Chart from John Murphy at StockCharts.com. My guess is we hold yet it is just a guess. The #TradeWars really is a problematic global economic issue. The “Art of the Deal” has never been more tested. Getting dicey.

Don’t Fight the Fed or the Tape indicator turned from negative to neutral this week and Volume Demand (buyers) remains greater than Volume Supply (sellers). Those indicators remain bullish. Also, investor sentiment has reach a bearish extreme which is short-term bullish for equities. Perhaps a short-term bottom is being made. Stick to a process.

A tremendous amount of academic and real life practitioner research supports trend following processes. I’m a trend trader since the early 1990’s and believe that price evidence trumps fundamental analysis. Though I do believe fundamental analysis is important. Trend analysis helps me limit risk when my fundamental view turns out to be wrong. Nothing is perfect in this business.

You’ll find the current positioning of our CMG TREND Series of Portfolios below. Several have de-risked while the weight of evidence for U.S. large cap equity exposure remains moderately bullish.

The next section walks you through all of the Trade Signals charts.

Long-time readers know that I am a big fan of Ned Davis Research. I’ve been a client for years and value their service. If you’re interested in learning more about NDR, please call John P. Kornack Jr., Institutional Sales Manager, at 617-279-4876. John’s email address is [email protected]. I am not compensated in any way by NDR. I’m just a fan of their work.

Click HERE for the latest Trade Signals.

Important note: Not a recommendation for you to buy or sell any security. For information purposes only. Please talk with your advisor about needs, goals, time horizon and risk tolerances.

Personal Note — The Masters and My Old Man

I spoke to my good friend, Peter, this week about the Masters. “My dad had eight aces,” he said. “We played so much golf together. The week before the Masters several years ago, I hit my ball three feet from the pin, turned to my dad and said, “$50 you can’t hit it closer to the pin.” He took the bet. Ace number seven followed. He happily took my $50 bucks. We always watched golf together and especially the masters.”

Peter told me that last year his father put a putting green in the basement of his nursing home. Peter wheeled him down and bet him $25. Picture a man in a wheelchair with two putters on his lap as well as early signs of dementia. “He took my $25 bucks,” Peter said and added, “The Masters means everything to me.” His father passed two months ago.

As a kid, I remember laying in our family room under the coffee table. Head propped up on pillow with eyes fixed to a simple TV. No flat screen high def back then. Dad has his usual spot on the couch with favorite beer in hand. Over the years we played so much golf together. And when I was young, we’d never miss a Masters together. Dad passed (graduated as I like to say) six years ago. Just a few days after one of the most memorable father/son Masters time spent together.

Dad laid in his hospital bed and he would drift in and out of consciousness. More out than in and the ins were brief. But boy, did his lights turn on when granddaughter, Brianna, came into the room with a Starbucks soy latte. “Am I allowed to have a coffee?” he sweetly asked. “You bet,” I answered and we told him pizza and beer was coming later that afternoon. He loved Michelob Ultra and we were going to get him one last beer before he departed.

Brie handed him his coffee, I jumped into bed next to him and as he came to, he saw the Masters on TV… what a gigantic shift. He was back to his old self and stayed alert for the next five hours as we watched Bubba Watson go on to win the tournament. Dad passed just a few days later. That was a really awesome day.

I’ve done the same with my kids over the years and cherish our time together. My son, Matthew, shot me several text messages this past Wednesday. The first asked if I was watching the par three nine hole Masters event. Tom Watson, Gary Player and Jack Nicklaus were all in the same group and Matt noted, “You’ve got to turn it on, they are throwing darts at the pin.” For non-golfers, that’s a shot that gets close to the pin. Tom Watson went on to win. Score one big win for us old guys. Dad loved Watson, Palmer, Player and Nicklaus, as I’m sure you do as well. The next text was a link to a Jack Nicklaus’s tweet. Jack’s grandson (Jack’s caddy for the day) had just made a hole-in-one. Score one for the young guys. The Masters and My Old Man… I’ll be enjoying the weekend and thinking about the big guy; hopefully, with son, Kyle, and Susan’s two boys on the couch as well. Definitely no Mich Ultra in hand but maybe a super-cold Head Hunter IPA and some beer nuts. I sure do miss my old man a lot.

Tom Watson wins Par-3 Contest, but GT Nicklaus, Jack’s grandson, steals the show: You can watch the hole in one here.

That was a lot about me so thanks for indulging in my story. I’m sure you have many great memories as well. Please feel free to share. I’d love to hear…

Here is a toast to you and all that is good in your life. And a hat tip to the important people in your life. Wishing you a wonderful weekend!

With kind regards,

Steve

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.