Presentation slides on Lam Research Corporation (LRCX) from Imran Siddiqui. He can be contacted at 710imrans (@)gmail.com

Executive Summary

- A world class business trading at a mouth-watering price level Dominant player in an industry with secular tailwinds

- Services business provides a growing annuity type income which should hold company in good stead should the memory

downturn accelerate - Shareholder friendly management team rewards owners with an attractive capital returns program

- Perceived cyclicality in semi-equipment sector is exaggerated relative to reality

- Short fuse: Quarterly earnings out on October 16th could prove to be a catalyst in turning sentiment around

Q3 hedge fund letters, conference, scoops etc

The Company

Lam Research Corporation (LRCX) was founded in 1980 and went public in May 1984. In 2011, in what was a transformative acquisition, Lam agreed to buy chip equipment manufacturer Novellus Systems, for $3.38. The deal was completed in June 2012, the same year that Martin Anstice was appointed as CEO.

Lam engages in the design, manufacture, marketing. and service of semiconductor processing equipment used in the fabrication of integrated circuits, including equipment for thin film deposition, plasma etch, photoresist strip, and wafer cleaning processes. Repeated throughout semiconductor manufacturing, these technologies help create transistors, interconnects, advanced memory, and packaging structures.

"Semiconductor Innovation is contributing increased value in a data-driven economy and we believe that trend is quite fundamental, exciting and sustainable." -- Martin Anstice, CEO, LamResearch

Short-term performance is simply not our goal. We have delivered and we aspire to continue to reward our stakeholders with multi-year industry outperformance measured by competing for and winning a greater proportion of our customers' investments; greater in quantity and greater in quality through the degree of codependency and annuity. -- Martin Anstice, CEO, L)am Research (July 2018)

Headline Data

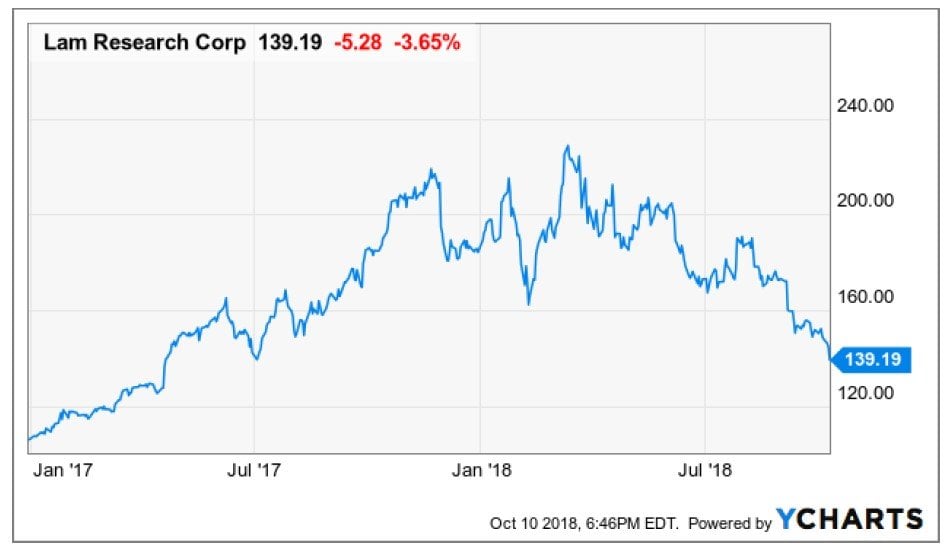

- Current Price: $139.78 (as at close on October 1oth)

- Market Cap: $21.3 B

- Enterprise Value: $18.8 B

- EV/EBITDA: 5.2x

LRCX: Price Action

In this context, we also concluded the strongest fiscal year in our history by delivering approximately $11 billion in revenues, representing growth of almost 40%, $3.4 billion in non-GAAP operating income, and $2.7 billion in cash from operations. Martin Anstice, CEO, Lam Research (July 2018)

See the full slides below.