Jehoshaphat Research is short Hannon Armstrong Sustainable Infrastructure Capital Inc (NYSE:HASI) because its good fortune has come to an abrupt end. Look for gains on sale to dry up suddenly in the new rate environment.

Jehoshaphat’s Short Thesis On Hannon Armstrong (HASI) – Executive Summary

In recent weeks, HASI investors have been presented with a short thesis from Muddy Waters that details the company’s aggressive accounting. We’ve been analyzing this company ourselves for months, and we found Muddy Waters’ claims to be valid…so valid, in fact, that we have nothing else to say about them.

Q2 2022 hedge fund letters, conferences and more

Jehoshaphat Research is short HASI today for an entirely different reason: HASI’s impressive gains on sale are going away this year. Gains on sale are ~50% of the company’s earnings.

These gains are the result of HASI selling loans that have gone up in value since they were originated. These credit assets are decades long in duration, so their market values are extremely rate-sensitive. Market rates were generally going sideways or falling for HASI’s entire history as a public company, so HASI was continually benefiting, originating “winners” which could later be sold for realized gains in a lower rate environment.

Unfortunately, rates exploded in recent months. Since going public, HASI has never lived through a rate shock this sharp. Worse, HASI’s portfolio is more rate-sensitive than it was a few years ago, possibly twice as much. Almost all its loans were originated in a lower-rate environment, and should therefore be well underwater now. You can’t produce gains on sale by selling assets whose market value has fallen since you originated them.

If we are right, the ~50% of earnings from gains on sale is going to almost zero. This is a 2022 event.

HASI’s problems don’t stop there. HASI’s funding model is reflexive, meaning its dividend is funded by stock issuance rather than cash flows. With the stock down tremendously from prior highs, HASI will need to issue tremendously more stock to fund the dividend. (Have you ever played “Would you rather”?)

Worrying about whether HASI’s accounting is clean or dirty is a luxury its shareholders won’t have for long.

Full Thesis In Two Parts

Part I: The Frailty of HASI’s Gains on Sale

“If you’re an investor in fixed income [like HASI is], and you’re a holder of stuff in a falling rate environment, you’re going to have a book of stuff you can sell at gains. If rates go up, you’re stuck with it.” - Former HASI executive

A. HASI’s earnings depend heavily on non-cash gains on sale from selling portfolio assets.

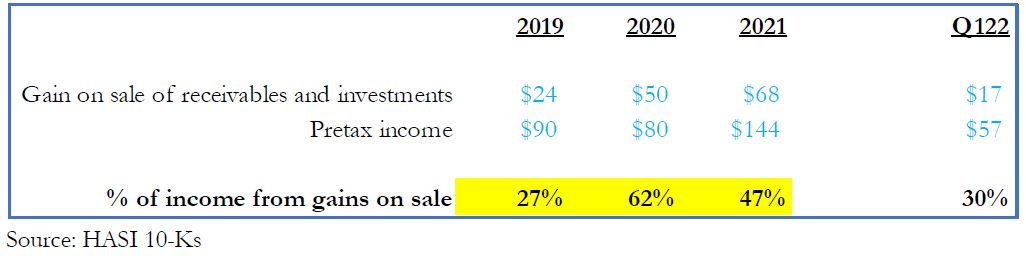

For its entire public life, HASI has made a business of selling (“securitizing”) fixed income assets from its portfolio and booking immediate gains upon doing so. It’s no secret that this gain-on-sale income is an important part of HASI’s “dual-revenue model.” It was more than 50% of HASI’s pretax earnings over the last two years, thanks to market interest rates bottoming out :

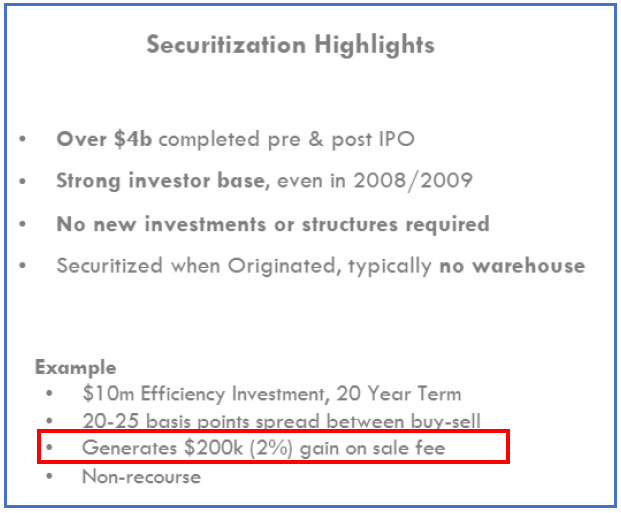

Aside from understanding these gains as a percentage of total HASI earnings, it’s important to understand them as a percentage of the assets being sold (gain on asset sold/total cost of asset sold). In May 2018’s earnings call, the HASI CEO talked about 2% being a decent approximation for the “normal” gain on sale to be expected from this process over time:

Analyst: It looks like you get a 2% gain on sale when you securitize assets…or is that very stable?

CEO: …There's no -- it's not like we're guaranteed a 2% fee. It can be lower or it can be higher…And it ebbs and flows. So 2% is not a bad number to think of for those. – HASI earnings call, May 2018

In this exchange the analyst and the CEO were referring to this part of the Q118 HASI investor presentation:

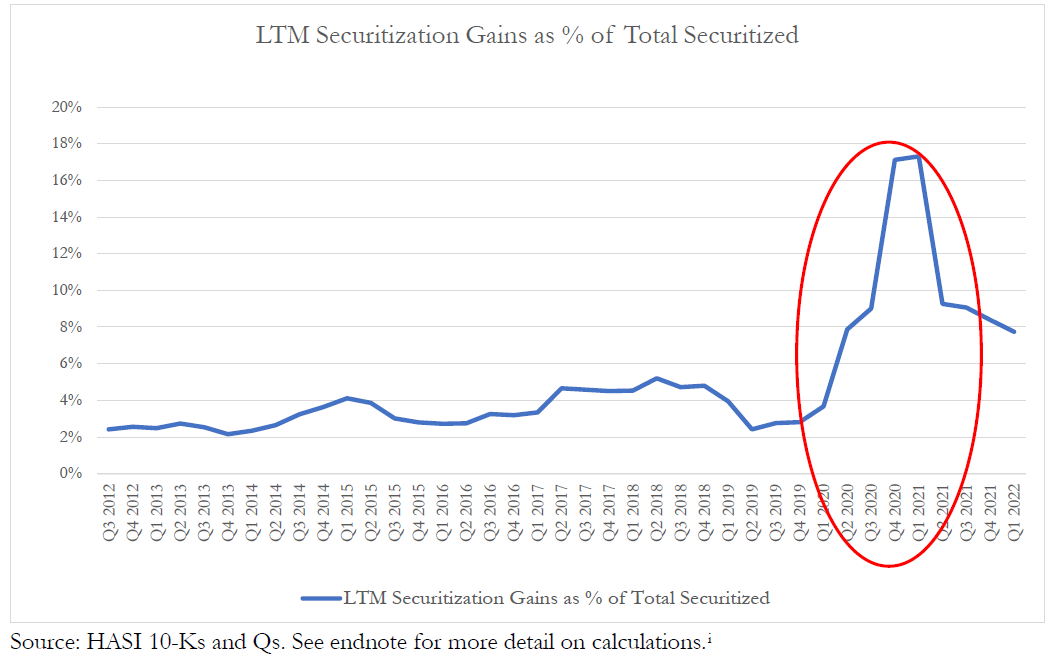

But in 2020, something changed. HASI’s gains on sale – that “normally 2%” number - skyrocketed:

While HASI had normally been able to generate gains equivalent to a low-single-digit percentage of the total values of the assets they were selling, this percentage exploded into the high teens during 2020. Why?

This is why:

This chart from Bloomberg shows the 30-year US treasury yield from the end of 2012 through the end of 2020. Interest rates has been going sideways or down for years, but in a relatively stable way. In 2019, interest rates began falling more, and then crashed in early 2020. This provided a gigantic tailwind to the value of HASI’s loan book, and therefore, to the size of the gains it could generate when selling those loans.

Read the full report here by Jehoshaphat Research