Following yesterday‘s weak rally and bonds showing, S&P 500 bears have the upper hand (timely announcement). Then, the crypto plunge is adding to downswing‘s credibility – about to spill over into tech. Note it didn‘t and doesn‘t take much of a dollar upswing – continuing the rise is enough. Yesterday‘s positive economic data are to be overshadowed by the Fed pronouncements sinking in. Yes, Daly, Kashkari spoke, even mentioning recession uncertainty… And it‘s clear we‘re likely to face quite some tightening ahead, more so than the markets are discounting – and any swift moves in inflation, are faciliated by economic contraction. The bull trap has been set.

Q2 2022 hedge fund letters, conferences and more

Next week won‘t be much better – I‘m looking for grim German PMIs Tuesday, challenged GDP readings on Thursday, and especially the hawkish Jackson Hole. It should be becoming increasingly clear that the risk-on rally is to meet serious reality check, and that lower stock (and other) market data are ahead. The sentiment of my Wednesday‘s recap of deteriorating economy, is to set the tone – and thankfully won‘t be as bad as the German persistently high PPI. Strong dollar to the rescue, a helpful tool in alleviating domestic inflation pressure in the States (yes, U.S. inflation peaked as I was advising you of in advance).

To feel the daily pulse, let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

S&P 500 and Nasdaq Outlook

S&P 500 bears have the initiative, and Nasdaq is likely to confirm that. Such a setup is where large downswings can be born – not guaranteed today, but quite possible.

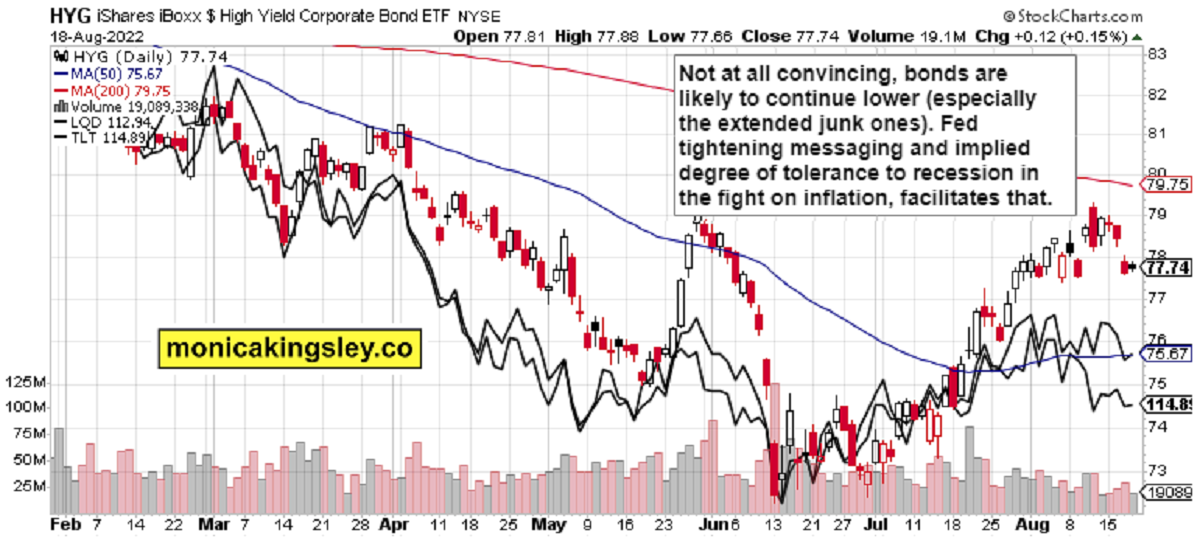

Credit Markets

Fine picture in bonds for the bears – this weak daily pause is likely to give way to lower values. Tightening is putting pressure on inflation trades.

Bitcoin and Ethereum

The crypto break is finally here, presaging more trouble ahead still – putting to rest notions of Ethereum decoupling, at least relatively decoupling. Let the open profits grow!

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.